“Ignore the Dow. Focus on the fundamentals.”

That’s Cushman & Wakefield’s sanguine advice in its latest “U.S. Macro Report,” in which the real estate services giant offers a bullish forecast about America’s economy, as well as the investment climate for real estate construction and transactions.

C&W provides a positive spin on investors’ two main concerns right now: the impact of China’s slower economic growth and tumbling global oil prices. The report points out that U.S. direct investment in China is currently $65 billion versus the $6 trillion the U.S. has invested globally. Only 9.2% of U.S. exports are sent to China, and exports account for only around 10% of all goods and services produced within the country. “The macroeconomic consequences of a hard landing in China tend to be overstated,” says C&W, which believes that China’s GDP growth could fall below 3% (it was 6.9% in 2015, a 25-year low) without causing a recession in the U.S.

Oil price erosion is a more significant threat to C&W’s baseline outlook, the report concedes. But it believes that declines in oil prices are ultimately a net positive for the U.S. economy because those declines spur increased consumption. “Every penny decline in retail gasoline prices adds more than $1 billion to consumer spending over the course of the year, according to Moody’s Analytics,” states the report. Its forecast calls for oil prices to average just over $40 per barrel in 2016. “That will add about 50 extra basis points to U.S. GDP growth, creating up to 23.8 million sf in additional demand for office and industrial space.”

C&W foresees a “quite healthy” 2.4% increase in U.S. GDP this year. It expects 2.6 million and 2.3 million nonfarm jobs to be created in 2016 and 2017, bringing the unemployment rate down to around 4.5%. “Wage growth and inflation should trend upwards more meaningfully at the same time, helping to buoy retail sales, consumer spending and consumer confidence.”

People are also getting their personal balance sheets in order. The household debt ratio—which measures debt affordability—is at its lowest point since 1980. Wages and total compensation rose by over 2% in 2015, the first time since 2008 those indices exceeded 2% growth.

A more confident, higher-spending consumer should benefit the industrial sector, which has enjoyed record-setting demand for warehouse and distribution space over the past few years. C&W projects that 220 million sf of space will be added this year, despite declines in manufacturing activity. “Overall vacancy will tighten further, falling from 7.5% in 2015 to 7% in 2016. This is on par with the tightest conditions ever observed in the sector; in 2000, the national vacancy rate was 6.9%,” the report states.

C&W expects that the economy will create 713,000 office-using jobs this year, and 666,000 in 2017. These estimates are slightly down from the 812,000 office jobs created last year, and C&W does expect slower aggregate demand for office space, albeit with a lag. Over the next two years, it expects 140 million sf of new office product to be delivered versus the almost 160 million sf of space that will be absorbed. “As a result, vacancy rates will continue to decline, falling from 14.2% in 2015 to 13% in 2017, the lowest annual reading since 2007.” Rent growth will accelerate to 4% this year and 4.5% next year. By 2018, new development should catch up with decelerating demand.

Positive consumer spending should also help fuel the retail sector. Net absorption is expected to average around its 2015 level (40 million sf) for the next two years, and focus on Class A product or new space. Vacancy is expected to decline from 7.7% in 2015 to 7% in 2016, and bounce below the 7% mark at times during the year.

C&W remains convinced that investors would continue to perceive the U.S. as a “safe haven” for stability and expected returns. Investors certainly showed their confidence in the U.S. economy in 2015, when investment sales volumes in the real estate sector increased by nearly 24% to $534 billion, just shy of the previous peak in 2007. “Capital markets activity is expected to be strong in 2016 and 2017 and should surpass prior peak levels assuming no major shock to the system.”

The developer acknowledges that a prolonged downturn in equity markets could short-circuit the U.S. economy, hit the consumer and end the expansion. But it doesn’t think that scenario is probable. “The fundamentals of the U.S. economy and the property markets remain on solid footing.”

Related Stories

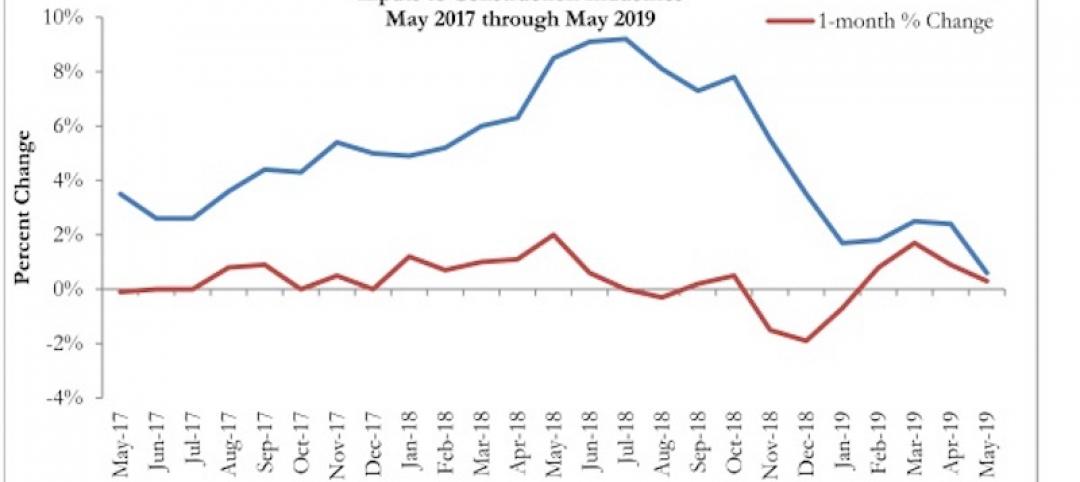

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.

