Investors in healthcare buildings view multi-tenant medical offices as their best bets for returns on investments whose financing, to an increasing degree, leans toward cash rather than debt.

Those are some of the findings in a 15-page report that CBRE’s U.S. Healthcare Capital Markets Group has released, based on responses from 80 healthcare real estate investors answering 26 questions. The largest group of respondents (32%) was healthcare real estate developers, followed by healthcare REITs and private capital healthcare investors (27% each).

Nearly one-third (32%) of all respondents say they target transactions that fall between $20 million and $50 million. Another 31% say that their preferred transaction range is $10 million to $20 million. Nearly all of the respondents—96%—are most interested in medical office buildings as the type of building that meets their acquisition criteria. The next preferred building type is ambulatory surgery centers (63%), wellness centers (41%), and assisted living facilities (39%).

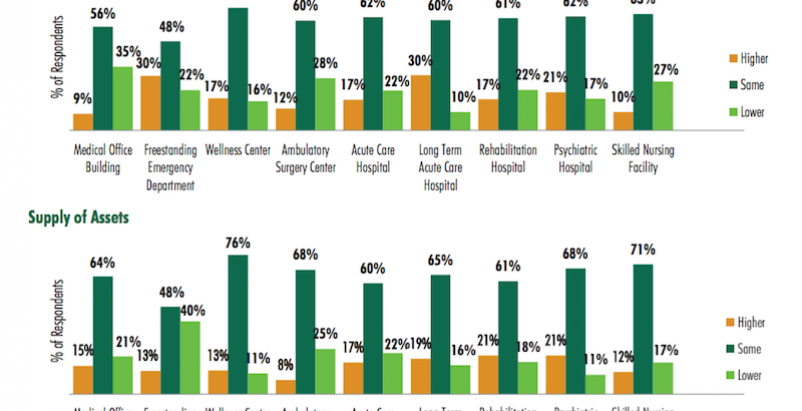

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

The total amount of equity that firms allocated for healthcare real estate investment this year, nearly $14.5 billion, was about 7% less than the $15.5 billion estimate from the 2015 survey. But the 2016 number is still considerably higher than estimates in the years 2011 through 2014, and is actually 132% of the total market transaction volume that traded in the healthcare sector in 2015.

The greatest portion of respondents (29%) says leveraged internal rate of return (IRR) is the investment return measurement they rely on most. However, that’s down from 33% in the 2015 survey. On the other hand, all-cash IRR saw a big jump—to 22% from 12% in 2015—as a relied-upon investment metric.

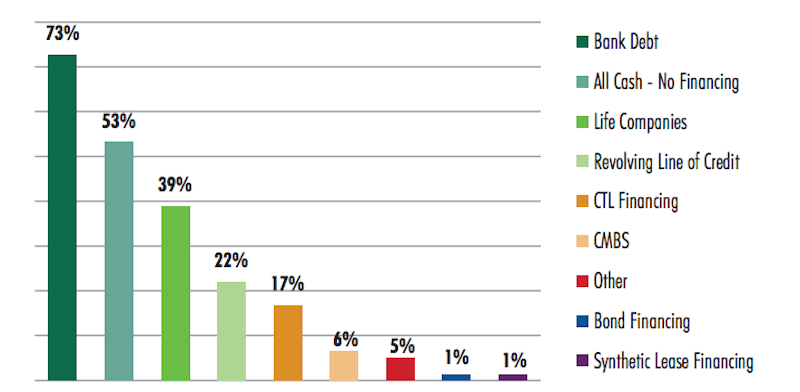

Interestingly, all-cash financing finished second, behind bank debt, as the type of financing the respondents used. Nearly nine of 10 REITs surveyed say they would use all-cash financing, whereas more than three-quarters of the developers would use bank debt to pay for their investments.

Healthcare REITs says they are more disposed to pay cash for acquisitions of medical office buildings, versus developers that lean more thoward bank financing of their deals. Image: CBRE

There’s wide variation in how long respondents hold onto healthcare investments. The greatest number—31%—say 10 years or more. But another 23% say they will hold only an investment for between five and seven years, and the same percentage are holding onto properties for only two and four year.

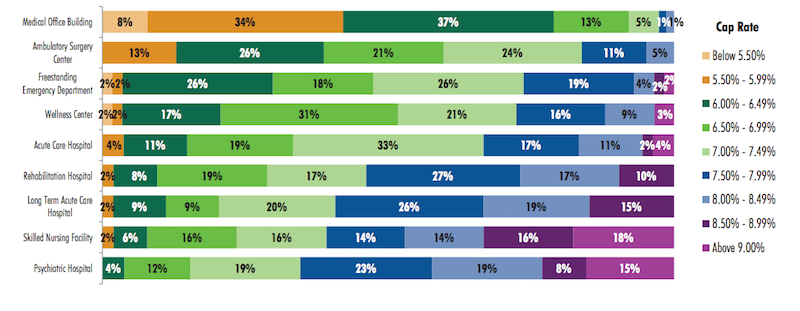

Class A on-campus medical office buildings are the healthcare product type that continues to price most aggressively, vis-à-vis Class A off-campus medical offices, although the differences are narrowing, according to this year’s survey. About 49% of respondents indicate that a market cap rate for Class A on-campus medical offices would be below 6%, compared to 53% who say the cap rate for Class A off-campus product would be below 6.5%.

