“Ignore the Dow. Focus on the fundamentals.”

That’s Cushman & Wakefield’s sanguine advice in its latest “U.S. Macro Report,” in which the real estate services giant offers a bullish forecast about America’s economy, as well as the investment climate for real estate construction and transactions.

C&W provides a positive spin on investors’ two main concerns right now: the impact of China’s slower economic growth and tumbling global oil prices. The report points out that U.S. direct investment in China is currently $65 billion versus the $6 trillion the U.S. has invested globally. Only 9.2% of U.S. exports are sent to China, and exports account for only around 10% of all goods and services produced within the country. “The macroeconomic consequences of a hard landing in China tend to be overstated,” says C&W, which believes that China’s GDP growth could fall below 3% (it was 6.9% in 2015, a 25-year low) without causing a recession in the U.S.

Oil price erosion is a more significant threat to C&W’s baseline outlook, the report concedes. But it believes that declines in oil prices are ultimately a net positive for the U.S. economy because those declines spur increased consumption. “Every penny decline in retail gasoline prices adds more than $1 billion to consumer spending over the course of the year, according to Moody’s Analytics,” states the report. Its forecast calls for oil prices to average just over $40 per barrel in 2016. “That will add about 50 extra basis points to U.S. GDP growth, creating up to 23.8 million sf in additional demand for office and industrial space.”

C&W foresees a “quite healthy” 2.4% increase in U.S. GDP this year. It expects 2.6 million and 2.3 million nonfarm jobs to be created in 2016 and 2017, bringing the unemployment rate down to around 4.5%. “Wage growth and inflation should trend upwards more meaningfully at the same time, helping to buoy retail sales, consumer spending and consumer confidence.”

People are also getting their personal balance sheets in order. The household debt ratio—which measures debt affordability—is at its lowest point since 1980. Wages and total compensation rose by over 2% in 2015, the first time since 2008 those indices exceeded 2% growth.

A more confident, higher-spending consumer should benefit the industrial sector, which has enjoyed record-setting demand for warehouse and distribution space over the past few years. C&W projects that 220 million sf of space will be added this year, despite declines in manufacturing activity. “Overall vacancy will tighten further, falling from 7.5% in 2015 to 7% in 2016. This is on par with the tightest conditions ever observed in the sector; in 2000, the national vacancy rate was 6.9%,” the report states.

C&W expects that the economy will create 713,000 office-using jobs this year, and 666,000 in 2017. These estimates are slightly down from the 812,000 office jobs created last year, and C&W does expect slower aggregate demand for office space, albeit with a lag. Over the next two years, it expects 140 million sf of new office product to be delivered versus the almost 160 million sf of space that will be absorbed. “As a result, vacancy rates will continue to decline, falling from 14.2% in 2015 to 13% in 2017, the lowest annual reading since 2007.” Rent growth will accelerate to 4% this year and 4.5% next year. By 2018, new development should catch up with decelerating demand.

Positive consumer spending should also help fuel the retail sector. Net absorption is expected to average around its 2015 level (40 million sf) for the next two years, and focus on Class A product or new space. Vacancy is expected to decline from 7.7% in 2015 to 7% in 2016, and bounce below the 7% mark at times during the year.

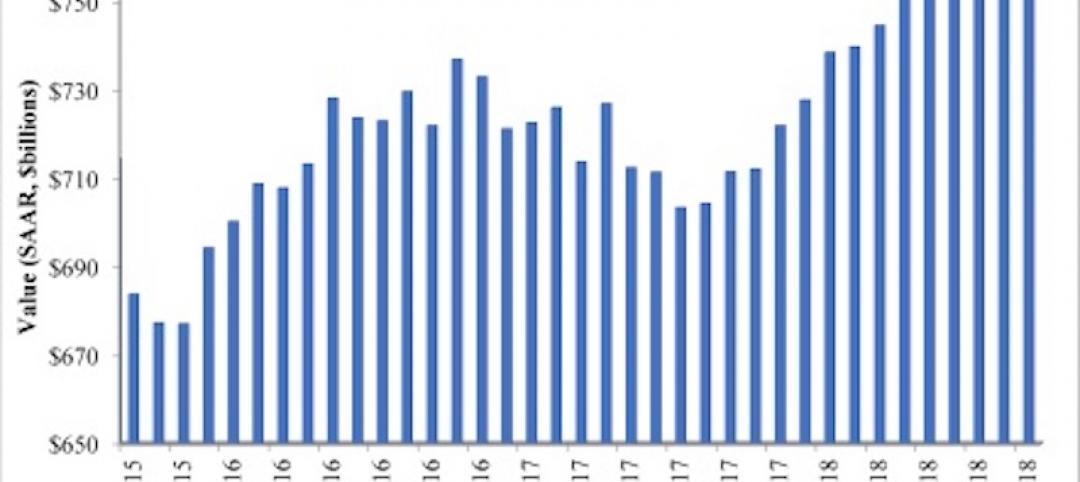

C&W remains convinced that investors would continue to perceive the U.S. as a “safe haven” for stability and expected returns. Investors certainly showed their confidence in the U.S. economy in 2015, when investment sales volumes in the real estate sector increased by nearly 24% to $534 billion, just shy of the previous peak in 2007. “Capital markets activity is expected to be strong in 2016 and 2017 and should surpass prior peak levels assuming no major shock to the system.”

The developer acknowledges that a prolonged downturn in equity markets could short-circuit the U.S. economy, hit the consumer and end the expansion. But it doesn’t think that scenario is probable. “The fundamentals of the U.S. economy and the property markets remain on solid footing.”

Related Stories

Market Data | Jan 16, 2019

AIA 2019 Consensus Forecast: Nonresidential construction spending to rise 4.4%

The education, public safety, and office sectors will lead the growth areas this year, but AIA's Kermit Baker offers a cautious outlook for 2020.

Market Data | Dec 19, 2018

Brokers look forward to a commercial real estate market that mirrors 2018’s solid results

Respondents to a recent Transwestern poll expect flat to modest growth for rents and investment in offices, MOBs, and industrial buildings.

Market Data | Dec 19, 2018

When it comes to economic clout, New York will far outpace other U.S. metros for decades to come

But San Jose, Calif., is expected to have the best annual growth rate through 2035, according to Oxford Economics’ latest Global Cities report.

Market Data | Dec 19, 2018

Run of positive billings continues at architecture firms

November marked the fourteenth consecutive month of increasing demand for architectural firm services.

Market Data | Dec 5, 2018

ABC predicts construction sector will remain strong in 2019

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry.

Market Data | Dec 4, 2018

Nonresidential spending rises modestly in October

Thirteen out of 16 subsectors are associated with year-over-year increases.

Market Data | Nov 20, 2018

Construction employment rises from October 2017 to October 2018 in 44 states and D.C.

Texas has biggest annual job increase while New Jersey continues losses; Iowa, Florida and California have largest one-month gains as Mississippi and Louisiana trail.

Market Data | Nov 15, 2018

Architecture firm billings continue to slow, but remain positive in October

Southern region reports decline in billings for the first time since June 2012.

Market Data | Nov 14, 2018

A new Joint Center report finds aging Americans less prepared to afford housing

The study foresees a significant segment of seniors struggling to buy or rent on their own or with other people.

Market Data | Nov 12, 2018

Leading hotel markets in the U.S. construction pipeline

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs.