ConstructConnect, a provider of construction information and technology solutions in North America, recently announced the release of its Q4 2017 Forecast Quarterly Report. The Winter 2017-18 starts forecast includes year-over-year estimates for 2017 that have become more upbeat than a quarter ago. Groundbreakings on several mega projects late this year have provided exceptional lift to the industrial and engineering type-of-structure categories.

“Out to 2021, residential will be the main driver of total construction starts, recording year-over-year increases of nearly +6.0% or more,” explained Chief Economist Alex Carrick. “Non-residential building will disappoint, with gains of only about +2.0% each year. Engineering will be strong in 2018 and 2019, as energy initiatives and infrastructure work are promoted by Washington, but will then moderate in 2020-21.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows some of the more robust 2018 starts forecasts:

- Single-family residential, +8.8%

- Warehouses, +4.7%

- Nursing homes, +5.9%

- Educational facilities, +4.2%

- Roads, +5.9%

- Bridges, +10.2%

- Miscellaneous civil (power, oil and gas), +13.8%

2017 total starts are now expected to be +7.9% (versus an earlier calculated +4.5%). Residential has been upgraded to +10.1% and engineering/civil to +23.1%. Non-residential building has been left essentially flat at -0.5%.

For 2018, the new forecasts shave a bit off what was previously expected. Total starts are now projected to be +4.8%, a little slower than the +5.9% of a quarter ago. Residential will be +6.7% in 2018; non-res building, +1.9%; and heavy engineering/civil, +6.6%.

In residential construction, the multi-family market has had its turn and it will be the single-family market that will expand more rapidly moving forward, aided by family-formations among the millennial generation.

The forecast reports that educational facilities will grow faster than hospitals in 2018, but beginning in 2019 their positions will reverse. Some other non-residential building type-of-structure categories with bullish outlooks include: courthouses and prisons; warehouses; and nursing homes. Airports and sports stadiums will also be stepping into the construction spotlight.

The report noted a few ongoing economic trends:

- A synchronous world expansion is underway, with North America, Japan, China and Europe all experiencing GDP growth

- Based on demographics, housing starts have fallen short of potential for almost a decade

- Office space demand will increasingly come from firms engaged in high-tech

- Prices for many internationally traded commodities are on the mend

To learn more about ConstructConnect or get a free copy of the Forecast Quarterly Report, visit constructconnect.com.

Related Stories

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

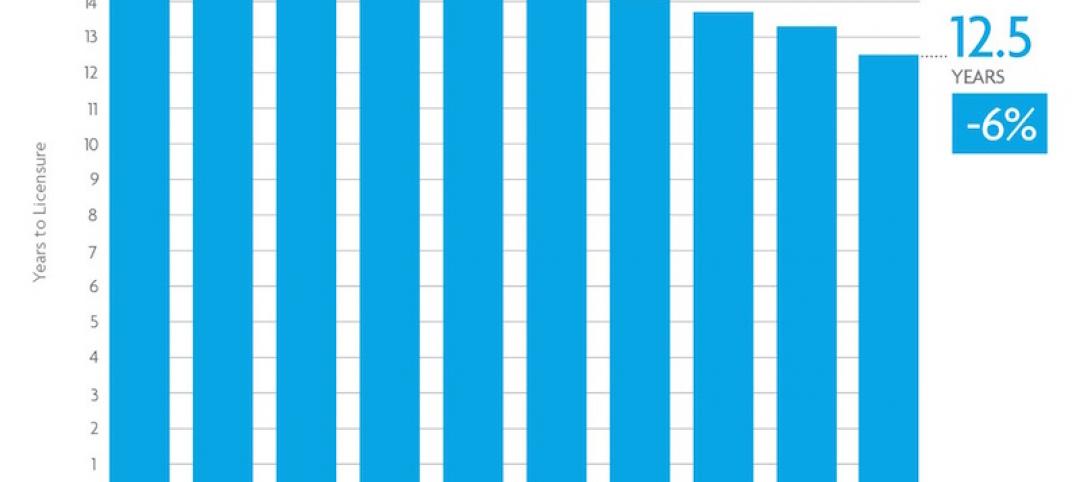

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

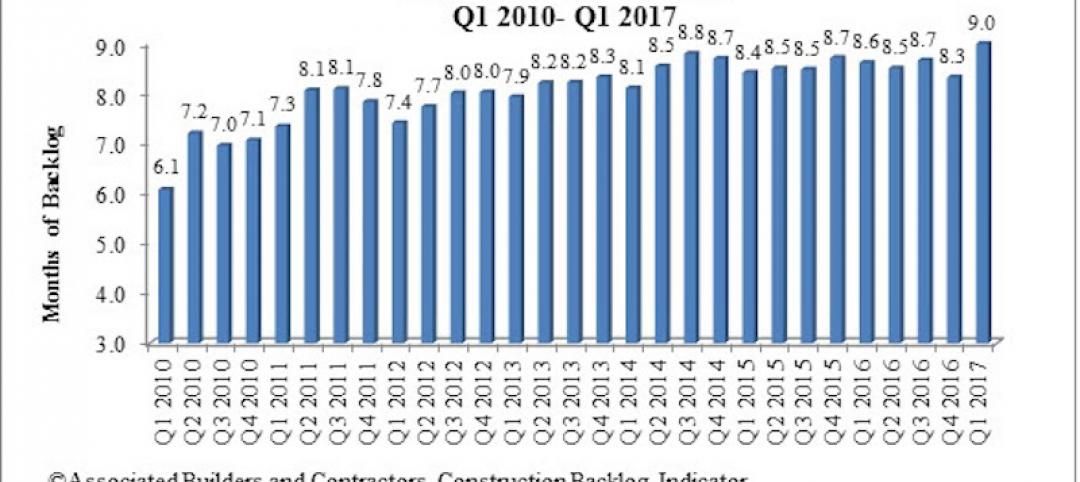

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.

Market Data | Jun 21, 2017

Design billings maintain solid footing, strong momentum reflected in project inquiries/design contracts

Balanced growth results in billings gains in all sectors.

Market Data | Jun 16, 2017

Residential construction was strong, but not enough, in 2016

The Joint Center for Housing Studies’ latest report expects minorities and millennials to account for the lion’s share of household formations through 2035.

Industry Research | Jun 15, 2017

Commercial Construction Index indicates high revenue and employment expectations for 2017

USG Corporation (USG) and U.S. Chamber of Commerce release survey results gauging confidence among industry leaders.

Market Data | Jun 2, 2017

Nonresidential construction spending falls in 13 of 16 segments in April

Nonresidential construction spending fell 1.7% in April 2017, totaling $696.3 billion on a seasonally adjusted, annualized basis, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.