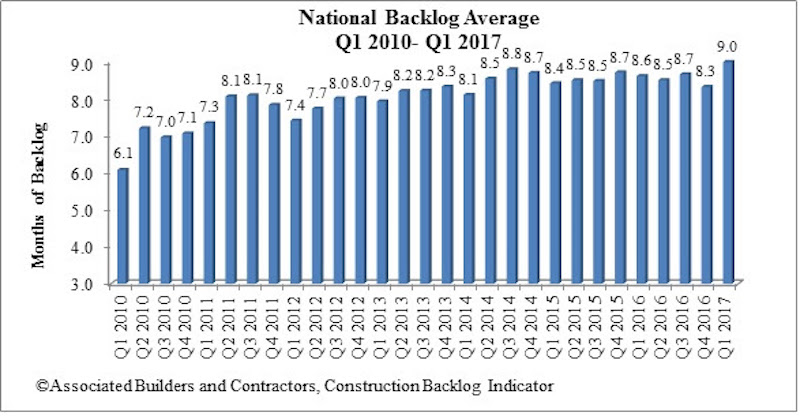

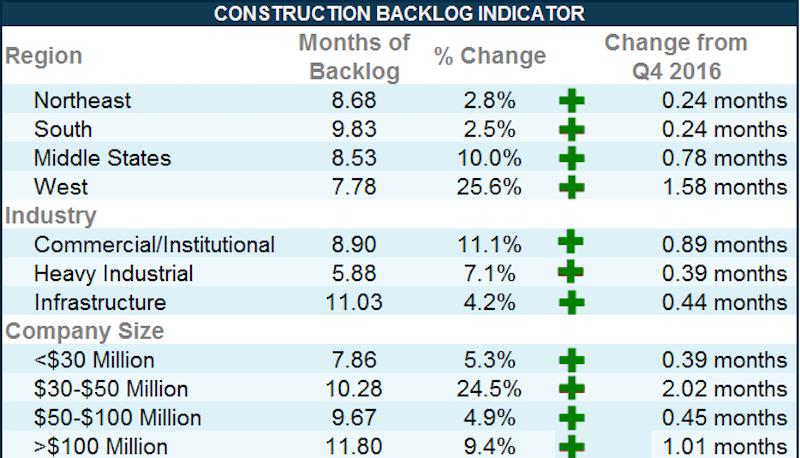

Associated Builders and Contractors (ABC) recently reported that its Construction Backlog Indicator (CBI) rose to 9 months during the first quarter of 2017, up 8.1 percent from the fourth quarter of 2016. CBI is up by 0.4 months, or 4 percent, on a year-over-year basis.

“This was a terrific report,” said ABC Chief Economist Anirban Basu. “For the first time in the series’ history, every category—firm size, industry and region—registered quarterly growth in CBI. Among the big winners were firms in the western United States and those with annual revenues between $30 million and $50 million per annum"

Highlights by Region

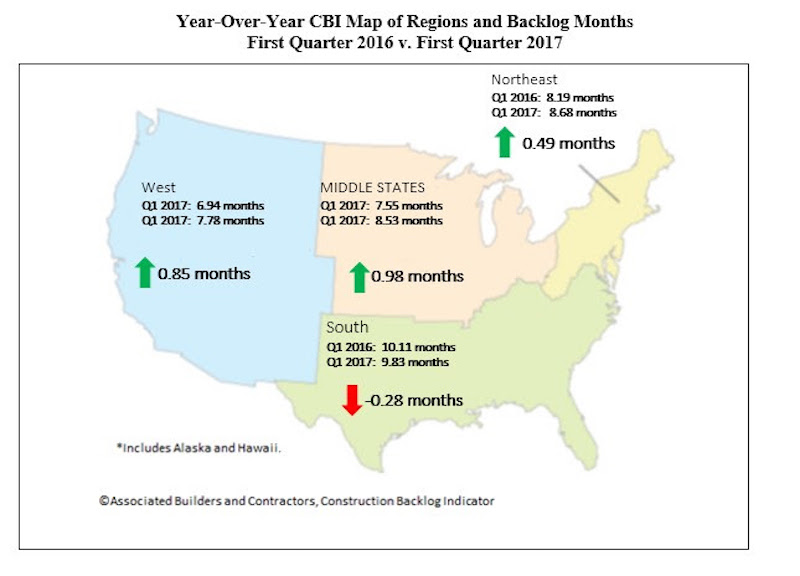

- Surging financial markets helped support activity in financial centers like New York, Philadelphia and Boston. Expanding cyber-security and life sciences activity supported markets as geographically diverse as Washington/Baltimore; Austin, Texas; Silicon Valley, Calif., and Seattle.

