Only 18 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020 despite a pickup in most states from October to November, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said one reason employment is below pre-pandemic levels in many parts of the country is the lack of available workers to hire.

“Construction activity has picked up in recent months but still has not reached the employment levels of early last year in most of the country during what has become a very tight labor market,” said Ken Simonson, the association’s chief economist. “If contractors had found enough qualified workers, more states would have recovered fully by now from the pandemic-induced job losses,” he added, noting that job openings at the end of October exceeded the number of workers hired into the industry that month.

From February 2020—the month before the pandemic caused projects to be halted or canceled—to last month, construction employment decreased in 32 states and increased in only 18 states and D.C. Texas shed the most construction jobs over the period (-42,600 jobs or -5.5%), followed by New York (-39,700 jobs, -9.7%), California (-23,100 jobs, -2.5%), and Louisiana (19,800 jobs, -14.5%). The largest percentage losses were in Louisiana, Wyoming (-13.1%, -3,000 jobs), and New York.

Florida added the most construction jobs since February 2020 (8,700 jobs, 1.55), followed by Utah (8,200 jobs, 7.25), and Washington (6,200 jobs, 2.8%). The largest percentage gains were in South Dakota (10.5%, 2,500 jobs), followed by Idaho (8.7%, 4,800 jobs), and Utah.

From October to November construction employment decreased in 13 states, increased in 36 states and D.C., and was unchanged in Kansas. Louisiana lost the most jobs (-2,200 jobs, -1.8%), followed by North Carolina (-1,900 jobs, -0.8%) and New Jersey (-1,800 jobs, -1.2%). Louisiana also had largest percentage decline, followed by Oklahoma (-1.5%, -1,200 jobs), New Jersey, and North Carolina.

Florida added the most construction jobs between October and November (8,200 jobs, 1.4%), followed by Illinois (3,800 jobs, 1.7%) and Texas (3,600 jobs, 0.5%). Montana had the largest percentage gain (2.7%, 800 jobs), followed by Missouri (2.6%, 3,200 jobs) and Vermont (2.1%, 300 jobs).

Association officials said labor shortages are undermining the construction industry’s ability to fully recover. They urged public officials to boost investments in career and technical education and other programs that expose more people to construction career opportunities. They added that the association was working with its chapters and member firms to recruit more, and more diverse, people into the industry.

“It is time to stop giving students the incorrect impression that every good career requires a college degree and takes place in an office of one kind or another,” said Stephen E. Sandherr, the association’s chief executive officer.

View state February 2020-November 2021 data and rankings, 1-month rankings.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

