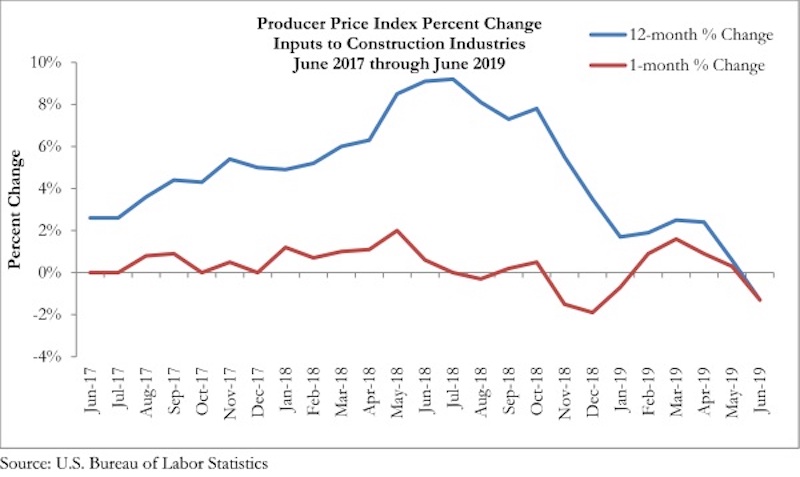

Construction input prices decreased 1.3% on both a monthly and yearly basis in June, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Overall, nonresidential construction input prices declined 1.4% from May 2019 but are down just 0.8% from June 2018. Among the 11 sub-categories, only natural gas (+1.6%) and concrete products (+0.9%) prices increased compared to May 2019. On a yearly basis, three of the sub-category prices have declined by more than 20%, including softwood lumber (-23.1%), crude petroleum (-22.2%) and natural gas (-22.3%).

“Eighteen months ago, surging construction materials prices represented one of the leading sources of concern among construction executives,” said ABC Chief Economist Anirban Basu. “That was a time of solid global economic growth and the first synchronized worldwide global expansion in approximately a decade. Yet things can change dramatically in a year and a half. According to today’s data release, construction materials prices are falling, in part a reflection of a weakening global economy.

“Given that the United States is in the midst of its lengthiest economic expansion with an unemployment rate at approximately a 50-year low, such low inflation remains a conundrum,” said Basu. “However, the June PPI numbers indicate that those commodities exposed to global economic weakness have been the ones to experience declines in prices, with the exception of concrete products and natural gas. While America has begun to export more natural gas, today’s prices largely reflect the domestic demand and supply.

“With the global economy continuing to stumble, there is little reason to believe that materials prices will bounce back significantly,” said Basu. “Of course, trade issues and other disputes can quickly alter the trajectories of prices. If economic forces are allowed to play out, contractors should be able to focus the bulk of their attention on labor compensation costs and worry relatively less about materials prices.”

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.