- Though backlog is slightly lower in the South on a year-over-year basis, it continues to report the lengthiest backlog, at 9.8 months. A number of markets remain extraordinarily active with respect to commercial construction, including Atlanta and Miami and Tampa, Fla. Distribution center construction also continues to be active due to a combination of busier seaports and the ongoing online retail boom.

- Backlog in the West was up by a remarkable 26 percent during the quarter. Part of this was due to statistical payback after a surprisingly weak fourth quarter. However, this is also a reflection of the rapid commercial growth in Seattle, Denver, Silicon Valley, San Diego, Phoenix and other population growth hotspots.

- Higher oil and natural gas prices helped to drive CBI higher in the Middle States. Backlog in the region expanded by a more-than-respectable 10 percent during the first quarter, and now stands at a healthy 8.5 months. Chicago continues to be a weak spot, however, registering slow job growth relative to other major U.S. metropolitan areas in recent quarters.

- Backlog in the Northeast rose to 8.7 months during the first quarter. Backlog is up by almost precisely half a month over the past year. The New York and Boston metropolitan areas remain particularly active.

Highlights by Industry

- Backlog in the commercial/institutional segment rose by more than 11 percent during the first quarter, and now stands at nearly 9 months. Backlog also expanded in the heavy industrial and infrastructure categories during the first three months of the year.

- Average backlog in the heavy industrial category rose to 5.88 months, but remains well below levels registered during much of the history of the series. Excluding the fourth quarter of 2016, this represents the lowest reading since the fourth quarter of 2014. There are many forces at work, including slowing auto sales, downward pressure on prices in a number of key manufacturing segments and soft exports.

- Backlog in the infrastructure category expanded during the first quarter and remains above historic levels. Actual infrastructure spending has been unimpressive in many categories recently, including wastewater, water supply, dams/levies and highway/street. Available survey data hint at a bit of a pickup in activity during the quarters ahead.

- Commercial/institutional backlog expanded to 8.9 months, matching its highest level since the third quarter of 2014. Though there are growing concerns regarding overbuilding in a number of metropolitan areas, and retail stores continue to close in large numbers, increases in office and hotel construction are helping to propel this category forward.

Highlights by Company Size

- Backlog for each of the four company size categories increased to start the year. Firms with revenues of $30 million to $50 million, many of which are in the commercial/institutional segments, were the clear outperformers in terms of expanding backlog during the first quarter of 2017. Backlog for this group of firms expanded by more than two months, indicating growing confidence among developers and other purchasers of construction services

- Backlog among firms with annual revenues of less than $30 million increased by 5.3 percent during the quarter. Over the course of time, the nonresidential construction recovery has broadened enough to encompass many of the smallest firms.

- The largest firms, those with annual revenues above $100 million and which are disproportionately represented in the infrastructure category, report the lengthiest backlog at 11.8 months. This was up by more than 9 percent during the quarter. Backlog for this group is approaching the one-year mark, which is considered to be a sign of significant health.