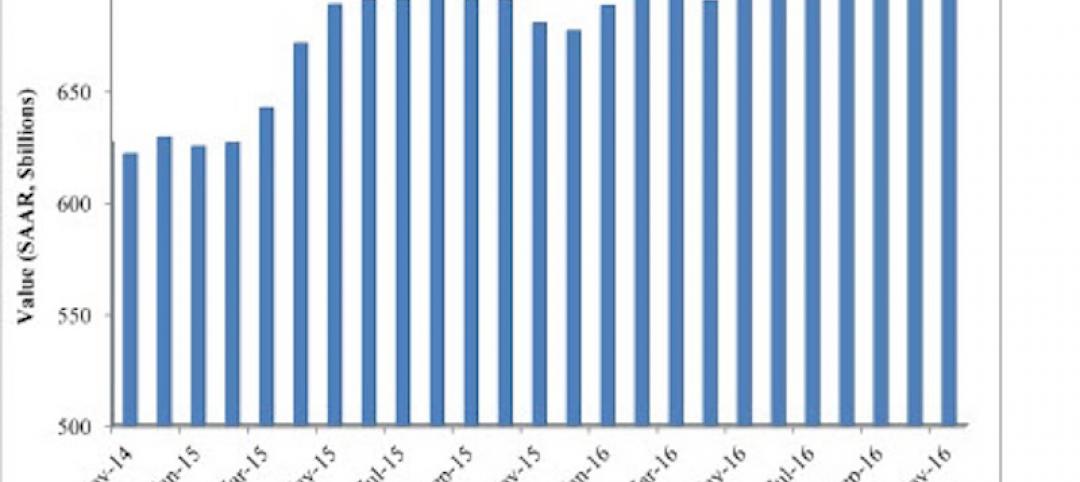

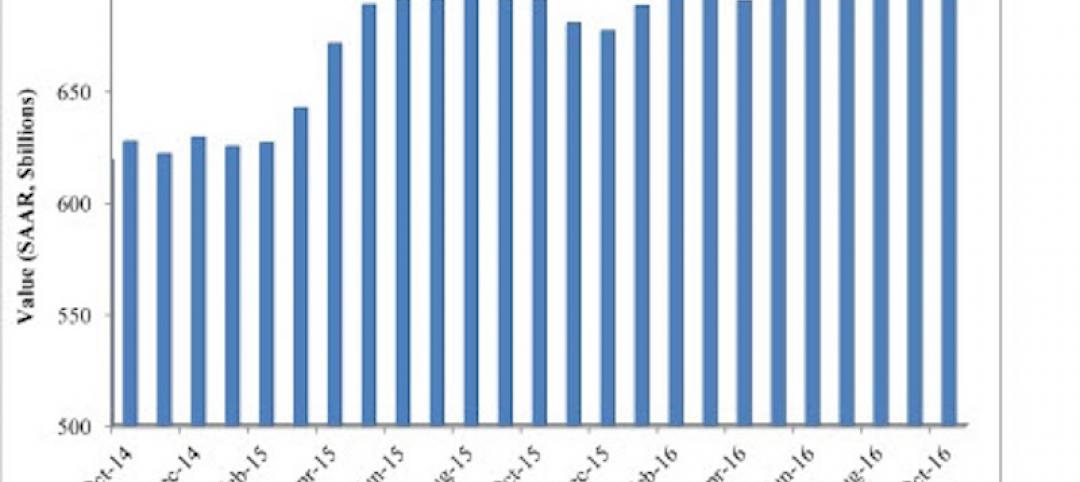

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

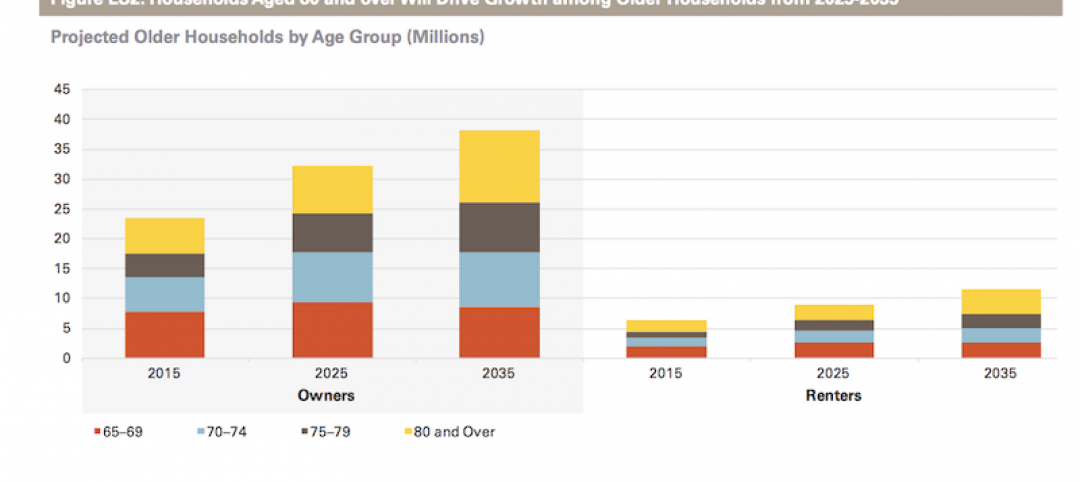

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.