Construction employment declined by 7,000 between May and June as the industry still employs 238,000 fewer people than before the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said that job losses in the nonresidential construction sector offset modest monthly gains in residential construction as many firms struggle with worker shortages, supply chain disruptions and rising materials prices.

“It is hard for the industry to expand when it can’t find qualified workers, key building materials are scarce, and the prices for them keep climbing,” said Stephen E. Sandherr, the association’s chief executive officer. “June’s job declines seem less about a lack of demand for projects and a lot more about a lack of supplies to use and workers to employ.”

Construction employment in June totaled 7,410,000, dropping 7,000 from the revised May total. The total in June remained 238,000 or 3.1% below February 2020, the high point before the pandemic drove construction employment down. The number of former construction workers who were unemployed in June, 730,000, dropped a quarter from a year ago and the sector’s unemployment rate fell from 10.1% in June 2020 to 7.5% this June.

Residential and nonresidential construction sectors have differed sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 15,200 employees during the month and have added 51,000 workers or 1.7% over 16 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 22,600 jobs in June and employed 289,000 fewer workers or 6.2% less than in February 2020.

Sandherr noted that many firms report key materials are backlogged or rationed, while also reporting frequent increases in the amount they pay for those materials. In addition, many firms report they are having a hard time finding workers to hire despite the relatively high number of people currently out of work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Association officials said they were taking steps to recruit more people into the construction industry. They noted the association launched its “Construction is Essential” recruiting campaign earlier this year. They said Washington officials could help the industry by taking steps to ease supply chain backups. They also continued to call on the President to remove tariffs on key construction materials, including steel.

“The good news is there are large numbers of qualified workers available to hire who are on the sidelines until schools reopen and the federal unemployment supplements expire,” said Stephen E. Sandherr, the association’s chief executive officer. “Our message to these workers is clear, there are high-paying construction careers available when they are ready.”

Related Stories

Market Data | Apr 16, 2019

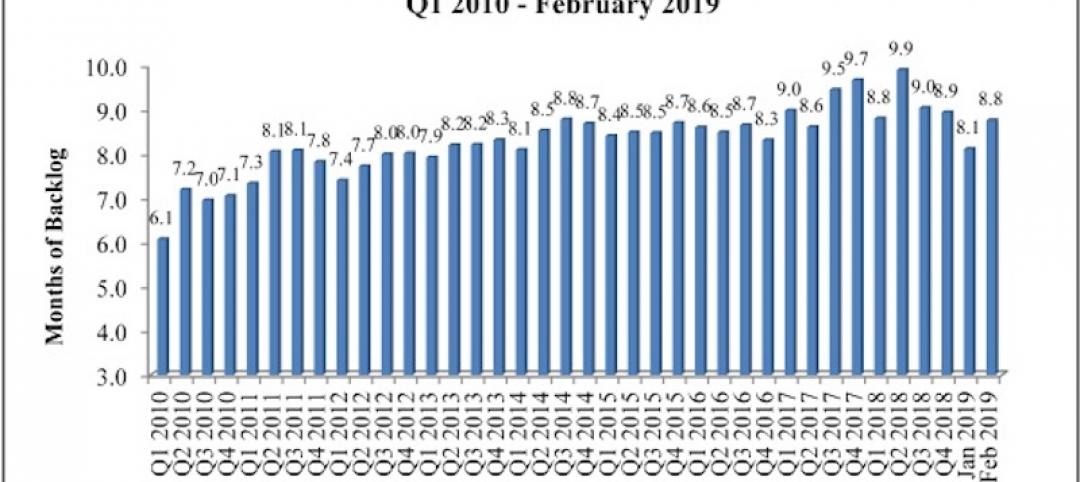

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

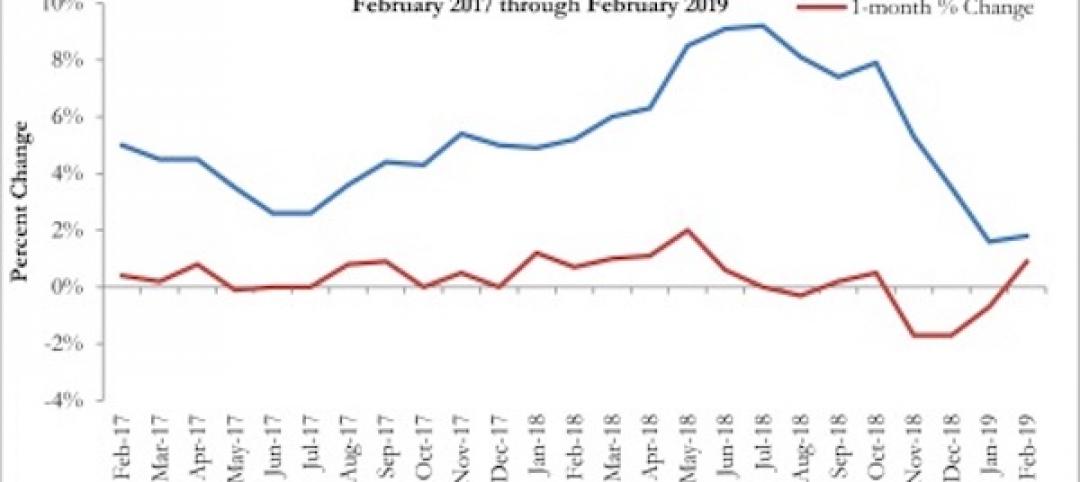

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

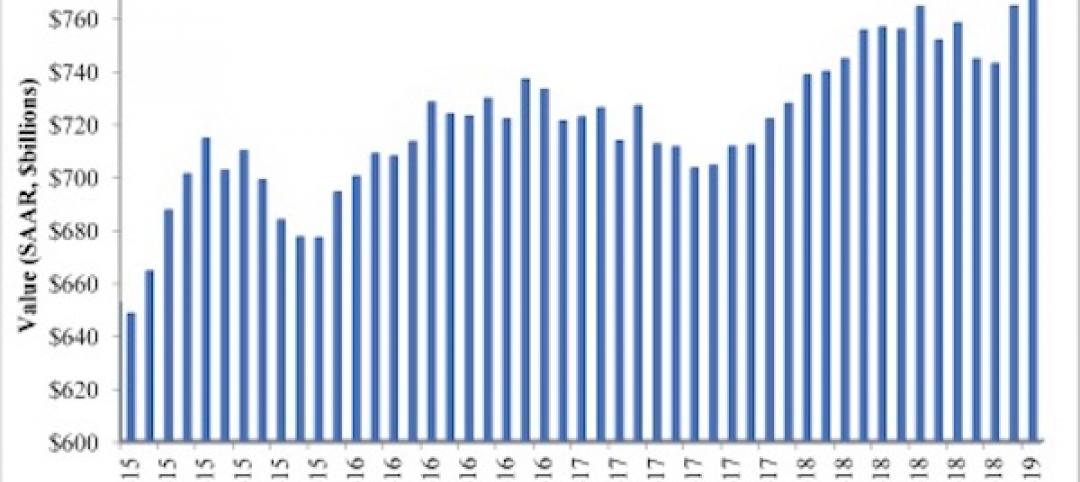

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.