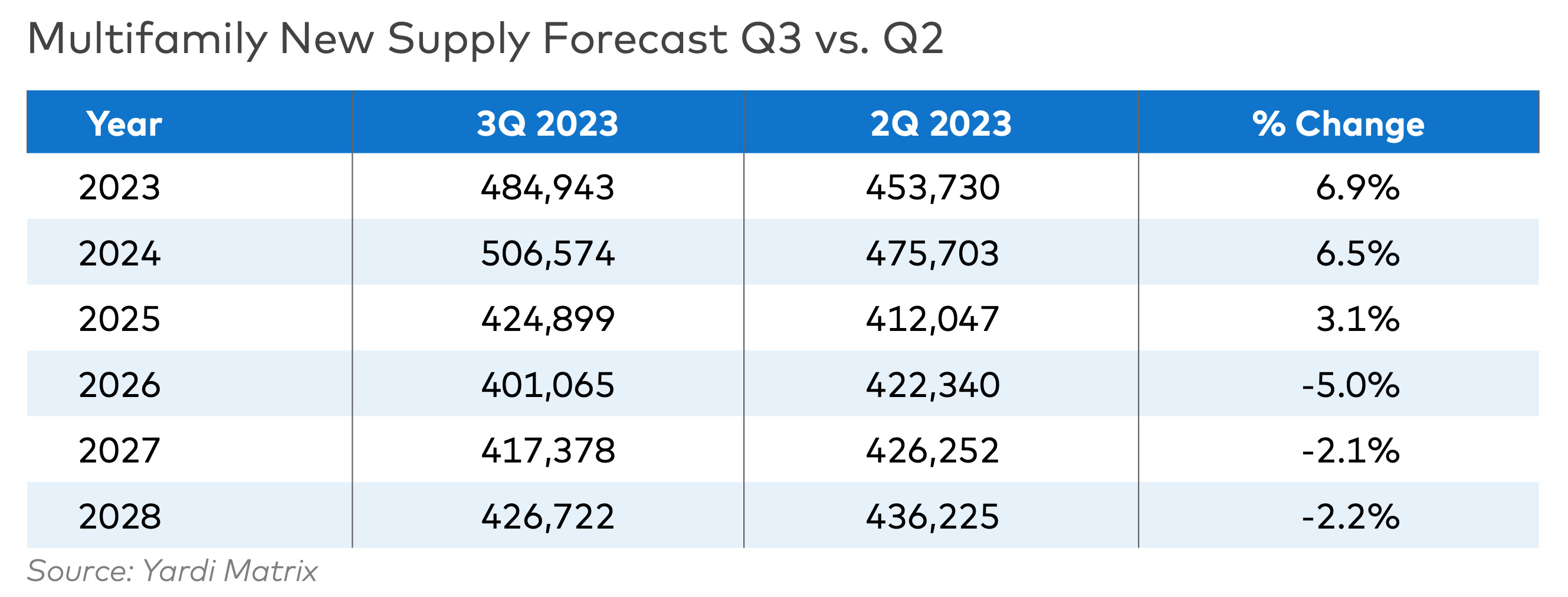

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

The Q3 2023 supply forecast update has increased forecast completions 6.9% for 2023 and 6.5% for 2024. The near-term forecast was increased this month as the under-construction pipeline continues to expand, and 2023 construction starts to date have not exhibited any signs of a slowdown.

