In late 2015, the future deployment of modular manufacturing at the service of nonresidential building was looking pretty grim.

Capsys, which has been providing modules for commercial and multifamily projects since 1996, announced that it would close its operations for good in March, after learning that its long-term lease at the Navy Yard in Brooklyn, N.Y., its headquarters, would not be renewed, and deciding that relocating to less-expensive digs would be logistically impractical.

Deluxe Building Systems in Berwick, Pa., which for the past five years has focused on producing steel and concrete modules that are 85% complete for apartments, college dorms, and hotels, was wrapping up work on two buildings for Pace University in Pleasantville, N.Y., which required 170 and 135 modules, respectively. However, this manufacturer didn’t have anything else in the hopper, and couldn’t even say whether one job it was contracted to supply—a 47-apartment building in the Washington Heights section of New York City—would get built.

The company’s 400,000-sf production facility, which was once pumping out 750,000 sf of modules per year, has been pretty quiet lately. “We might need to consider a different business model,” says DBS’s Vice President Dan Meske, whose family started the company in 1965, and during its early years focused on wood-framed single-family housing.

And then in late November, Forest City Ratner, complying with New York State law, notified that state’s Department of Labor, via a “warn notice,” that in the proceeding 90 days it may lay off its 220 union workers from FC Modular, the building giant’s modular housing division that oversees its Brooklyn Navy Yard factory. FC Modular has been providing modules for B2 BKLYN, the controversial 32-story building on the corner of that borough’s Flatbush Avenue and Dean Street, which will be the tallest modular tower to date.

FC Modular has every intention of moving forward, says Susan Hayes, the firm’s President, and had learned some valuable lessons from its experience with the 363-unit B2 BKLYN project, which should be completed this summer and open in the third quarter of the year.

B2 has gone through numerous trials and tribulations, including a work stoppage in 2014 after Forest City’s joint-venture partner, Skanska, furloughed 157 workers that September. The two companies subsequently sued each other over contractual disputes revolving around the integrity of the building’s design and what had caused $50 million in cost overruns.

Forest City eventually bought out Skanska’s interest in their joint venture, and resumed B2’s construction in January 2015. Six months later, the company hired Susan Hayes for the newly created position of President of FC Modular. Hayes had previously been CEO of 5 Elements West, a Manhattan-based construction firm. At the time of Hayes’ appointment, Forest City’s CEO, MaryAnne Gilmartin, voiced her support for modular construction, which she told Crain’s New York Business would be “an important part of the future for our industry.”

In an interview with BD+C in early December, Hayes echoed those sentiments. FC Modular has every intention of moving forward, she says, and had learned some valuable lessons from its experience with the 363-unit B2 project, which should be completed this summer and open in the third quarter of the year.

“The difference today for FC Modular is that we are not an indoor construction company; we are [instead] an assembly plant with the same quality controls and standards for excellence as any other factory.” By becoming more of a factory and less of a construction company, FC Modular “is now able to meet what our clients want, and to deliver quality to our customer base.”

Hayes says FC Modular has projects in various stages of development. She wouldn’t disclose how many, their clients, locations, or timetables, and admits “we’re not getting 75 RFPs a week for modular.” But she also points out that modular construction requires its own systems and designs that can take six to nine months to prepare before construction can begin.

She is confident that modular is going to be “a bigger deal” in nonresidential building, primarily because an “exhausted” workforce simply can’t keep up with the amount of construction going on in the New York metropolitan area. “There is no better way to beat a schedule on a project by 40% than modular,” she asserts.

Hayes is quick to praise B2’s union workforce as “the best I’ve ever encountered.” She says those workers took the warn notice “in stride as best they could.” She calls the possibility of layoffs “routine” in a cyclical business, and wasn’t overly worried about finding qualified workers if and when factory production starts up again.

Related Stories

| May 27, 2014

Contractors survey reveals improving construction market

The construction industry is on the road to recovery, according to a new survey by Metal Construction News. Most metrics improved from the previous year’s survey, including a 19.4% increase in the average annual gross contracting sales volume. SPONSORED CONTENT

| May 26, 2014

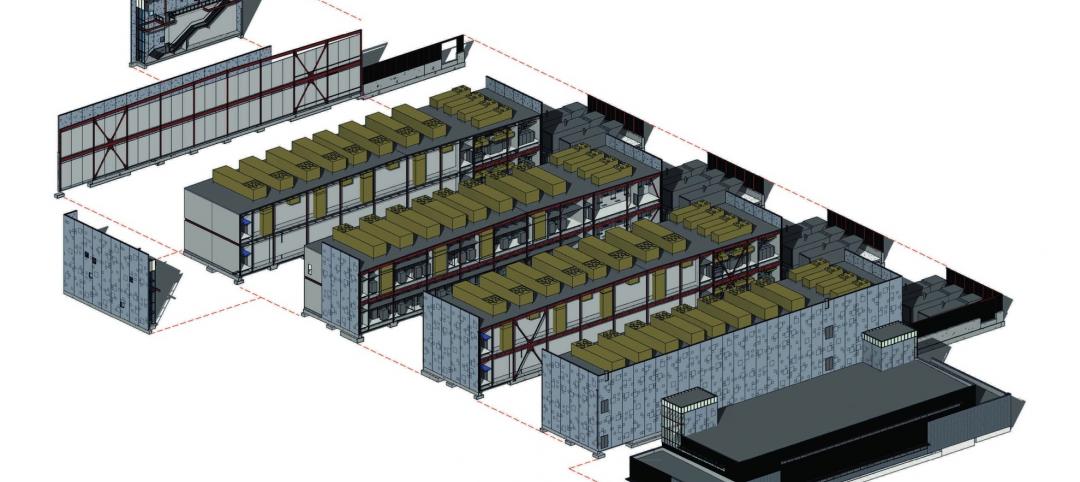

New Jersey data centers will manage loads with pods

The two data center facilities totaling almost 430,000 sf for owner Digital Realty Trust will use the company's TK-Flex planning module, allowing for 24 pods.

| May 22, 2014

BIM-driven prototype turns data centers into a kit of parts

Data center design specialist SPARCH creates a modular scheme for solutions provider Digital Realty.

| May 19, 2014

What can architects learn from nature’s 3.8 billion years of experience?

In a new report, HOK and Biomimicry 3.8 partnered to study how lessons from the temperate broadleaf forest biome, which houses many of the world’s largest population centers, can inform the design of the built environment.

| May 14, 2014

Prefab payback: Mortenson quantifies cost and schedule savings from prefabrication techniques

Value-based cost-benefit analysis of prefab approaches on the firm's 360-bed Exempla Saint Joseph Heritage Project shows significant savings for the Building Team.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 11, 2014

8 starter questions to answer when thinking about building

So, are you ready to start building? Completing these eight questions will help you answer that confidently. SPONSORED CONTENT

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.

| Apr 29, 2014

USGBC launches real-time green building data dashboard

The online data visualization resource highlights green building data for each state and Washington, D.C.

| Apr 28, 2014

Welcome to the Hive: OVA designs wild shipping container hotel for competition

Hong Kong-based OVA envisions a shipping-container hotel, where rooms could be removed at will and designed by advertisers.