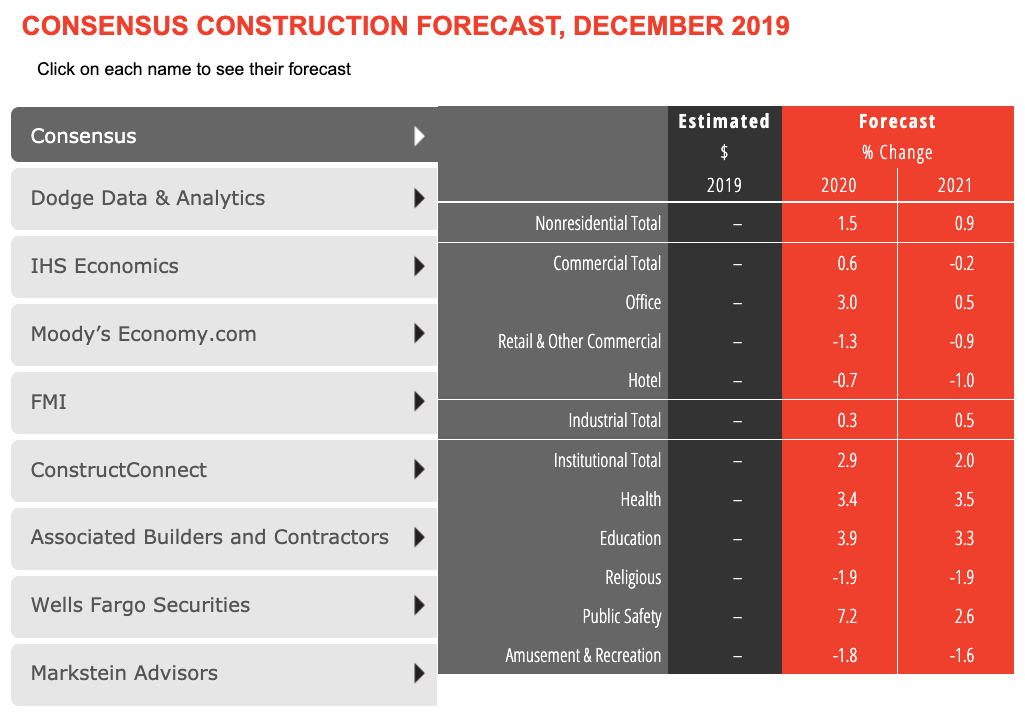

Following modest increases in construction spending for nonresidential buildings in 2019, economists from eight leading industry organizations forecast slight growth in 2020 and 2021—1.5% and 0.9%, according to AIA's latest Consensus Construction Forecast panel.

Public safety, education, healthcare, and office are the bright spots in a market that is entering growth-slowdown mode. However, no downturn is projected by the economists.

The public safety sector is expected to grow 7.2% in 2020, followed by education (3.9%), healthcare (3.4%), and office (3.0%). Four sectors—hotels, religious facilities, amusement/recreation, and retail—will take a step back in construction spending in 2020, according to the report.

More from the AIA Consensus Construction Forecast:

Construction spending last year was surprisingly weak, but current estimates suggest the industry had a modest increase in 2019. Retail construction activity was expected to underperform in 2019 but did not see the double-digit percentage declines that were expected. The AIA’s Consensus Construction forecast panel expects similar conditions this year and next.

“The broader economy is expected to continue to see slower growth this year, but the number of potential trouble spots seems to be diminishing,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Revenue trends at architecture firms saw an uptick in the fourth quarter last year, which suggests construction spending will continue to see growth in the coming quarters.”

Related Stories

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

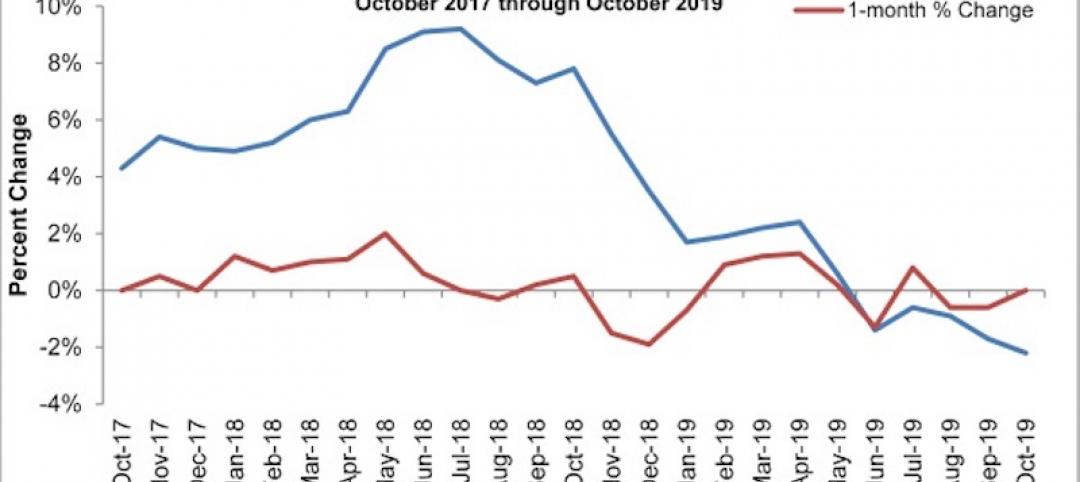

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

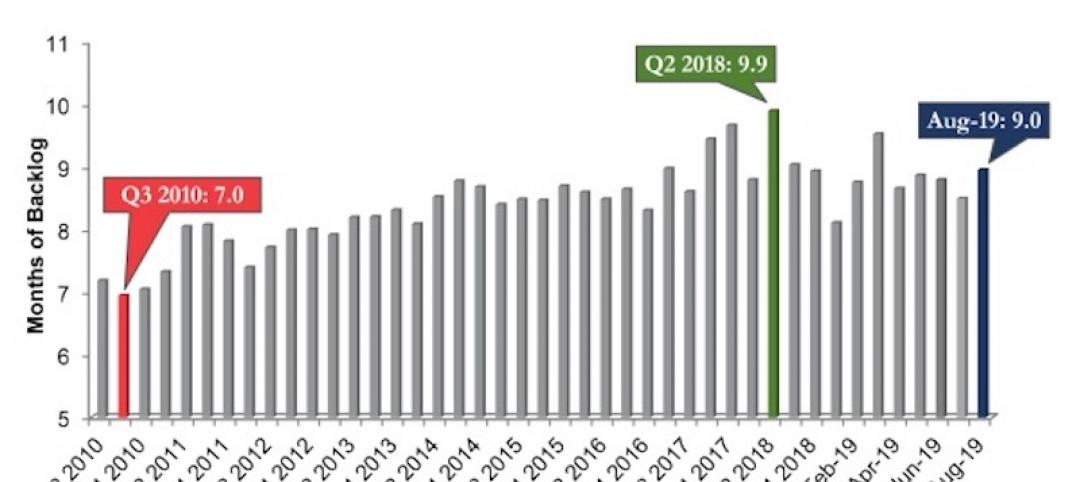

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.