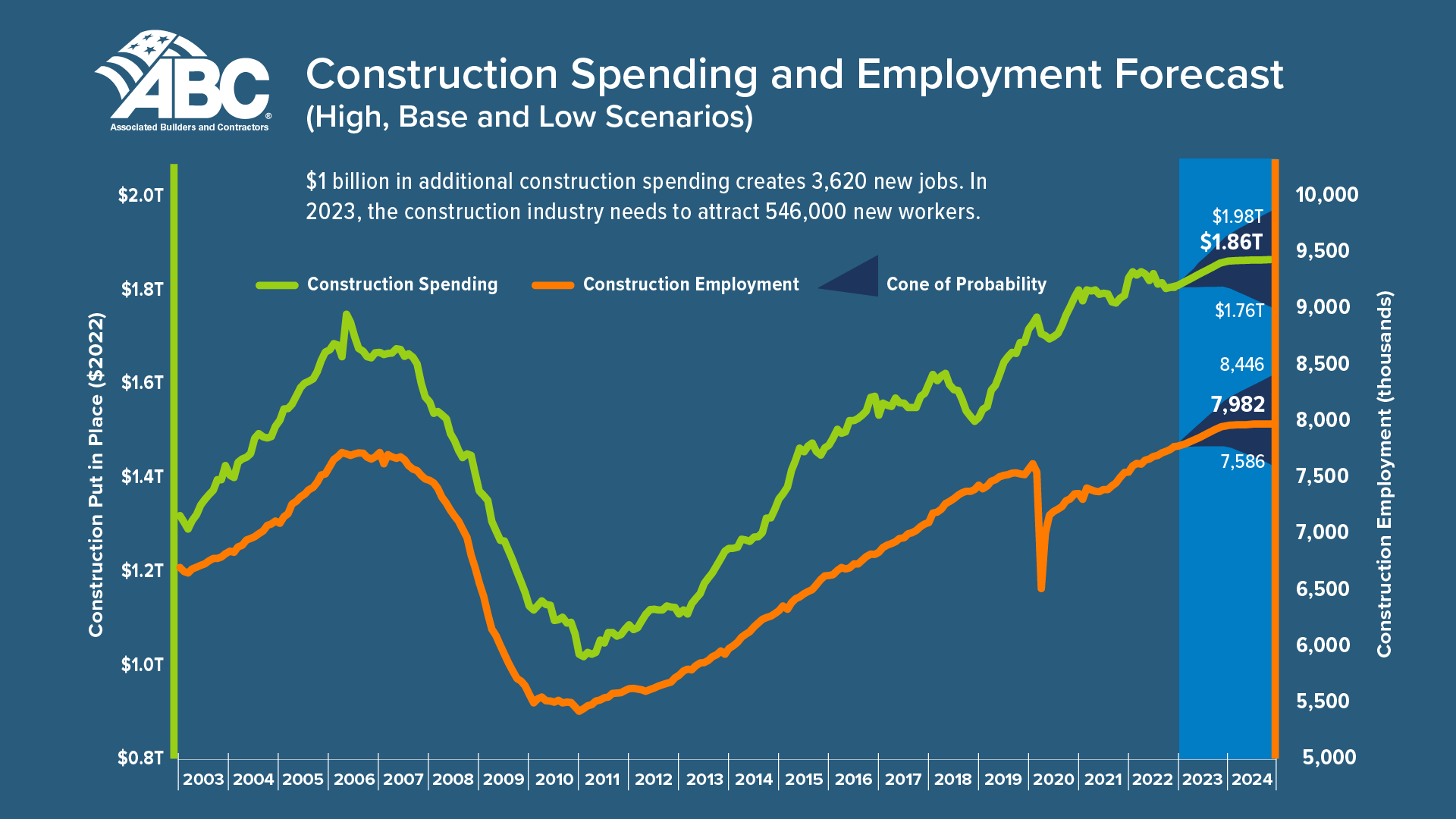

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

ABC predicts demand for labor to increase by 3,620 new jobs for every $1 billion in new construction spending. New funding for large projects such as chip manufacturing plants, clean energy facilities, and infrastructure upgrades will continue to put pressure on the job market.

ABC predicts that in 2024, the industry will need to hire 324,000 new workers on top of its normal pacing, and that assumes overall construction spending slows significantly. The number of workers with licensed skills hasn’t been enough to keep up with demand, and the ranks of licensed carpenters has actually declined in the last decade.

Here is full release from Associated Builders and Contractors:

The U.S. construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor, according to a proprietary model developed by Associated Builders and Contractors.

