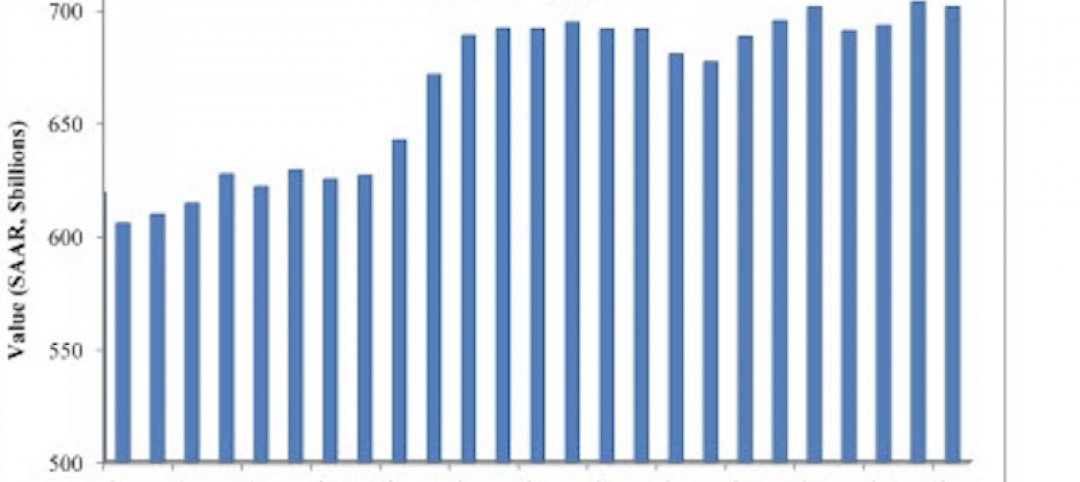

ConstructConnect, a provider of construction information and technology solutions in North America, recently announced the release of its Q4 2017 Forecast Quarterly Report. The Winter 2017-18 starts forecast includes year-over-year estimates for 2017 that have become more upbeat than a quarter ago. Groundbreakings on several mega projects late this year have provided exceptional lift to the industrial and engineering type-of-structure categories.

“Out to 2021, residential will be the main driver of total construction starts, recording year-over-year increases of nearly +6.0% or more,” explained Chief Economist Alex Carrick. “Non-residential building will disappoint, with gains of only about +2.0% each year. Engineering will be strong in 2018 and 2019, as energy initiatives and infrastructure work are promoted by Washington, but will then moderate in 2020-21.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows some of the more robust 2018 starts forecasts:

- Single-family residential, +8.8%

- Warehouses, +4.7%

- Nursing homes, +5.9%

- Educational facilities, +4.2%

- Roads, +5.9%

- Bridges, +10.2%

- Miscellaneous civil (power, oil and gas), +13.8%

2017 total starts are now expected to be +7.9% (versus an earlier calculated +4.5%). Residential has been upgraded to +10.1% and engineering/civil to +23.1%. Non-residential building has been left essentially flat at -0.5%.

For 2018, the new forecasts shave a bit off what was previously expected. Total starts are now projected to be +4.8%, a little slower than the +5.9% of a quarter ago. Residential will be +6.7% in 2018; non-res building, +1.9%; and heavy engineering/civil, +6.6%.

In residential construction, the multi-family market has had its turn and it will be the single-family market that will expand more rapidly moving forward, aided by family-formations among the millennial generation.

The forecast reports that educational facilities will grow faster than hospitals in 2018, but beginning in 2019 their positions will reverse. Some other non-residential building type-of-structure categories with bullish outlooks include: courthouses and prisons; warehouses; and nursing homes. Airports and sports stadiums will also be stepping into the construction spotlight.

The report noted a few ongoing economic trends:

- A synchronous world expansion is underway, with North America, Japan, China and Europe all experiencing GDP growth

- Based on demographics, housing starts have fallen short of potential for almost a decade

- Office space demand will increasingly come from firms engaged in high-tech

- Prices for many internationally traded commodities are on the mend

To learn more about ConstructConnect or get a free copy of the Forecast Quarterly Report, visit constructconnect.com.

Related Stories

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.