CBRE's survey finds that the market cap rate that investors target varies considerably by product type in the healthcare sector. Image: CBRE

When discussing their target 10-year IRR for all-cash investments in multi-tenant medical office buildings, 42% of respondents say it falls between 7% and 9.49%. Another 31% say their IRR target for this product type would be between 9.5% and 11.99%. “Respondents indicated a lack of desire for the most aggressively priced product, with only 4% indicating a target all-cash IRR below 7%, compared to 17% in 2015,” CBRE reports.

Single-tenant medical office buildings are pricing the most aggressively, with the largest group of respondents (37%) indicating a cap rate range of 6% to 6.49%, and another 42% indicating a cap rate lower than 5.99% In contrast, more than one quarter of respondents indicates a cap rate of 6% to 6.49% for ambulatory surgery centers, while 31% indicate a cap rate range of 6.5% to 6.99% for wellness centers, and 33% a 7% to 7.49% range for acute care hospitals.

The product types with the least-aggressive pricing, according to the survey’s respondents, are long-term acute care hospitals, skilled nursing facilities, and psychiatric hospitals.

The vast majority of respondents—82%—say their medical office investments this year would make them "net buyers."

Majorities of respondents expect supply of and demand for healthcare sector buildings in general to remain pretty much the same this year as in 2015, with some intriguing collisions: for example 30% of respondents think demand for freestanding emergency departments would be higher even as 40% expect supply of that product type would be lower.

Rents for medical office buildings were up between 2% and 3% for the respondents’ portfolios, and none is predicting much growth beyond that in the next 12 months, which is curious given that 59% of those surveyed say their portfolio’s occupancy rates were higher than the year before.

CBRE’s report touches on a host of other investment topics, including operating expenses, credit ratings, acceptable terms for sale-leasebacks (10 to 14 years appears to be the preferred threshold), and issues revolving around ground lease price floors and structuring.

And when the questions home in on developers specifically, nearly half (48%) of developers who responded predict that development request for proposal (RFP) activity would be similar to last year. The biggest number of developers—36%—says that a lease constant of below 7% was the minimum they would consider for a healthcare development opportunity that met their highest standards of investment. (Nearly half says they’d consider a lease constant below 8% for a new development.)

Most developers (44% of those who responded) prefer at least 50% to 60% of a project to be preleased, and a large majority (82%) of developer-respondents require that 50% to 80% of a project to be preleased before they’d invest.

Related Stories

Engineers | Jun 14, 2023

The high cost of low maintenance

Walter P Moore’s Javier Balma, PhD, PE, SE, and Webb Wright, PE, identify the primary causes of engineering failures, define proactive versus reactive maintenance, recognize the reasons for deferred maintenance, and identify the financial and safety risks related to deferred maintenance.

Healthcare Facilities | Jun 5, 2023

Modernizing mental health care in emergency departments: Improving patient outcomes

In today’s mental health crisis, there is a widespread shortage of beds to handle certain populations. Patients may languish in the ED for hours or days before they can be linked to an appropriate inpatient program.

Healthcare Facilities | Jun 1, 2023

High-rise cancer center delivers new model for oncology care

Atlanta’s 17-story Winship Cancer Institute at Emory Midtown features two-story communities that organize cancer care into one-stop destinations. Designed by Skidmore, Owings & Merrill (SOM) and May Architecture, the facility includes comprehensive oncology facilities—including inpatient beds, surgical capacity, infusion treatment, outpatient clinics, diagnostic imaging, linear accelerators, and areas for wellness, rehabilitation, and clinical research.

Healthcare Facilities | May 19, 2023

A new behavioral health facility in California targets net zero energy

Shortly before Mental Health Awareness Month in May, development and construction firm Skanska announced the topping out of California’s first behavioral health facility—and the largest in the nation—to target net zero energy. Located in Redwood City, San Mateo County, Calif., the 77,610-sf Cordilleras Health System Replacement Project is slated for completion in late 2024.

3D Printing | May 12, 2023

World’s first 3D-printed medical center completed

3D construction printing reached new heights this week as the world’s first 3D-printed medical center was completed in Thailand.

Sustainability | May 11, 2023

Let's build toward a circular economy

Eric Corey Freed, Director of Sustainability, CannonDesign, discusses the values of well-designed, regenerative buildings.

Digital Twin | May 8, 2023

What AEC professionals should know about digital twins

A growing number of AEC firms and building owners are finding value in implementing digital twins to unify design, construction, and operational data.

Design Innovation Report | Apr 27, 2023

BD+C's 2023 Design Innovation Report

Building Design+Construction’s Design Innovation Report presents projects, spaces, and initiatives—and the AEC professionals behind them—that push the boundaries of building design. This year, we feature four novel projects and one building science innovation.

Sustainability | Apr 20, 2023

13 trends, technologies, and strategies to expect in 2023

Biophilic design, microgrids, and decarbonization—these are three of the trends, technologies, and strategies IMEG’s market and service leaders believe are poised to have a growing impact on the built environment.

Design Innovation Report | Apr 19, 2023

HDR uses artificial intelligence tools to help design a vital health clinic in India

Architects from HDR worked pro bono with iKure, a technology-centric healthcare provider, to build a healthcare clinic in rural India.