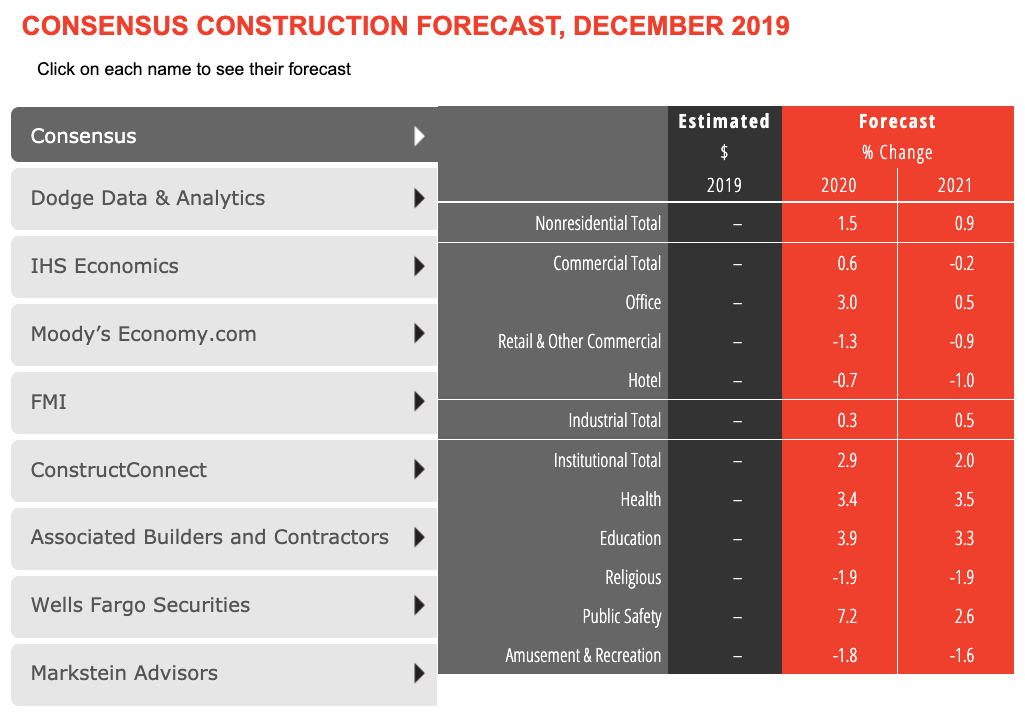

Following modest increases in construction spending for nonresidential buildings in 2019, economists from eight leading industry organizations forecast slight growth in 2020 and 2021—1.5% and 0.9%, according to AIA's latest Consensus Construction Forecast panel.

Public safety, education, healthcare, and office are the bright spots in a market that is entering growth-slowdown mode. However, no downturn is projected by the economists.

The public safety sector is expected to grow 7.2% in 2020, followed by education (3.9%), healthcare (3.4%), and office (3.0%). Four sectors—hotels, religious facilities, amusement/recreation, and retail—will take a step back in construction spending in 2020, according to the report.

More from the AIA Consensus Construction Forecast:

Construction spending last year was surprisingly weak, but current estimates suggest the industry had a modest increase in 2019. Retail construction activity was expected to underperform in 2019 but did not see the double-digit percentage declines that were expected. The AIA’s Consensus Construction forecast panel expects similar conditions this year and next.

“The broader economy is expected to continue to see slower growth this year, but the number of potential trouble spots seems to be diminishing,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Revenue trends at architecture firms saw an uptick in the fourth quarter last year, which suggests construction spending will continue to see growth in the coming quarters.”

Related Stories

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.