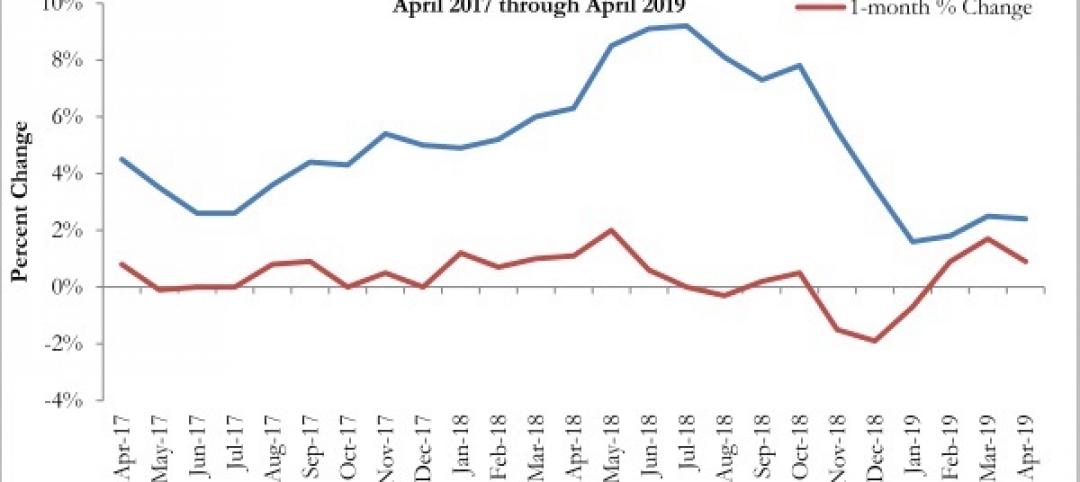

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

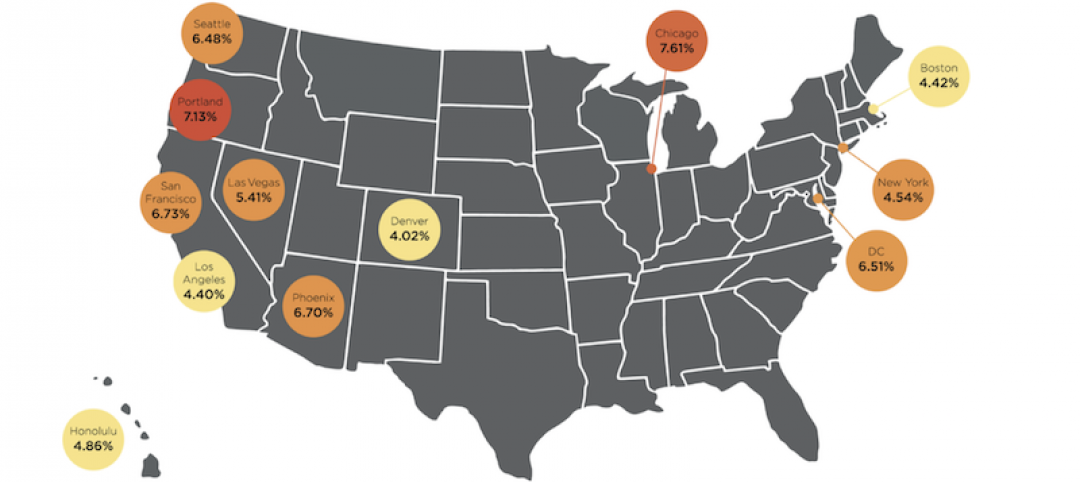

Market Data | May 7, 2019

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

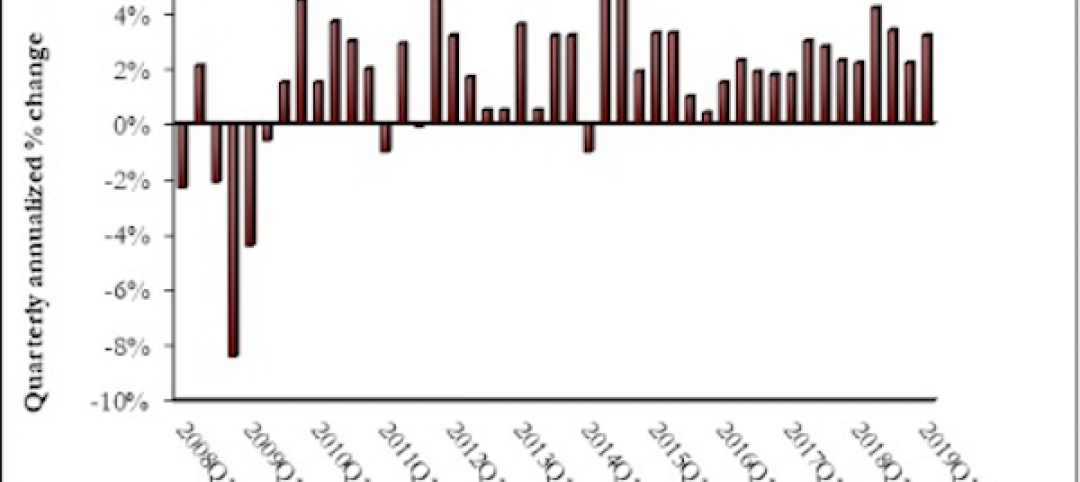

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.