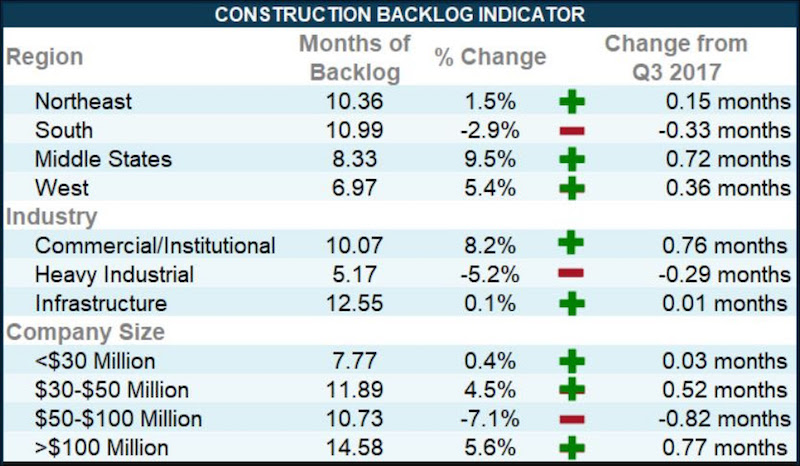

Associated Builders and Contractors (ABC) today reported that its Construction Backlog Indicator(CBI) expanded to 9.67 months during the fourth quarter of 2017—its highest level ever and a 2.25% increase from the prior quarter. Backlog records were broken in the Northeast region, the commercial/industrial segment and among firms with $30 to $50 million in annual revenues. CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.

“During the fourth quarter of 2017, the CBI established an all-time high, breaking records set during both the first and third quarters of last year,” said ABC Chief Economist Anirban Basu. “The implication is that the average nonresidential construction firm entered 2018 with significant momentum. Construction spending is set to be elevated this year under virtually any conceivable scenario.

“A confluence of factors has produced this result, including still-expansionary monetary policy and accelerating global growth in much of the world, brisk foreign investment in U.S. commercial real estate, surging business/developer confidence, deregulation of certain key industries, higher energy prices, strong consumer spending, a recovering U.S. manufacturing sector and rising spending in a handful of publicly financed construction categories,” said Basu. “Recently enacted tax reform is likely to serve as an additional tailwind to an already strong construction story.

“As always, there is reason for some concern. While 2018 is likely to be a solid year for construction spending, there are grey clouds emerging from the silver linings. A trade dispute with Canada has helped push softwood lumber prices higher. Recently announced tariffs on steel and aluminum may have similar effects. Indeed, inflationary pressures are building in various elements of the economy, including wages, health care, homes, apartments and tuition. The result is an increasingly inflationary economy likely to produce higher interest rates over time,” said Basu. “Should interest rates rise too quickly, backlog is likely to eventually decline as fewer developments are green-lighted due to higher borrowing costs.”

Highlights by Region

Backlog in the South fell 2.9% during the fourth quarter, but remains nearly 15%higher on a year-over-year basis. Southern markets such as Orlando, Atlanta, Nashville, Dallas and Austin continue to be associated with significant construction momentum. The storms of several months ago also have helped lift backlog in Houston and other impacted communities.

Backlog in the Northeast expanded for a fifth consecutive quarter as cities like Boston, New York and Philadelphia continue to experience brisk commercial investment. The region’s backlog has expanded by nearly 23% during the past year and now stands at its highest recorded level.

Backlog in the Middle States rebounded during the fourth quarter after declining during the prior two quarters. The 9.5% quarterly increase represented the largest quarterly increase in any of the four regions.

Backlog in the West continued to rise during the fourth quarter, but still stands at just 7 months. The 2017 California wildfire season, which was the most destructive on record and burned nearly 1.4 million acres, likely stalled a certain volume of construction projects and suppressed fourth quarter backlog.

Highlights by Industry

Backlog in the commercial/institutional segment expanded briskly for a second consecutive quarter. At 10.1 months, the segment’s average backlog is at its highest level in the history of the series.

Average backlog in the heavy industrial category fell for a third consecutive quarter. At 5.2 months, the segment’s backlog is down 5.2% on a quarterly basis and 5.8% on a year-over-year basis. CBI has neatly predicted recently observed declines in construction activity related to U.S. manufacturing.

Backlog in the infrastructure category inched up to 12.55 months during the fourth quarter, the highest reading on record for the segment. Improving state and local government finances are helping spur additional public construction, including in the education, public safety, highway/street and transportation categories.

Highlights by Company Size

Large firms, those with annual revenues in excess of $100 million, have experienced skyrocketing backlog during the past year. The combination of large-scale commercial/mixed-use development and stepped up public construction activity has produced an average backlog approaching 14.6 months. Backlog for the nation’s largest nonresidential construction firms is up an astonishing 35% during the past year.

Backlog among firms with annual revenues between $50 million and $100 million fell by 0.8 months in the fourth quarter and currently stands at a still-healthy 10.73 months. Backlog for this category is at its second highest level since the late stages of 2013.

Firms with $30 million to $50 million in annual revenues experienced their fifth consecutive quarter of rising backlog. The fourth quarter reading of 11.89 months surpasses the third quarter of 2012 as the highest on record.

Backlog for firms with annual revenues below $30 million increased by 0.4% during the fourth quarter and remains remarkable steady. For the past three years, backlog for this category has remained in a tight range between 7.2 months and 8.1 months. It is conceivable that the lack of pronounced growth in backlog for this group is due to a lack of available workforce. The lack of a reliably available workforce renders it difficult for smaller firms to commit to the larger-scale projects that would pump up backlog.

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed. CBI is measured in months, with a lengthening backlog implying expanding demand for construction services. More CBI charts and graphs are available on abc.org.

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.