Construction employment increased by 16,000 jobs in August, but the gains were concentrated in housing, while the infrastructure and nonresidential building construction sector lost 11,000 jobs, according to an analysis by the Associated General Contractors of America of government data released today. The new jobs data comes as association officials reported that a survey of more than 2000 contractors it released this week found growing pessimism about a return to normal levels of construction business amid a proliferation of project cancellations.

“Construction is becoming a tale of two sectors, as homebuilding and limited nonresidential niches thrive but most other private, as well as public, construction shrinks,” said Ken Simonson, the association’s chief economist. “These employment numbers are in line with our survey, which found a plurality of construction firms expect it will take more than six months before their volume of business matches year-ago levels.”

The AGC of America-Autodesk Workforce Survey, released on September 2, found that 38% of respondents expect it will take more than six months for their firm’s volume of business to return to normal, relative to a year earlier. In a survey the association conducted in mid-June, only 30% of firms said they expected a return to normal volume would require more than six months.

A likely reason for the more pessimistic outlook is the rapid increase in postponed or canceled projects, the economist said. He noted that the latest survey found 60% of firms report a scheduled project has been postponed or canceled, nearly double the 32% reporting cancellations in the June survey.

The employment pickup in August was limited to homebuilding, home improvement and a portion of nonresidential construction, Simonson noted. There was a rise of 27,700 jobs in residential construction employment, comprising residential building (3,200) and residential specialty trade contractors (24,500). There was a net decrease of 11,000 jobs in nonresidential construction employment, covering nonresidential building (10,200), specialty trades (-15,700) and heavy and civil engineering construction (-5,500).

The industry’s unemployment rate in August was 7.6%, with 762,000 former construction workers idled. These figures were more than double the August 2019 figures of 3.6% and 361,000 workers, respectively.

Association officials said that the commercial construction sector was likely to continue losing jobs without additional federal coronavirus relief measures. They urged Congress and the administration to pass a one-year extension to the current highway and transit law so state officials can properly plan for the next construction season. They also called for additional infrastructure funding, liability protections for contractors who are taking appropriate steps to protect workers from the coronavirus and other pro-growth measures.

“It is clear that the commercial construction industry will not begin to recover unless Washington can enact responsible new recovery measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the administration should take the opportunity to create needed new middle-class jobs, rebuild infrastructure and restore the economy.”

View the 2020 AGC of America-Autodesk Workforce Survey release and related materials.

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

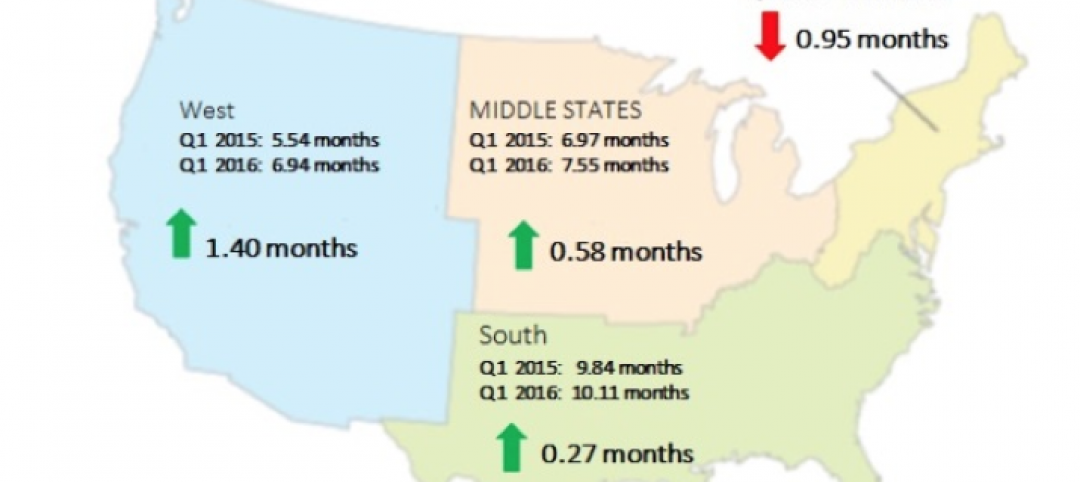

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.