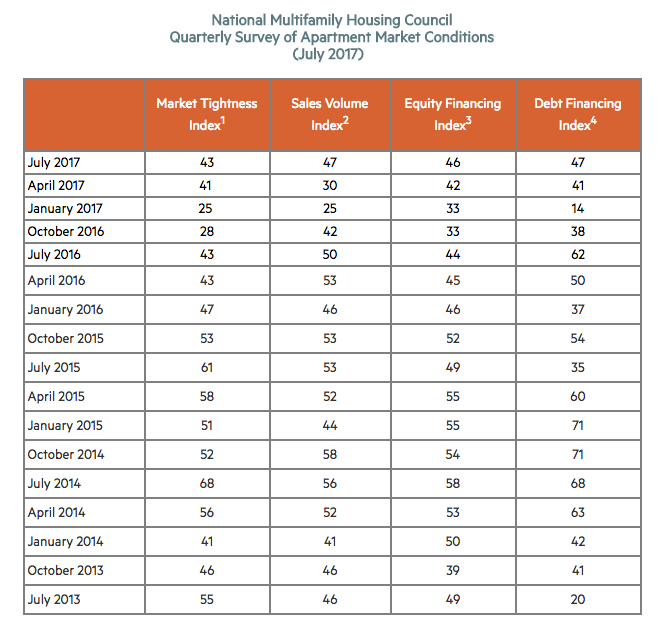

All four indexes of the National Multifamily Housing Council’s (NMHC) July Quarterly Survey of Apartment Market Conditions remained slightly below the breakeven level of 50, the fourth consecutive quarter indicating softening conditions. The Market Tightness (43), Sales Volume (47), Equity Financing (46), and Debt Financing (47) Indexes all improved from April, but still hovered just below 50.

“All four indexes are below 50 but rising, suggesting that the softening is less wide-spread than in previous quarters,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite some softness at the high end of the apartment market—due to construction having finally ramped up to the level needed—demand for apartments will continue to be substantial for years to come.”

The Market Tightness Index edged up from 41 to 43, as almost half of respondents (48 percent) reported unchanged conditions. One-third (33 percent) of respondents saw conditions as looser than three months ago, while the remaining 19 percent reported tighter conditions. This marks the seventh consecutive quarter of overall declining conditions.

The Sales Volume Index increased from 30 to 47, just shy of the breakeven level of 50. Twenty-seven percent of respondents reported higher sales volume than three months prior, compared to 33 percent that reported lower volume.

The Equity Financing Index increased four points to 46, with almost a quarter (24 percent) of respondents believing that equity financing was less available than three months prior. Sixteen percent thought that equity financing was more available compared to three months ago.

The Debt Financing Index increased from 41 to 47, showing a similar trend to the equity market. While a quarter of respondents (25 percent) reported worse conditions for debt financing compared to three months prior, another 19 percent disagreed, believing conditions had become more favorable.

About the Survey:

The July 2017 Quarterly Survey of Apartment Market Conditions was conducted July 10-July 17, 2017; 123 CEOs and other senior executives of apartment-related firms nationwide responded.

Related Stories

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Designers | Feb 23, 2024

Coverings releases top 2024 tile trends

In celebration of National Tile Day, Coverings, North America's leading tile and stone exhibition, has announced the top 10 tile trends for 2024.

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Building Tech | Feb 20, 2024

Construction method featuring LEGO-like bricks wins global innovation award

A new construction method featuring LEGO-like bricks made from a renewable composite material took first place for building innovations at the 2024 JEC Composites Innovation Awards in Paris, France.

Student Housing | Feb 19, 2024

UC Law San Francisco’s newest building provides student housing at below-market rental rates

Located in San Francisco’s Tenderloin and Civic Center neighborhoods, UC Law SF’s newest building helps address the city’s housing crisis by providing student housing at below-market rental rates. The $282 million, 365,000-sf facility at 198 McAllister Street enables students to live on campus while also helping to regenerate the neighborhood.

Multifamily Housing | Feb 16, 2024

5 emerging multifamily trends for 2024

As priorities realign and demographic landscapes transform, multifamily designers and developers find themselves in a continuous state of adaptation to resonate with residents.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.

MFPRO+ News | Feb 15, 2024

Oregon, California, Maine among states enacting policies to spur construction of missing middle housing

Although the number of new apartment building units recently reached the highest point in nearly 50 years, construction of duplexes, triplexes, and other buildings of from two to nine units made up just 1% of new housing units built in 2022. A few states have recently enacted new laws to spur more construction of these missing middle housing options.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.