“The construction industry must recruit hundreds of thousands of qualified, skilled construction professionals each year to build the places where we live, work, play, worship, learn and heal,” said Michael Bellaman, ABC president and CEO. “As the demand for construction services remains high, filling these roles with skilled craft professionals is vital to America’s economy and infrastructure rebuilding initiatives.”

ABC’s proprietary model uses the historical relationship between inflation-adjusted construction spending growth, sourced from the U.S. Census Bureau’s Construction Put in Place survey, as well as payroll construction employment, sourced from the U.S. Bureau of Labor Statistics, to convert anticipated increases in construction outlays into demand for construction labor at a rate of approximately 3,620 new jobs per billion dollars of additional construction spending. This increased demand is added to the current level of above-average job openings. Projected industry retirements, shifts to other industries and other forms of anticipated separation are also embodied within computations.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record, higher than only the 4.5% unemployment rate observed in 2019. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

“Despite sharp increases in interest rates over the past year, the shortage of construction workers will not disappear in the near future,” said ABC Chief Economist Anirban Basu. “First, while single-family home building activity has moderated, many contractors continue to experience substantial demand from a growing number of mega-projects associated with chip manufacturing plants, clean energy facilities and infrastructure. Second, too few younger workers are entering the skilled trades, meaning this is not only a construction labor shortage but also a skills shortage.

“With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce,” said Basu. “Many of these older construction workers are also the most productive, refining their skills over time. The number of construction laborers, the most entry-level occupational title, has accounted for nearly 4 out of every 10 new construction workers since 2012. Meanwhile, the number of skilled workers has grown at a much slower pace or, in the case of certain occupations like carpenter, declined.

“To fill these important roles, ABC is working hard to recruit, educate and upskill the construction workforce through our national network of more than 800 apprenticeship, craft, safety and management education programs—including more than 300 government-registered apprenticeship programs across 20 different construction occupations—to build the people who build America,” said Bellaman. “ABC members invested $1.6 billion in 2021 to educate 1.3 million course attendees to build a construction workforce that is safe, skilled and productive.”

In 2024, the industry will need to bring in more than 342,000 new workers on top of normal hiring to meet industry demand, and that’s presuming that construction spending growth slows significantly next year.

View ABC’s methodology in creating the workforce shortage model.

Related Stories

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.

K-12 Schools | Nov 30, 2022

School districts are prioritizing federal funds for air filtration, HVAC upgrades

U.S. school districts are widely planning to use funds from last year’s American Rescue Plan (ARP) to upgrade or improve air filtration and heating/cooling systems, according to a report from the Center for Green Schools at the U.S. Green Building Council. The report, “School Facilities Funding in the Pandemic,” says air filtration and HVAC upgrades are the top facility improvement choice for the 5,004 school districts included in the analysis.

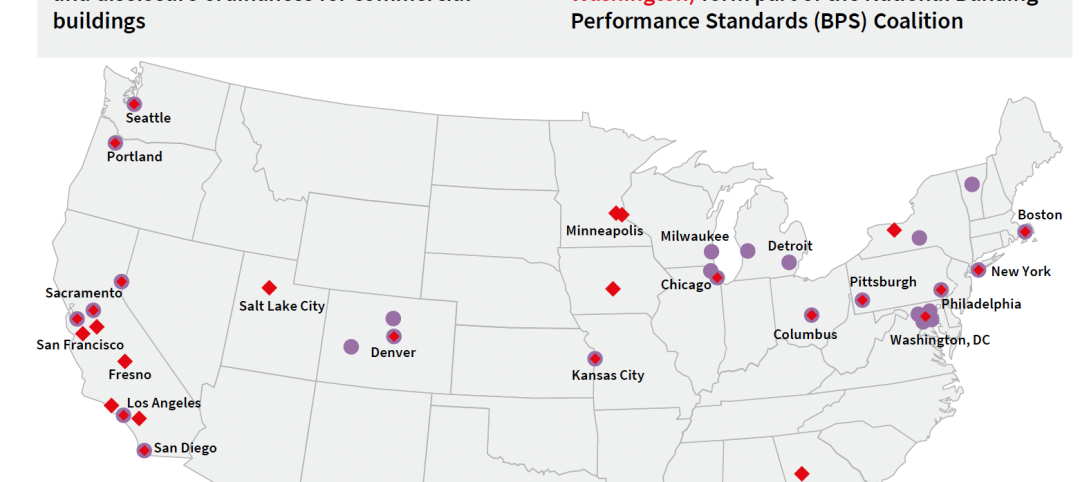

Industry Research | Nov 8, 2022

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.