Yardi Matrix's Multifamily Supply Forecast

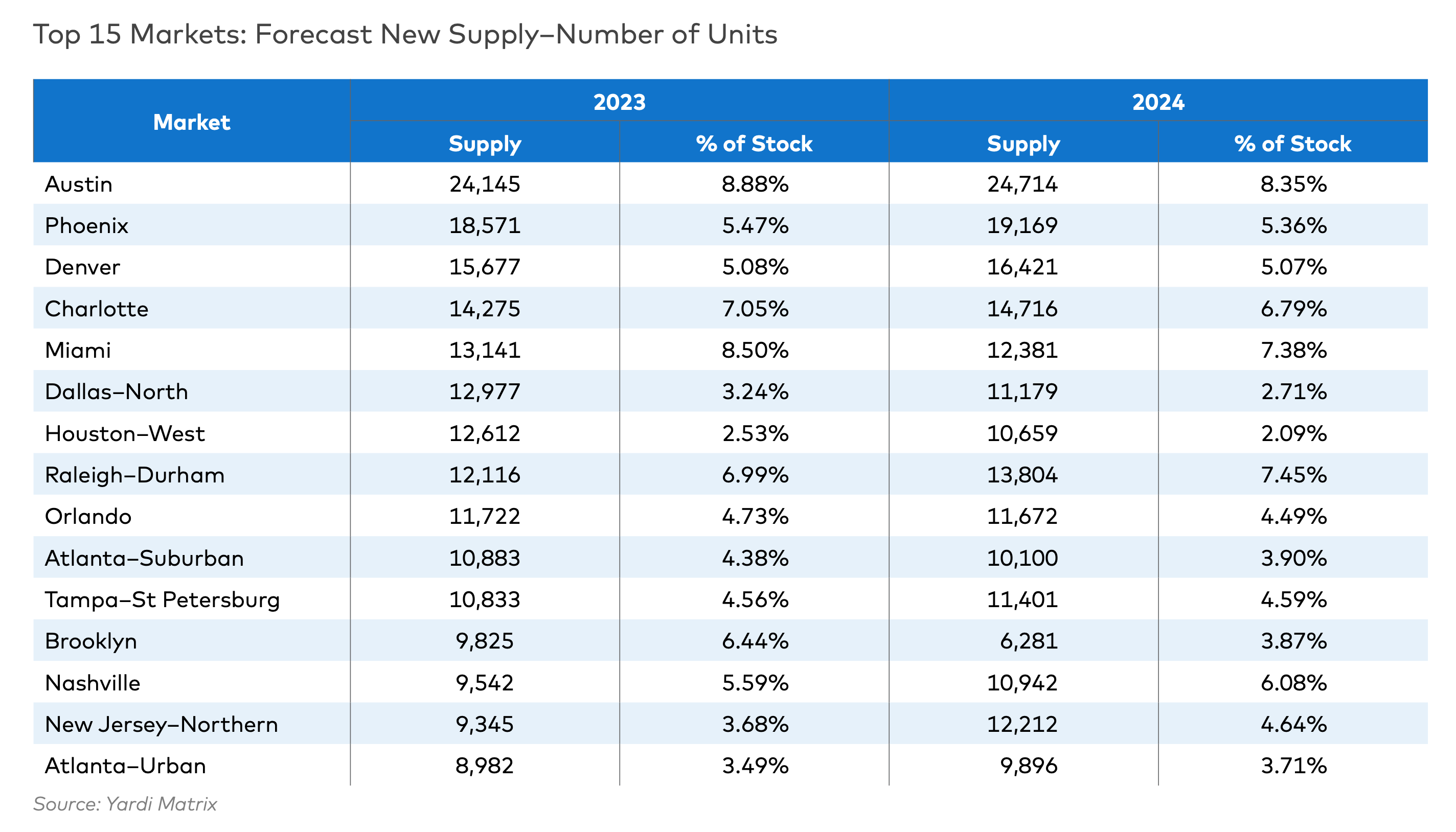

For multifamily markets tracked on or before January 2020, there are currently just over 1.1 million units under construction. Of these units, 429,626 are currently in lease-up, roughly in line with the trailing 12-month average of 421,000 units. Most of these units will complete in 2023 or the first half of 2024.

As of this report’s release, Yardi Matrix is tracking 688,420 under-construction units that are not in lease-up. This represents a 36.9% year-over-year increase and a 96.7% increase over pre-pandemic levels.

The longer-term supply forecast accounts for depressing completions in 2025 and 2026 relative to current levels, with a rebound taking hold in 2027. Forecast completions for 2026 have been reduced by 5% to 401,065, while forecast 2027 and 2028 completions have been reduced to 417,378 and 426,722 units, respectively.

Review the latest Multifamily Supply Forecast here.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Affordable Housing | May 17, 2023

Affordable housing advocates push for community-owned homes over investment properties

Panelists participating in a recent webinar hosted by the Urban Institute discussed various actions that could help alleviate the nation’s affordable housing crisis. Among the possible remedies: inclusionary zoning policies, various reforms to increase local affordable housing stock, and fees on new development to offset the impact on public infrastructure.

Multifamily Housing | May 16, 2023

Legislators aim to make office-to-housing conversions easier

Lawmakers around the country are looking for ways to spur conversions of office space to residential use.cSuch projects come with challenges such as inadequate plumbing, not enough exterior-facing windows, and footprints that don’t easily lend themselves to residential use. These conditions raise the cost for developers.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Multifamily Housing | May 1, 2023

A prefab multifamily housing project will deliver 200 new apartments near downtown Denver

In Denver, Mortenson, a Colorado-based builder, developer, and engineering services provider, along with joint venture partner Pinnacle Partners, has broken ground on Revival on Platte, a multifamily housing project. The 234,156-sf development will feature 200 studio, one-bedroom, and two-bedroom apartments on eight floors, with two levels of parking.

| Apr 28, 2023

$1 billion mixed-use multifamily development will add 1,200 units to South Florida market

A giant $1 billion residential project, The District in Davie, will bring 1.6 million sf of new Class A residential apartments to the hot South Florida market. Located near Ft. Lauderdale and greater Miami, the development will include 36,000 sf of restaurants and retail space. The development will also provide 1.1 million sf of access controlled onsite parking with 2,650 parking spaces.