The latest coliving phenomenon has spawned its share of startup businesses, all looking to cash in on the demand among younger workers for relatively inexpensive living quarters in urban job centers where affordable housing is scarce-to-nonexistent.

The New York Times recently ran an article titled “The Elusive $1,500 rental,” in which the newspaper noted that the median rent for a Manhattan apartment was $3,475, and that more than half of all New Yorkers spend more than one-third of their incomes on rent.

The solution, for many urban workers, is to find roommates to share the rent burden. And given the market’s supply-and-demand dynamics, it’s not surprising that investors have been diverting their attentions to coliving ventures that answer that call with rentals that require limited lease commitments, and are more like hotels with “all-inclusive” amenities such as furnishings, in-room Wi-Fi, toiletries, linens and towels, and laundry and room-cleaning services.

Coliving companies operate under dwell-like monikers such as The Nook, Node, Roam Co-Living (which caters to global workers), Krash, and Pure House. In May, Bisnow.com reported that Ollie, a co-living company with two locations, had announced the biggest coliving project in North America: a development (with Simon Baron Development and Quadrum Global) in Long Island City, N.Y., that will have 426 beds on 14 floors. It’s scheduled to open next January.

Ollie is currently preleasing 166 coliving beds in an apartment building that will open in Pittsburgh this fall. The company continues to seek institutional financing for growth in markets like Los Angeles and Jersey City, N.J.

Another potential heavy hitter could be WeLive, a coliving venture that WeWork, the fast-growing shared workplace developer, launched in 2016. So far, the company is renting apartments in two buildings, in New York City and Arlington, Va. But expansion plans are on hold so WeLive can “refine” its product, according to James Woods, who leads the WeLive division.

Then there’s New York-based Common, which since launching in the fall of 2015 has raised at least $23.4 million from investors who include some real estate developers. Common currently rents more than 300 bedrooms in nine apartments buildings in New York, San Francisco, and Washington, D.C. (In D.C., a neighborhood association is trying to block Common and developer Oaktree from opening Richardson Place, a 24-unit coliving facility, which the group argues is a commercial property that would be operating in a residential-zoned area).

Earlier this year, Common opened The Baltic in the Boerum Hill section of Brooklyn, N.Y. It was Common’s first hybrid building: 29 apartments with 70 beds for coliving, and 67 studios and one-bedrooms for individual renters.

Sophie Wilkinson, Common’s head of design and construction, notes that Common is different from several of its competitors in that most of its properties have been ground-up construction, including The Baltic, whose developer Adam America owns the building.

Common is also attempting to foment more of a communal living environment. In a recent commentary on Quartz’s website that otherwise disparaged coliving’s responsibility-free ethic, Annaliese Griffin, editor-in-chief of BrookynBased.com, positively singled out Common’s business model that “actively works to maintain long-term tenants and build a strong community within each house.”

Brad Hargreaves, Common's founder, is on record stating his preference for buildings with only around 15 tenants so it’s easier for renters to get to know one another. Common no longer offers one-month leases, and gives tenants discounts on 12-month leases. Each “house” has a “leader” who also gets a discounted lease rate for serving in that role.

Common has been working with developers to design spaces specifically for roommate situations.

A roofdeck lounge is one of the amenities available to coliving renters at The Baltic, one of nine properties operated by Common, a shared-housing provider that is looking to double its bed count this year. Image: Common

Common’s coliving monthly rents in New York start at $1,340 to $2,500 per bedroom, depending on the location; in San Francisco from $2,450 to $2,600; and in Washington D.C., at $1,700. A renter becomes a Common “member” by leasing space. Membership includes free utilities, and access to washers and dryers, household supplies, roof deck spaces, gyms, and weekly room-cleaning. Wilkinson says that, typically, bedrooms are between 100 and 200 sf each, and the apartments are around 900 sf. At The Baltic, there are two to three renters per apartment, although other Common buildings have as many as five coliving renters per apartment.

Wilkinson says designs for coliving apartments focus on communal amenities and spaces, as well as “comfort and privacy on a human scale.” The rooms have lots of natural light. And the designs, she says, take into account “the mechanics of coliving,” in terms of kitchens, storage, and counter spaces.

Common has received more than 15,000 applications for its portfolio of bedrooms, and is looking to do more hybrid projects, Wilkinson says, partly because there are more opportunities to attract developers for them.

Wilkinson was reticent about revealing Common’s expansion plans, noting only a recent announcement about its plan to expand into New Orleans. But earlier this month, the Commercial Observer, based on interviews with Common’s principals, reported that the company intends to more than double to 650 bedrooms by the end of this year, and expand to 2,000 bedrooms by the end of 2018.

