1. Mobile ordering is a centerpiece of Burger King’s new design (BD+C)

"The first new designed restaurants will be built in Miami (Restaurant Brands’ headquarters city), Latin America, and the Caribbean islands. Restaurant Brands did not disclose when the new designs would be extended to other cities in the U.S. Burger King has 18,756 locations in more than 100 countries, nearly all of which are independently owned franchises."

2. Property values face collapse as more hotels hit the market (American City Business Journals via National Real Estate Investor)

"More San Antonio hotel owners may be compelled to sell at reduced rates as loan payments become tougher to cover."

3. How lenders are helping AEC firms cross COVID hurdles (Commercial Property Executive)

"Financially stable architecture, engineering and construction firms have been able to roll with work stoppages and workforce issues, says Phillip Ross of Anchin."

4. SURVEY: 63% of the Empire State's restaurants could be gone 'In A New York Minute' by 2021 (Bisnow)

"Nearly two-thirds of New York’s restaurants are on track to close by the end of 2020 and over half of those restaurants are likely to do so within the next two months. Just under 64% of some 1,042 restaurants across the state said they would close by New Year’s Day without monetary assistance and 54.8% said they would be forced to close by Nov. 1, according to a survey conducted by the New York State Restaurant Association and released Thursday."

5. New digital weapons in the apartment amenities arms race (Propmodo)

"The amenities arms race. That is what the real estate industry loves to call the escalating level of services offered by apartment buildings. For decades in the country’s hottest luxury rental markets property owners have been investing outside of their units, providing all kinds of high-end facilities and high-touch services. In these competitive markets, gyms become closer to fitness clubs than weight rooms, doormen are more like concierge than security, and common areas more closely resemble private lounges than they do motel lobbies."

6. Rent collection high In most asset types, Marcus & Millichap finds (Commercial Property Executive)

"While in some sectors more than 95 percent of tenants are meeting their rent obligations, some retail assets continue to struggle."

Related Stories

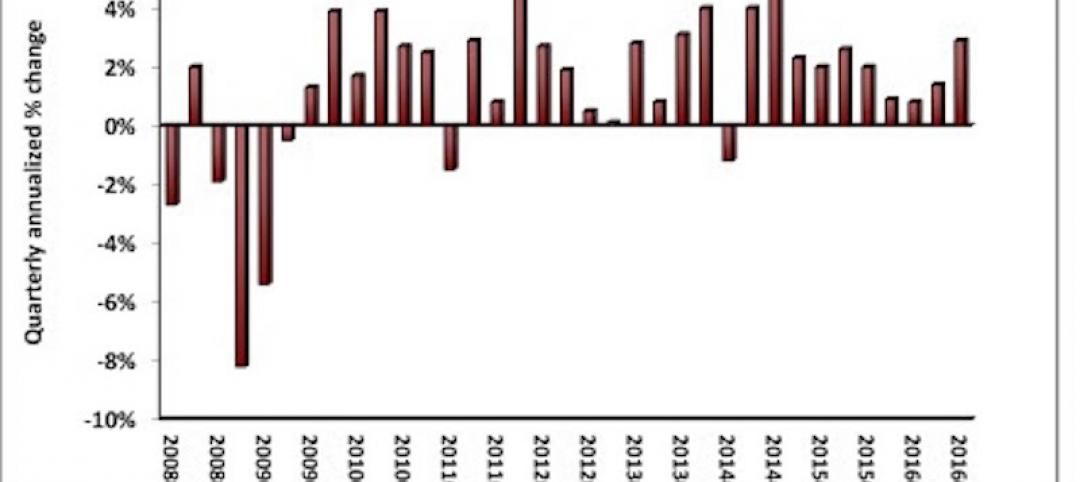

Market Data | Oct 31, 2016

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.