Construction companies remain consistent in their concern about risk exposure in 2016, with respondents reporting in a new survey that their “risk sentiment” has remained steady at 4.4 on a scale of 1-10 (it was at 4.4 at the end of 2015 as well). The latest “Sterling Risk Sentiment Index” shows that most report improving profit margins, but while they say their concerns about staffing are decreasing, access to adequate numbers of employees continues as the No. 1 business risk.

Businesses were also surveyed about how the current election cycle is affecting their businesses. A majority said “election year uncertainty” was having an impact and most felt that the election of a Republican President would improve their business.

The survey noted other key issues of concern. Financial & cash flow issues saw a significant jump (up 8%), with increased competition and government regulation remaining high.

Highlights from the Summer 2016 Sterling Risk Sentiment Index

Note: Where noted, comparisons are with the December 2015 Sterling Risk Sentiment Index

● The #1 risk issue is remains overwhelmingly staffing, with construction companies struggling to have enough employees to handle projects. But the percentage is at 47 percent, down from 60 percent in Fall 2015 Risk Index. Economic issues ranked a distant second at 20 percent.

● Staffing again was the issue companies reported they felt least prepared to deal with right now (30 percent). Health care costs were next (15 percent), followed by cash flow and financial issues (9 percent).

● 64 percent say their company’s exposure for risk is lower than a year ago, a drop from December’s 71 percent.

● 86 percent of respondents say they have formal strategies in place to manage their risk, up from 74 percent in December.

● 75 percent have reviewed their risk management plans in the last 12 months, down from 69 percent.

The new survey also asked construction companies several general questions:

● 80 percent of those surveyed said that they’d see an improvement in their business if a Republican was elected President. Just seven (7) percent said Democrat and ten (10) percent said Libertarian.

● 45 percent said the election year uncertainty affected their businesses. Thirty-seven percent said no and 18 percent didn’t know.

Additional Survey Results

● 84 percent say their profit margins are better today than a year ago

● 88 percent say their pipeline of opportunities is better today than a year ago

● 78 percent say they are able to build adequate contingencies into their project budgets

The Summer 2016 Sterling Risk Sentiment Index surveyed 86 top executives in Atlanta’s construction industry using SurveyMonkey.com. The survey was conducted between July and August 2016.

Related Stories

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

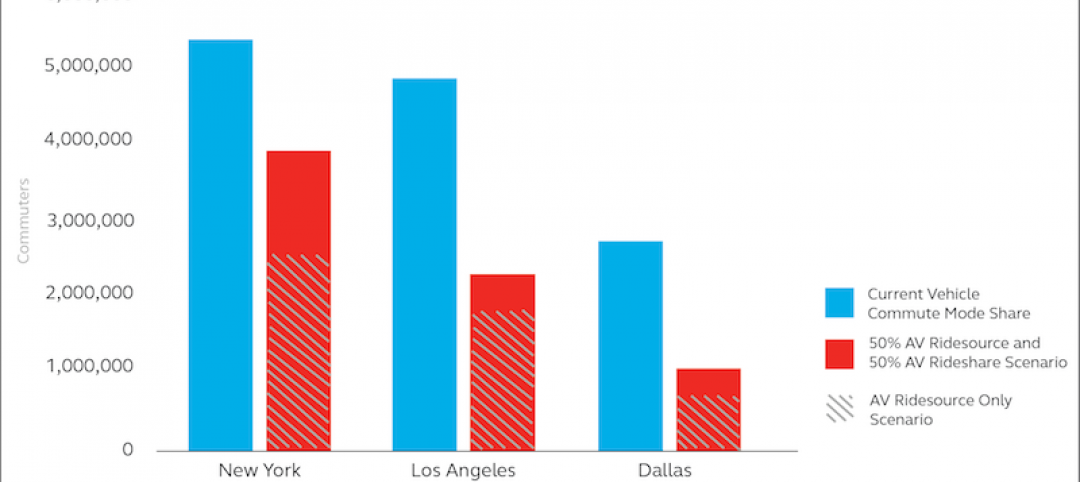

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.

Office Buildings | Mar 7, 2017

Large creative office projects generate staggering returns for property investors

A new Transwestern report examines the adaptive reuse trend across the U.S.

Industry Research | Mar 7, 2017

These are the 10 most expensive cities in the world to build in

Paris, Frankfurt, and Macau are all on the list, but none of them are more expensive than the city in the number one spot.

Office Buildings | Mar 2, 2017

White paper from Perkins Eastman and Three H examines how design can inform employee productivity and wellbeing

This paper is the first in a planned three-part series of studies on the evolution of diverse office environments and how the contemporary activity-based workplace (ABW) can be uniquely tailored to support a range of employee personalities, tasks and work modes.

Industry Research | Feb 15, 2017

Putting workers first should be every employer’s priority

The latest Sodexo report on workplace trends explores 10 factors that are impacting the global work environment.

Industry Research | Feb 13, 2017

How thought leadership marketing can generate referrals for your firm

The most effective way to boost your reputation is through thought leadership marketing.

Market Data | Feb 1, 2017

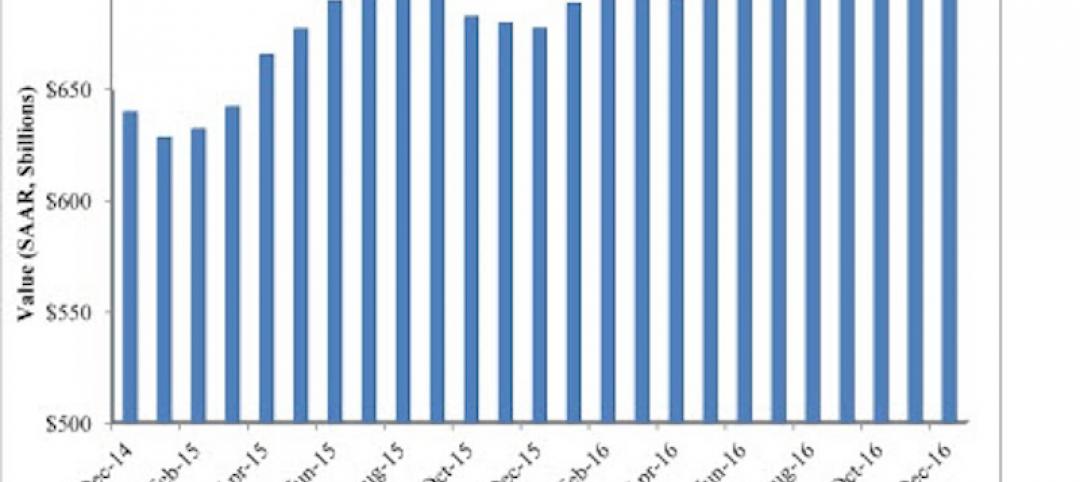

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.