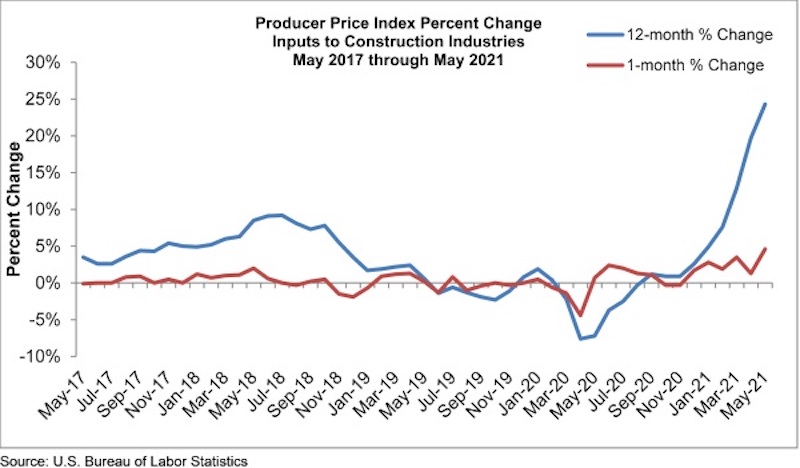

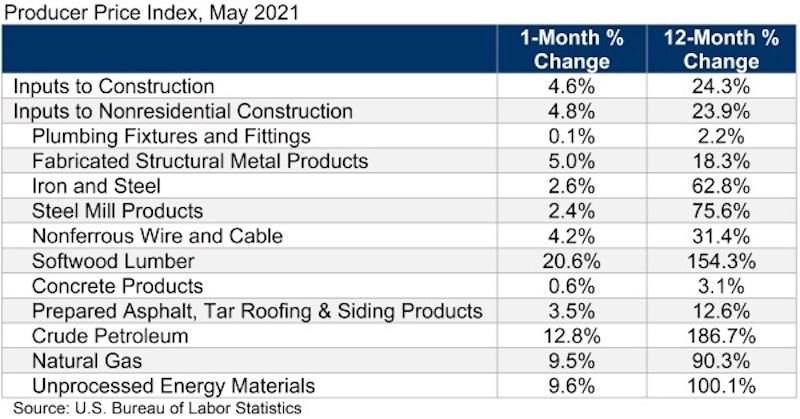

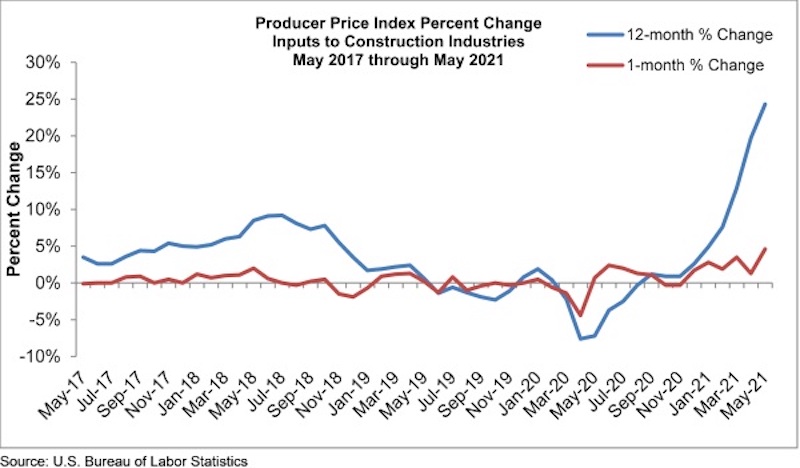

Construction input prices increased 4.6% in May compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices increased 4.8% for the month.

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span. Similar to last month, all three energy subcategories registered significant year-over-year price increases. Crude petroleum has risen 187%, while the prices of unprocessed energy materials and natural gas have increased 100% and 90%, respectively. The price of softwood lumber has expanded 154% over the past year.

“The specter of elevated construction input prices will not end anytime soon,” said ABC Chief Economic Anirban Basu. “While global supply chains should become more orderly over time as the pandemic fades into memory, global demand for inputs will be overwhelming as the global economy comes back to life. Domestically, contractors expect sales to rise over the next six months, as indicated by ABC’s Construction Confidence Index. This means that project owners who delayed the onset of construction for a few months in order to secure lower bids may come to regret that decision.

“Many economists continue to believe that the surge in prices is temporary, the result of an economic reopening shock,” said Basu. “To a large extent, they are correct. The cure for high prices is high prices. When prices are elevated, suppliers have greater incentive to boost capacity and bolster output. That dynamic eventually results in a downward shift in prices. Operations at input producers should also become smoother over time as staff is brought back and standard operating procedures are reestablished.

“Still, there are some things that have changed during the pandemic and will not shift back,” said Basu. “For instance, money supply around the world has expanded significantly. Governments have been running large deficits. This means that some of the inflationary pressure that contractors and others are experiencing may not be temporary, and that inflation and interest rates may not be as low during the decade ahead as they were during the decade leading up to the pandemic.”

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.