ConstructConnect, a provider of construction information and technology solutions in North America, recently announced the release of its Q4 2017 Forecast Quarterly Report. The Winter 2017-18 starts forecast includes year-over-year estimates for 2017 that have become more upbeat than a quarter ago. Groundbreakings on several mega projects late this year have provided exceptional lift to the industrial and engineering type-of-structure categories.

“Out to 2021, residential will be the main driver of total construction starts, recording year-over-year increases of nearly +6.0% or more,” explained Chief Economist Alex Carrick. “Non-residential building will disappoint, with gains of only about +2.0% each year. Engineering will be strong in 2018 and 2019, as energy initiatives and infrastructure work are promoted by Washington, but will then moderate in 2020-21.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows some of the more robust 2018 starts forecasts:

- Single-family residential, +8.8%

- Warehouses, +4.7%

- Nursing homes, +5.9%

- Educational facilities, +4.2%

- Roads, +5.9%

- Bridges, +10.2%

- Miscellaneous civil (power, oil and gas), +13.8%

2017 total starts are now expected to be +7.9% (versus an earlier calculated +4.5%). Residential has been upgraded to +10.1% and engineering/civil to +23.1%. Non-residential building has been left essentially flat at -0.5%.

For 2018, the new forecasts shave a bit off what was previously expected. Total starts are now projected to be +4.8%, a little slower than the +5.9% of a quarter ago. Residential will be +6.7% in 2018; non-res building, +1.9%; and heavy engineering/civil, +6.6%.

In residential construction, the multi-family market has had its turn and it will be the single-family market that will expand more rapidly moving forward, aided by family-formations among the millennial generation.

The forecast reports that educational facilities will grow faster than hospitals in 2018, but beginning in 2019 their positions will reverse. Some other non-residential building type-of-structure categories with bullish outlooks include: courthouses and prisons; warehouses; and nursing homes. Airports and sports stadiums will also be stepping into the construction spotlight.

The report noted a few ongoing economic trends:

- A synchronous world expansion is underway, with North America, Japan, China and Europe all experiencing GDP growth

- Based on demographics, housing starts have fallen short of potential for almost a decade

- Office space demand will increasingly come from firms engaged in high-tech

- Prices for many internationally traded commodities are on the mend

To learn more about ConstructConnect or get a free copy of the Forecast Quarterly Report, visit constructconnect.com.

Related Stories

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

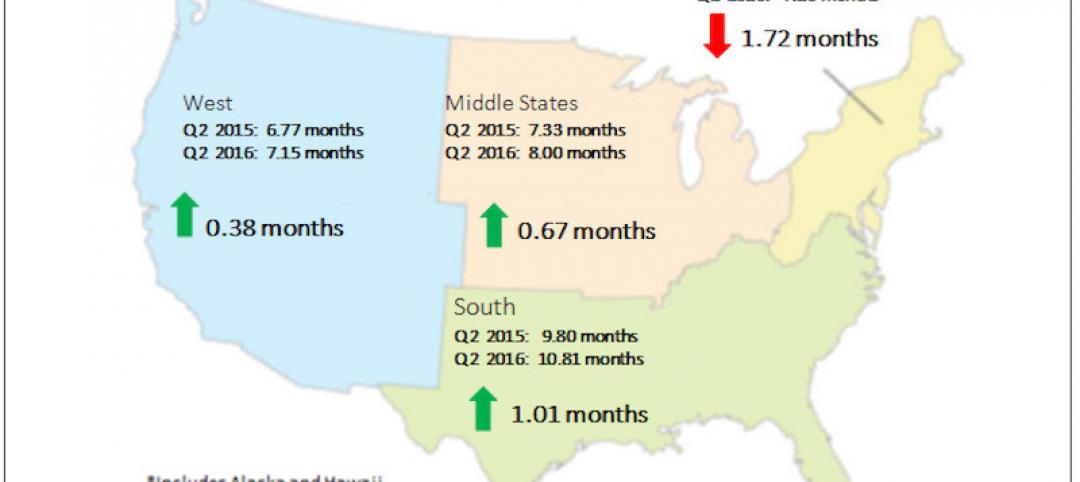

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.