The American Institute of Architects (AIA) today announced the publication of a white paper on the nation’s $3 trillion public infrastructure crisis and how public private partnerships (P3) offer a possible solution.

The AIA also announced that it was co-sponsoring with Governing Magazine the May 12 Summit on Infrastructure & Public Private Partnerships, a conference geared for state and local government officials tasked with updating their infrastructure, but who lack the means to do so.

“Building-Up: How States Utilize Public-Private Partnerships for Social & Vertical Infrastructure,” chronicles the public infrastructure crisis facing the United States and how states have found themselves facing sizeable budgetary shortfalls amid a stock of aging highways, public buildings and water distribution systems.

Through case studies, the white paper cites examples of innovative solutions used by the states and localities to combat this crisis while capitalizing on the P3 model for a variety of infrastructure needs. It includes a map highlighting a number of the current non-transportation P3s from around the country.

To help government optimize the value of P3 and its long-term quality implications, the AIA is co-sponsoring with Governing Magazine the May 12 Summit on Infrastructure & Public Private Partnerships (P3), a conference geared for state and local government officials tasked with updating their infrastructure.

A recent study by Governing Magazine found that half of all state and local leaders surveyed believe that a lack of infrastructure investment is their most significant financial problem. The summit will address the needs of local officials contemplating major infrastructure projects and who are trying to decide if a P3 is suitable for their jurisdictions.

Among the topics to be addressed:

- Evaluating, pricing and managing risk

- Defining clear project goals and cost projections

- Insights from industry experts on life-cycle cost considerations and private sector equity

- Case Studies - Public sector leaders who have implemented P3 will share lessons learned and tips for success

While P3 is a financing concept gaining popularity worldwide, it is under-utilized in the U.S., relative to other countries, according to Governing. The single biggest barrier is a lack of public-sector expertise in negotiating what can be complex, long-term agreements that assume risk on behalf of taxpayers. This Summit will share best practices, lessons learned and case studies that will help governments negotiate successful agreements and common pitfalls.

Related Stories

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

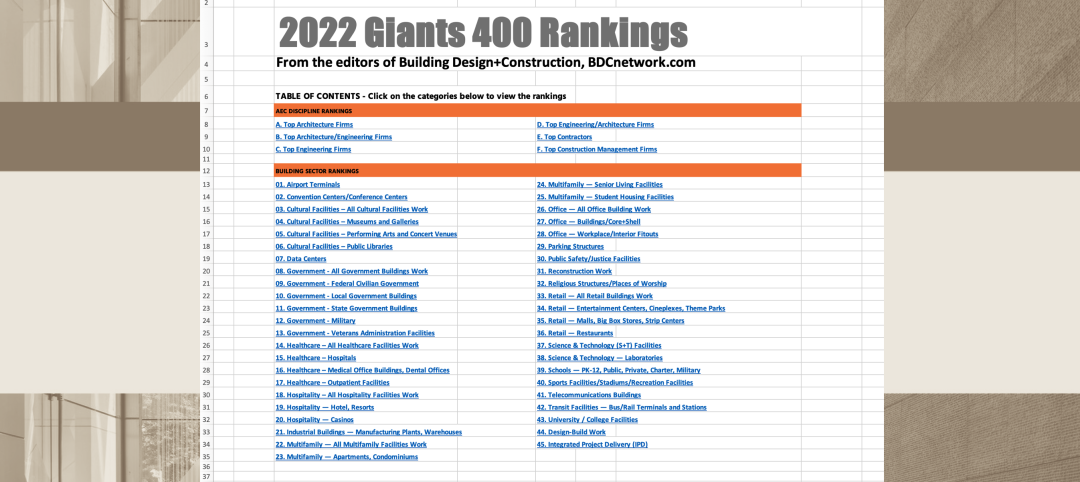

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.