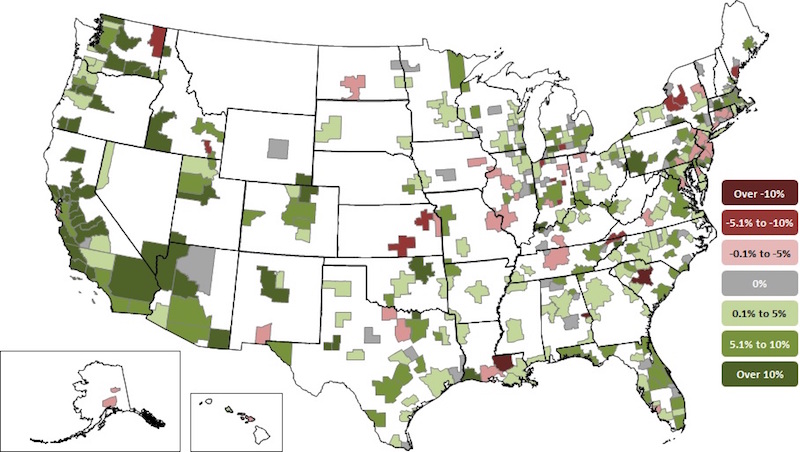

Construction employment increased in 257 out of 358 metro areas between February 2017 and February 2018, declined in 50 and stagnated in 51, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the employment gains are occurring as construction firms in many parts of the country are having a hard time finding enough qualified workers to keep pace with demand.

"Growing private-sector demand for construction services is prompting construction firms to hire more people to complete projects," said Ken Simonson, the association's chief economist. "Yet tight labor markets, particularly for qualified construction workers, is making it increasingly difficult for firms to find people to bring on board."

Riverside-San Bernardino-Ontario, Calif. added the most construction jobs during the past year (12,000 jobs, 13%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,900 jobs, 9%); Dallas-Plano-Irving, Texas (9,700 jobs, 7%); Houston-The Woodlands-Sugar Land, Texas (9,300 jobs, 4%) and Los Angeles-Long Beach-Glendale, Calif. (7,700 jobs, 6%). The largest percentage gains occurred in the Merced, Calif. metro area (33%, 700 jobs) followed by Midland, Texas (22%, 5,400 jobs); Lake Charles, La. (21%, 4,700 jobs) and Weirton-Steubenville, W.V.-Ohio (21%, 300 jobs).

The largest job losses from February 2017 to February 2018 were in Baton Rouge, La. (-6,500 jobs, -12%), followed by St. Louis, Mo.-Ill. (-2,500 jobs, -4%); Columbia, S.C. (-2,200 jobs, -11%); Fort Worth-Arlington, Texas (-2,000 jobs, -3%) and Middlesex-Monmouth-Ocean, N.J. (-1,700 jobs, -5%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-38%, -1,500 jobs) followed by Baton Rouge, Columbia, S.C. and Kokomo, Ind. (-9%, -100 jobs).

Association officials said that growing private sector demand in February is prompting many firms to add more staff as they work to complete projects. They added that the recently-enacted federal spending measure includes up to $10 billion in additional infrastructure funding for this year, meaning firms that perform public-sector work are likely to begin expanding as well amid tight labor market conditions.

"As demand for construction continues to expand, it will only get harder for many firms to find qualified workers to hire," said Stephen E. Sandherr, the association's chief executive officer. "Congress and the administration should work together to expand career and technical education opportunities so more high school students will opt for good-paying careers in construction."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.