Continuing the positive momentum of a nearly three-point bump in January, the Architecture Billings Index (ABI) reached its first positive mark since February 2020, according to a new report today from The American Institute of Architects (AIA).

AIA’s ABI score for February was 53.3 compared to 44.9 in January (any score above 50 indicates an increase in billings). February also marked the first time the design contract score rose back into positive territory since the pandemic began with a score of 51.6 compared to 48.8 in January. The new project inquiries score for February reached a 22-month high water mark with a score of 61.2 compared to 56.8 in January.

“Hopefully, this is the start of a more sustained recovery. It is possible that scores will continue to bounce above and below 50 for the next few months, as recoveries often move in fits and starts,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Beyond the encouraging billing data, architecture employment added 700 new positions in January and has now regained 45 percent of the jobs that were lost since the beginning of the pandemic.”

Key ABI highlights for February include:

• Regional averages: South (52.4); West (49.5); Midwest (49.3); Northeast (46.9)

• Sector index breakdown: mixed practice (52.5); commercial/industrial (50.5); multi-family residential (48.3); institutional (47.8)

• Project inquiries index: 61.2

• Design contracts index: 51.6

The regional and sector categories are calculated as a three-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

Visit AIA’s website for more ABI information.

Related Stories

Market Data | Apr 16, 2019

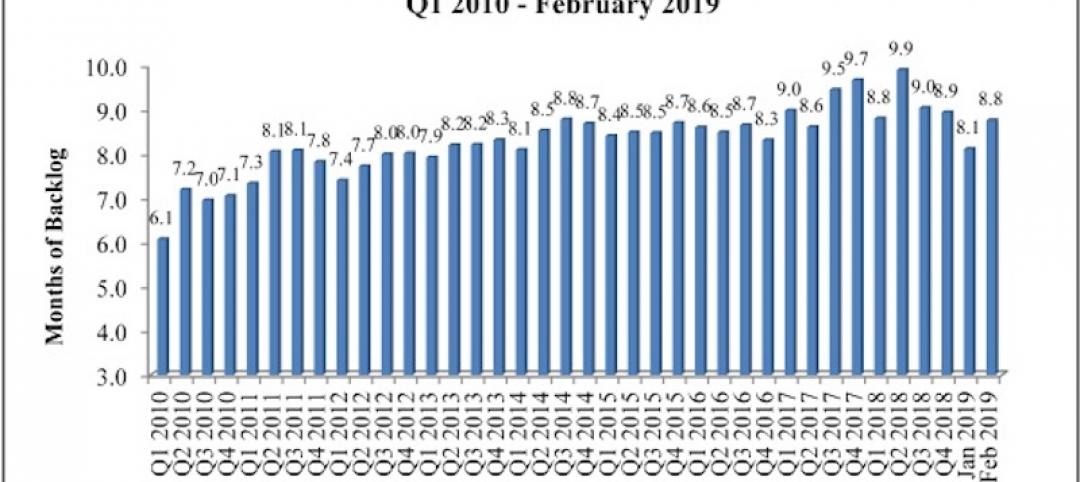

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

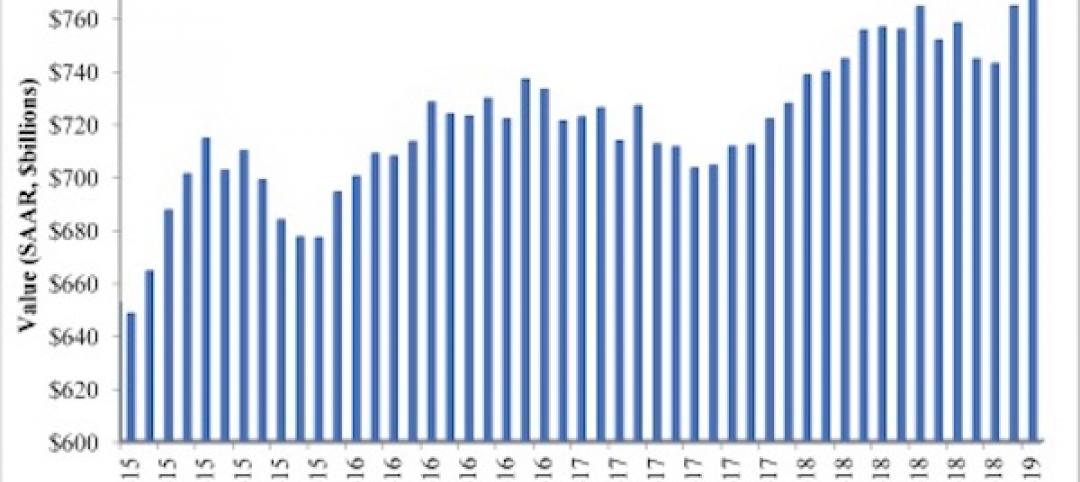

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

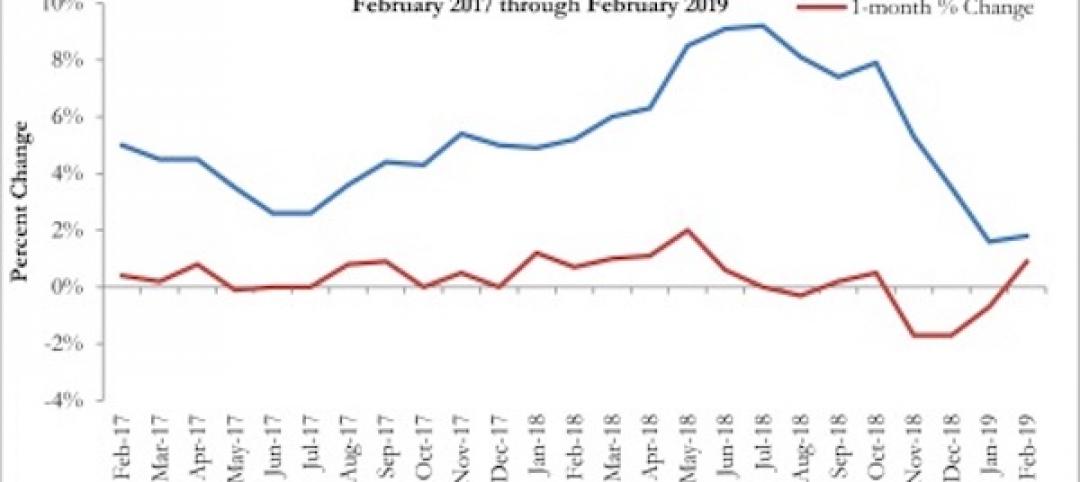

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.