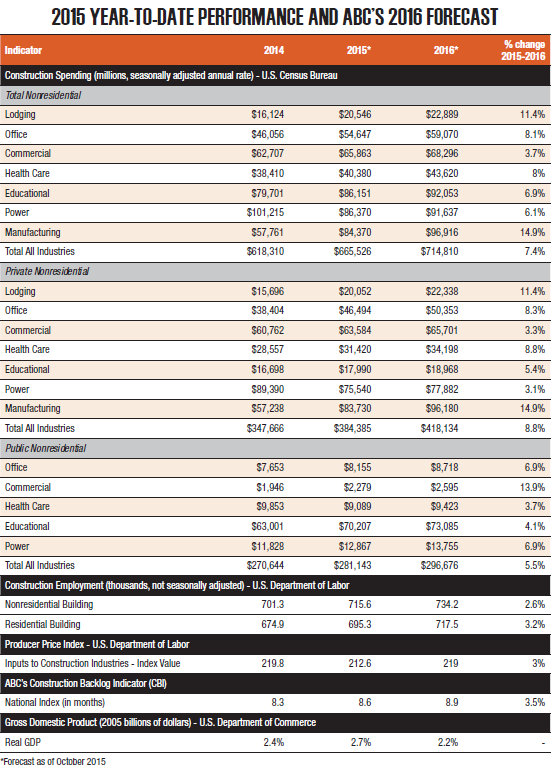

Despite a weak global economy, the industry's solid economic recovery in 2015 should continue in 2016, led by strong consumer spending, according to the 2016 construction industry forecast from the Associated Builders and Contractors (ABC).

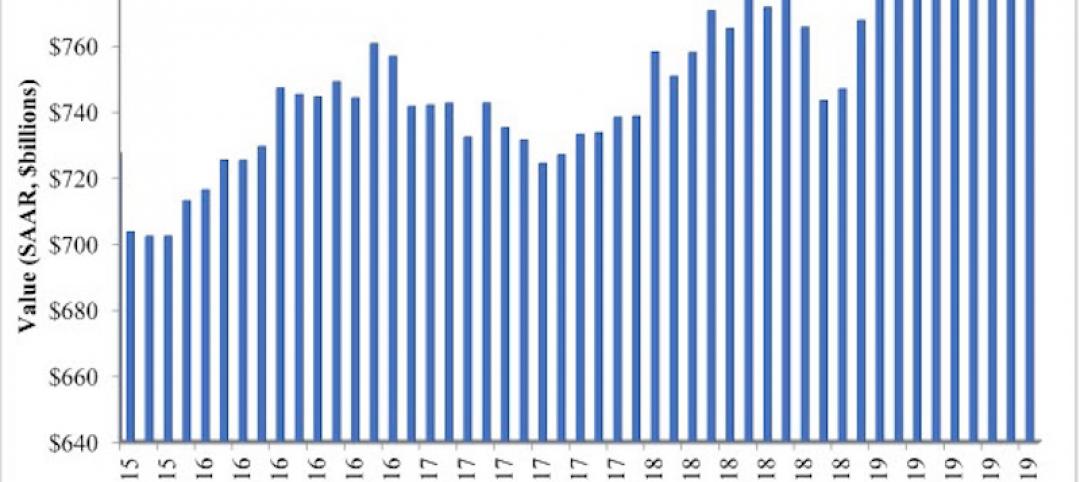

The group forecasts growth in nonresidential construction spending of 7.4% next year, along with growth in employment and backlog.

"The mid-phase of the recovery is typically the lengthiest part and ultimately gives way to the late phase, when the economy overheats,” ABC Chief Economist Anirban Basu said. "Already, signs of overheating are evident, particularly with respect to emerging skills shortages in key industry categories such as trucking and construction."

Basu said that average hourly earnings across all industries are up only 2% in the past year, below the Federal Reserve's goal of 3.5%. Purchase prices in real estate and technology segments are rocketing higher and capitalization rates remain unusually low.

According to the most recent ABC Construction Confidence Index, overall contractor confidence has increased with respect to both sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase rapidly during the next six months, largely because of the lack of suitably trained skilled personnel, the rate of new hires will continue at a steady pace.

