Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year. This followed the 8.0 NPMI in the 4th Quarter of 2022, which marked the lowest level since the final quarter of 2020 and the second-lowest NPMI recorded in the last 10 years.

PSMJ President Greg Hart noted that the 1st quarter results are a pleasant surprise, especially since data was collected after the Silicon Valley Bank collapse and amid continuing interest rate hikes and recession predictions. “I don’t think anybody expected this kind of recovery,” he said. “But inflation is cooling and there are some positive signs in the housing market, so maybe we’ve found the bottom.”

First quarter results have historically been the strongest throughout the history of the QMF survey, which may play some part in the jump in project opportunities. In the last 10 years, the first quarter NPMI averaged 45.2, with the results weakening in subsequent quarters. The average NPMI for the 2nd quarter since 2013 is 36.5, with the third and fourth quarters averaging 29.0 and 25.7, respectively. Year-over-year, the NPMI for the first three months of 2023 was down substantially from a near-record NPMI of 60.2 reported in the first quarter of 2022.

PSMJ’s proprietary NPMI is the difference between the percentage of respondents who say that proposal opportunities are growing and those reporting a decrease. In addition to overall activity, the QMF surveys A/E/C firm leaders about their proposal activity experience in 12 major markets and 58 submarkets.

Private Sector Construction Markets Struggle, Publics Thrive

Firms working in private-sector markets continue to report historically low levels of proposal activity, while those in the public sector perform better, as the chart below indicates. Environmental topped all 12 major markets with an NPMI of 71.4, followed by Water/Wastewater at 70.8. Transportation continues to thrive, aided by the Infrastructure Investment and Jobs Act (IIJA), with an NPMI of 65.5. Energy/Utilities remains solid, repeating its fourth-place finish from the prior quarter and a near-exact NPMI of 55.1 (down from 55.2).

Since the 1st quarter of 2019, the Energy/Utilities market has been out of the top five only once (the 2nd quarter of 2021), and the Water/Wastewater market has missed the top five just twice.

The biggest surprise of the 1st Quarter may be that Education was the fifth-strongest among the major markets with an NPMI of 42.2. This is the first time that Education hit the top five since the 2nd quarter of 2018. The Higher Education (NPMI of 45.3) and K-12 (42.3) submarkets drove the resurgence.

Related Stories

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

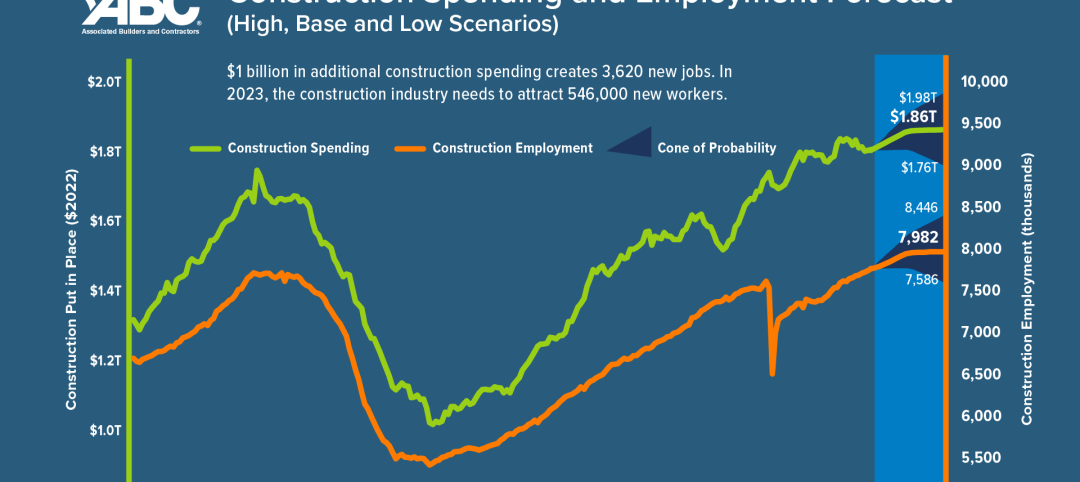

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

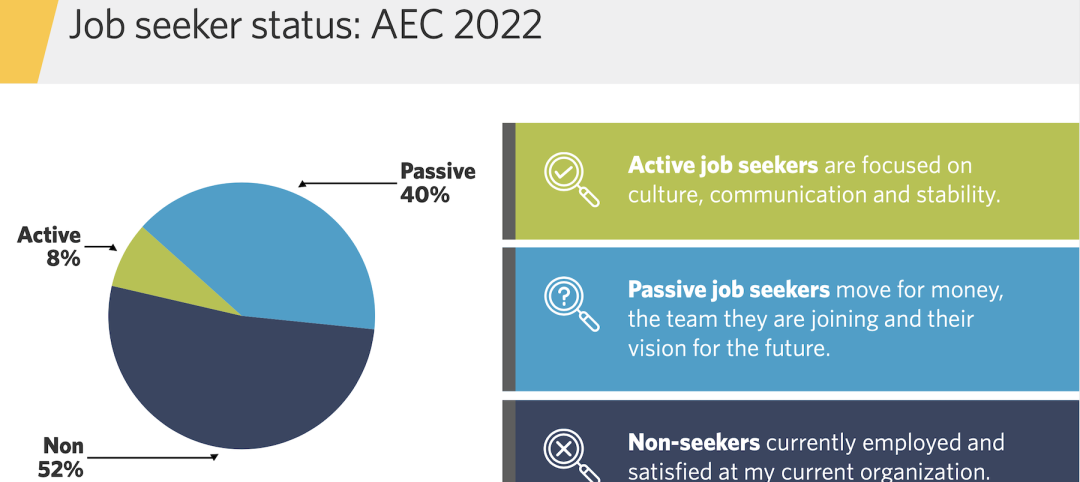

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.