Only 18 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020 despite a pickup in most states from October to November, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said one reason employment is below pre-pandemic levels in many parts of the country is the lack of available workers to hire.

“Construction activity has picked up in recent months but still has not reached the employment levels of early last year in most of the country during what has become a very tight labor market,” said Ken Simonson, the association’s chief economist. “If contractors had found enough qualified workers, more states would have recovered fully by now from the pandemic-induced job losses,” he added, noting that job openings at the end of October exceeded the number of workers hired into the industry that month.

From February 2020—the month before the pandemic caused projects to be halted or canceled—to last month, construction employment decreased in 32 states and increased in only 18 states and D.C. Texas shed the most construction jobs over the period (-42,600 jobs or -5.5%), followed by New York (-39,700 jobs, -9.7%), California (-23,100 jobs, -2.5%), and Louisiana (19,800 jobs, -14.5%). The largest percentage losses were in Louisiana, Wyoming (-13.1%, -3,000 jobs), and New York.

Florida added the most construction jobs since February 2020 (8,700 jobs, 1.55), followed by Utah (8,200 jobs, 7.25), and Washington (6,200 jobs, 2.8%). The largest percentage gains were in South Dakota (10.5%, 2,500 jobs), followed by Idaho (8.7%, 4,800 jobs), and Utah.

From October to November construction employment decreased in 13 states, increased in 36 states and D.C., and was unchanged in Kansas. Louisiana lost the most jobs (-2,200 jobs, -1.8%), followed by North Carolina (-1,900 jobs, -0.8%) and New Jersey (-1,800 jobs, -1.2%). Louisiana also had largest percentage decline, followed by Oklahoma (-1.5%, -1,200 jobs), New Jersey, and North Carolina.

Florida added the most construction jobs between October and November (8,200 jobs, 1.4%), followed by Illinois (3,800 jobs, 1.7%) and Texas (3,600 jobs, 0.5%). Montana had the largest percentage gain (2.7%, 800 jobs), followed by Missouri (2.6%, 3,200 jobs) and Vermont (2.1%, 300 jobs).

Association officials said labor shortages are undermining the construction industry’s ability to fully recover. They urged public officials to boost investments in career and technical education and other programs that expose more people to construction career opportunities. They added that the association was working with its chapters and member firms to recruit more, and more diverse, people into the industry.

“It is time to stop giving students the incorrect impression that every good career requires a college degree and takes place in an office of one kind or another,” said Stephen E. Sandherr, the association’s chief executive officer.

View state February 2020-November 2021 data and rankings, 1-month rankings.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

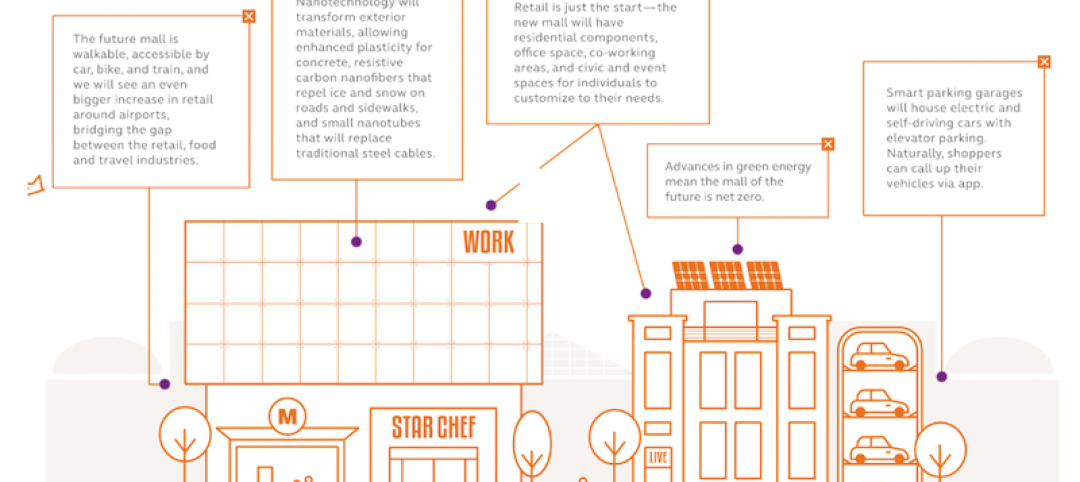

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.