Wilkinson did note, however, that she doesn’t think coliving will be confined to urban markets. “I absolutely see us in smaller markets. And what’s been interesting has been that renters are looking for a community aspect.”

Related Stories

MFPRO+ News | Dec 5, 2023

DOE's Zero Energy Ready Home Multifamily Version 2 released

The U.S. Department of Energy has released Zero Energy Ready Home Multifamily Version 2. The latest version of the certification program increases energy efficiency and performance levels, adds electric readiness, and makes compliance pathways and the certification process more consistent with the ENERGY STAR Multifamily New Construction (ESMFNC) program.

Transit Facilities | Dec 4, 2023

6 guideposts for cities to create equitable transit-oriented developments

Austin, Texas, has developed an ETOD Policy Toolkit Study to make transit-oriented developments more equitable for current and future residents and businesses.

Multifamily Housing | Nov 30, 2023

A lasting housing impact: Gen-Z redefines multifamily living

Nathan Casteel, Design Leader, DLR Group, details what sets an apartment community apart for younger generations.

Products and Materials | Nov 30, 2023

Top building products for November 2023

BD+C Editors break down 15 of the top building products this month, from horizontal sliding windows to discreet indoor air infusers.

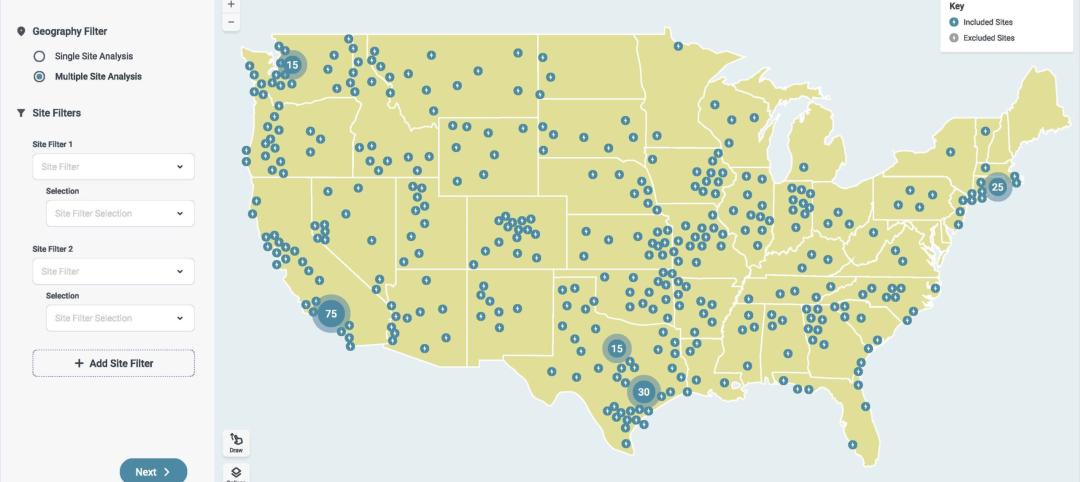

Engineers | Nov 27, 2023

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

MFPRO+ Blog | Nov 27, 2023

7 ways multifamily designers can promote wellness in urban communities

Shepley Bulfinch's Natalie Shutt-Banks, AIA, identifies design elements that multifamily developers can use to maximize space while creating a positive impact on residents and the planet

MFPRO+ New Projects | Nov 21, 2023

An 'eco-obsessed' multifamily housing project takes advantage of downtown Austin’s small lots

In downtown Austin, Tex., architecture firm McKinney York says it built Capitol Quarters to be “eco-obsessed, not just eco-minded.” With airtight walls, better insulation, and super-efficient VRF (variable refrigerant flow) systems, Capitol Quarters uses 30% less energy than other living spaces in Austin, according to a statement from McKinney York.

MFPRO+ News | Nov 21, 2023

California building electrification laws could prompt more evictions and rent increases

California laws requiring apartment owners to ditch appliances that use fossil fuels could prompt more evictions and rent increases in the state, according to a report from the nonprofit Strategic Actions for a Just Economy. The law could spur more evictions if landlords undertake major renovations to comply with the electrification rule.

MFPRO+ News | Nov 21, 2023

Underused strip malls offer great potential for conversions to residential use

Replacing moribund strip malls with multifamily housing could make a notable dent in the housing shortage and revitalize under-used properties across the country, according to a report from housing nonprofit Enterprise Community Partners.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.