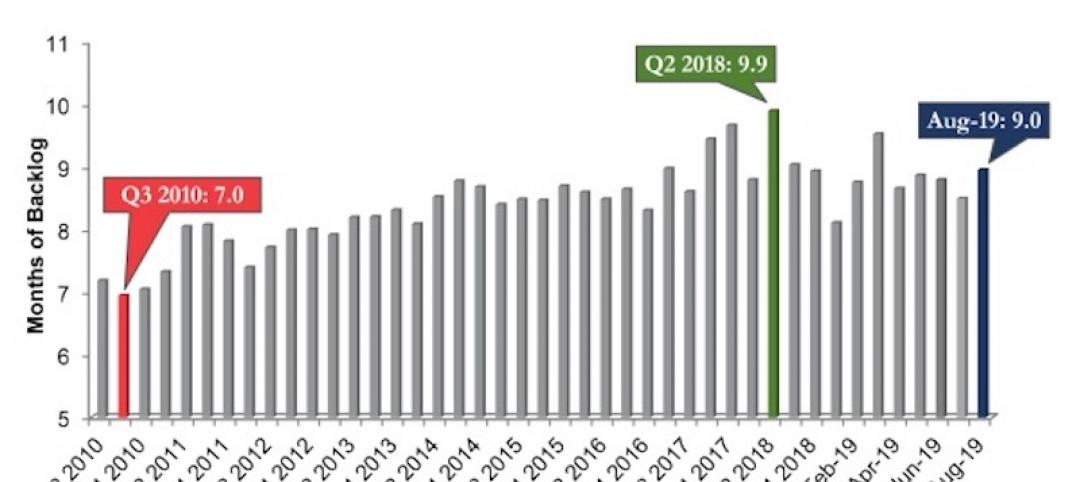

ABC's Construction Backlog Indicator also signals strong demand. According to the latest survey, average contractor backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western United States and the heavy industrial category.

Basu's full forecast is available in the December edition of ABC's Construction Executive magazine, along with the regional outlook for commercial and industrial construction by economist Bernard Markstein, PhD. Free subscriptions are available to construction industry professionals.

Related Stories

Market Data | Dec 4, 2019

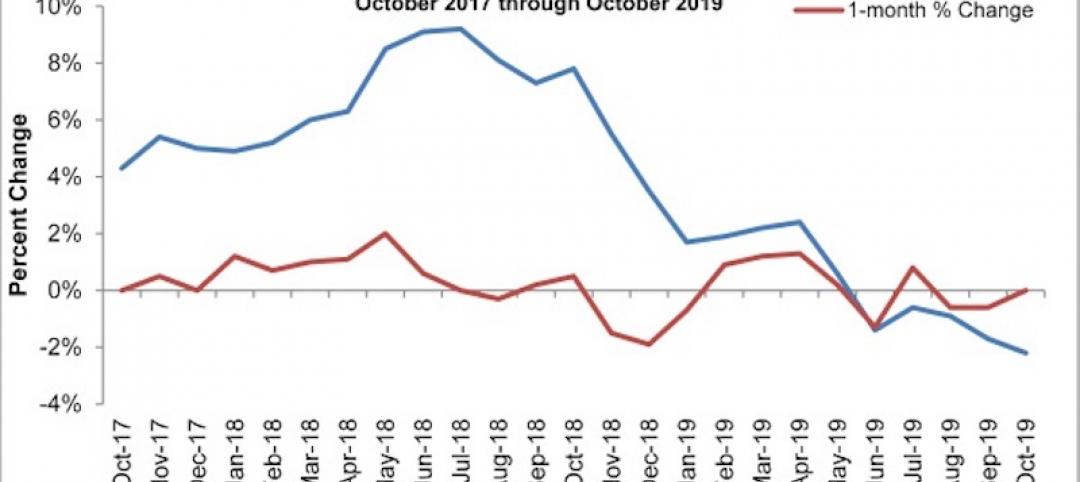

Nonresidential construction spending falls in October

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.