Related Stories

Market Data | Apr 3, 2017

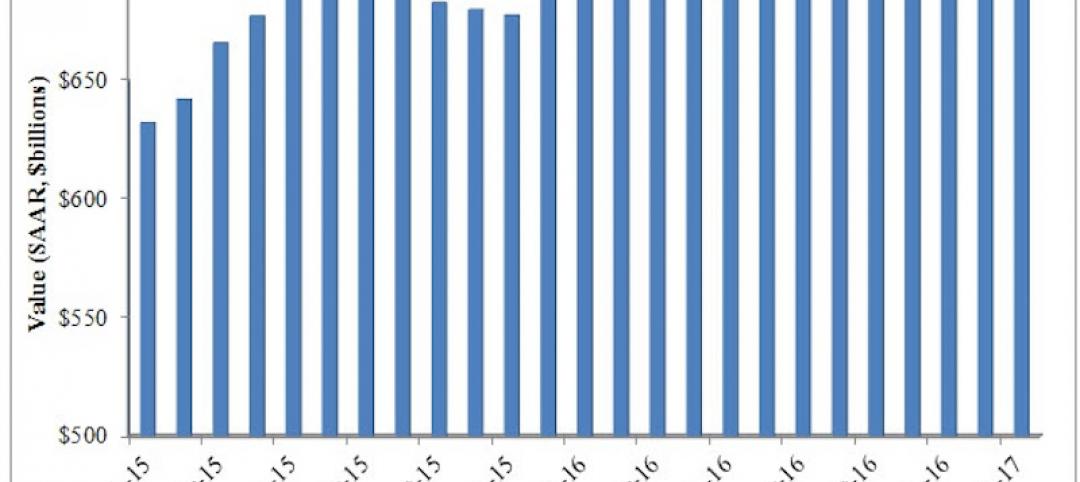

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

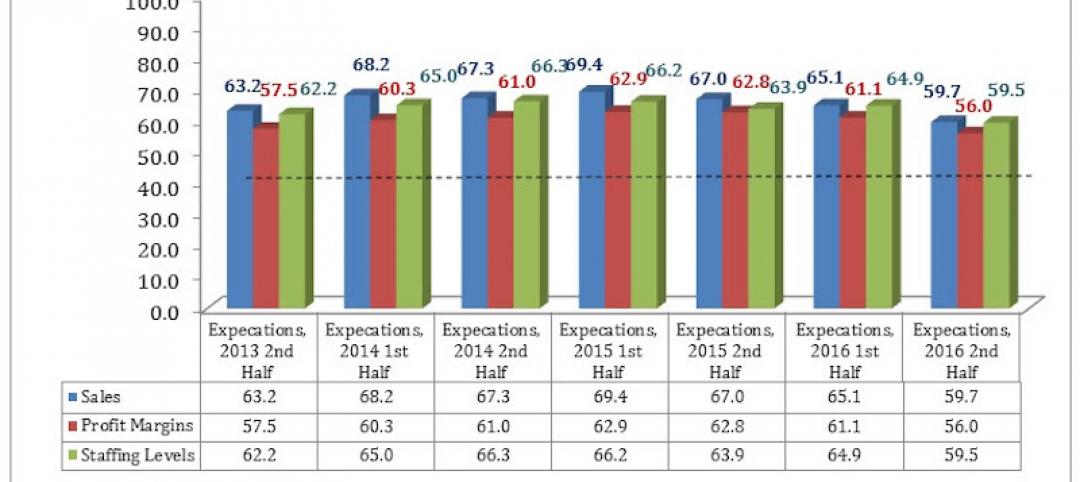

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

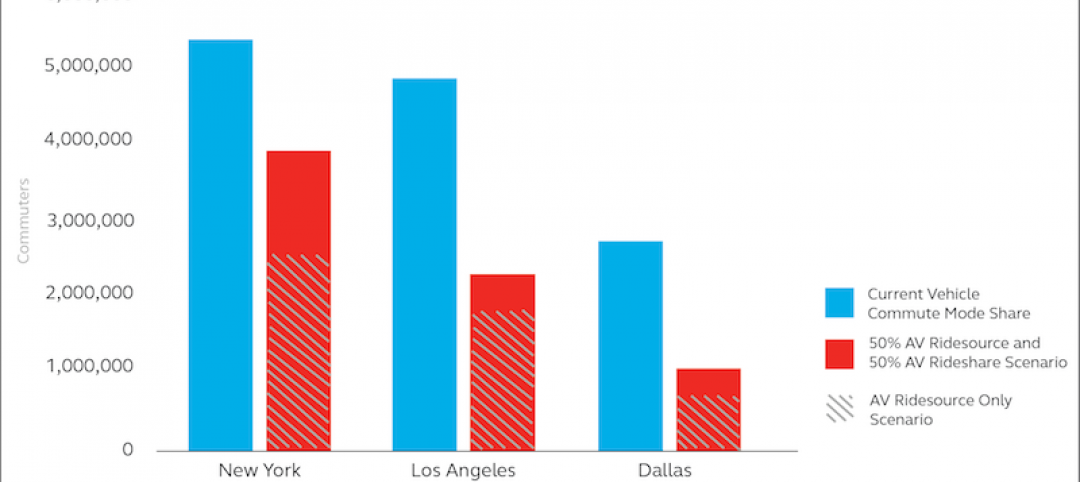

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.

Office Buildings | Mar 7, 2017

Large creative office projects generate staggering returns for property investors

A new Transwestern report examines the adaptive reuse trend across the U.S.

Industry Research | Mar 7, 2017

These are the 10 most expensive cities in the world to build in

Paris, Frankfurt, and Macau are all on the list, but none of them are more expensive than the city in the number one spot.

Office Buildings | Mar 2, 2017

White paper from Perkins Eastman and Three H examines how design can inform employee productivity and wellbeing

This paper is the first in a planned three-part series of studies on the evolution of diverse office environments and how the contemporary activity-based workplace (ABW) can be uniquely tailored to support a range of employee personalities, tasks and work modes.

Industry Research | Feb 15, 2017

Putting workers first should be every employer’s priority

The latest Sodexo report on workplace trends explores 10 factors that are impacting the global work environment.