Societies continue to move toward megacity cultures, lifestyles, and economies that are becoming more vital, in some cases, than the countries that spawn them.

One result of this trend has been a growing tendency among owners, developers, and their Building Teams to package smaller and multiple commercial projects into large, single megaprojects whose construction costs exceed $1 billion, in spite of such projects’ historically erratic success rates and shortcomings.

“Speed to market has become critical for owners. In addition, construction companies are getting larger, making it more feasible for them to handle bigger projects,” explains Ron Magnus, a founding Principal with the market research firm FMI, which has just come out with a new study titled “Megaprojects: Changing the Conversation.”

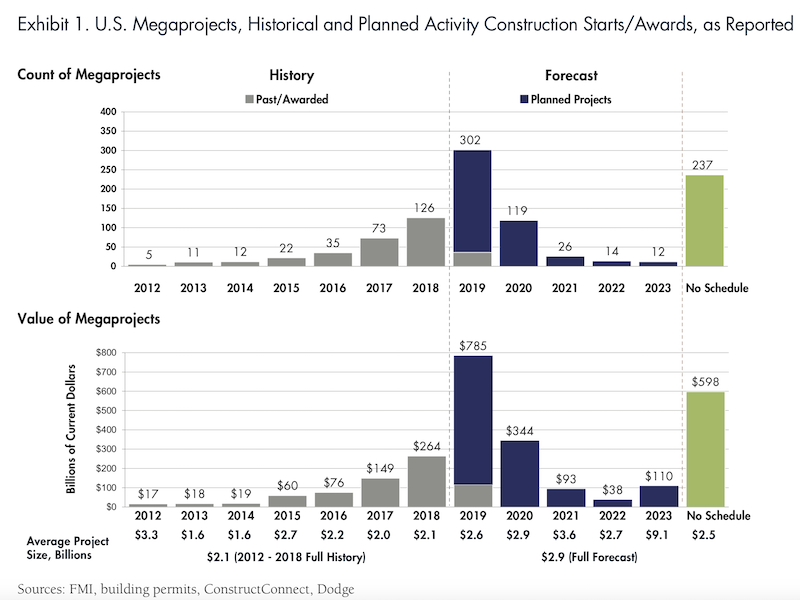

FMI’s report, authored by its content director Sabine Hoover, indicates that at least 320 megaprojects have been awarded in the U.S. alone since 2012—at an aggregate investment valued at over $700 billion.

Additionally, more than 670 megaprojects are being planned, a future investment opportunity likely to reach $2 trillion. Most of these planned megaprojects are expected to be built in the South and West, with three states accounting for 40% of the total starts value (New York, 15%; California, 15%; and Texas, 10%).

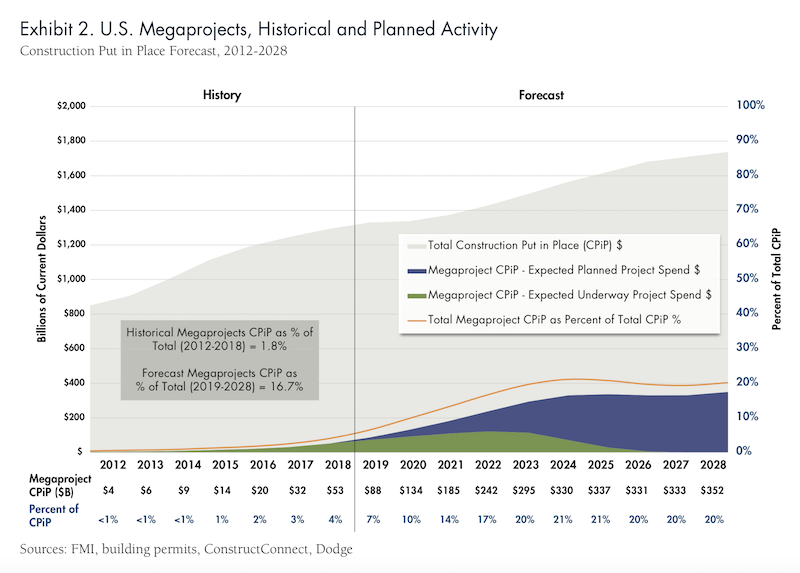

FMI predicts that megaprojects could account for 20% or more of construction spending within the next five years. Chart: FMI

Megaprojects have been expanding in number and value. Between 2013 and 2018, the annual value of U.S. megaproject starts increased from 3% to approximately 33% of all U.S. construction project starts. FMI predicts that, over the next decade, annual construction put in place on megaprojects will explode by nearly 600% to $350 billion.

Measured another way, megaproject construction put in place accounted for only 1.8% of total CPiP between 2012 and 2018. FMI estimates that within the next decade—and possibly within the next five or six years—annual megaproject spending could equal around 20% of total construction spending.

While FMI acknowledges that industrial and infrastructure starts have accounted for the bulk of megaproject starts (61% in 2018), it also sees more evidence of this trend in nonresidential building.

The value of megaproject starts could rise at an especially brisk clip over the next two years. Chart: FMI

The big question, though, is whether the industry is ready to meet this demand. Part of FMI’s research for this report included input from a roundtable of 22 stakeholders—AEC firms, owners, academics—that have engaged megaprojects in the past. From that discussion FMI gleaned five key success factors:

•Trust. Stakeholders on successful megaprojects invest a lot of time upfront in building trust through off-site meetings, getting to know each other on a personal basis. “Trust is the cornerstone, the basic building block,” says Jim Whitaker, FAIA, FDBIA, Principal and Senior Vice President with HKS Inc.

•Culture of Cohesion and Collaboration. DPR Construction on one megaproject spent two weeks with the owner and architect charting the work and setting up its organizational structure. By doing so, the team reduced that project’s budget by $200 million without yielding functionality, square footage, or quality.

Keith Molenaar, associate dean for research at the University of Colorado Boulder, in collaboration with the Pankow Foundation, has studied more than 200 different building projects and found that early collaboration was key to success. The delivery method chosen, on the other hand, had far less impact.

•Transparent and authentic leadership. Effective megaproject leaders, says FMI, are experts in developing a team environment that fosters emotional engagement, shared purpose and accountability.

•Nimble and autonomous teams. Successful megaproject teams are getting away from centralized management and are setting up smaller, more nimble project teams that can move quickly. “Like the platoon model for marines, these teams enjoy a certain degree of autonomy and are empowered to make decisions without approval from the top, and at each decision point,” says FMI.

•Educated and experienced owners. The report quotes Darin Daskarolis, senior director of Global Construction-Data Centers at Facebook, who notes that since commercial construction is largely a relationship-based business, “we knew we had to form strong bonds with our contractors to develop a common and realistic view of the challenges ahead. This common view informed sensible budgets and guided strategic staffing decisions.

The global strategist Parag Khanna sees a world that is becoming more connected by buildings and structures. So where global defense budgets and military spending total about $2 trillion per year, infrastructure spending is expected to increase from $3 trillion today to $9 trillion annually by 2030.

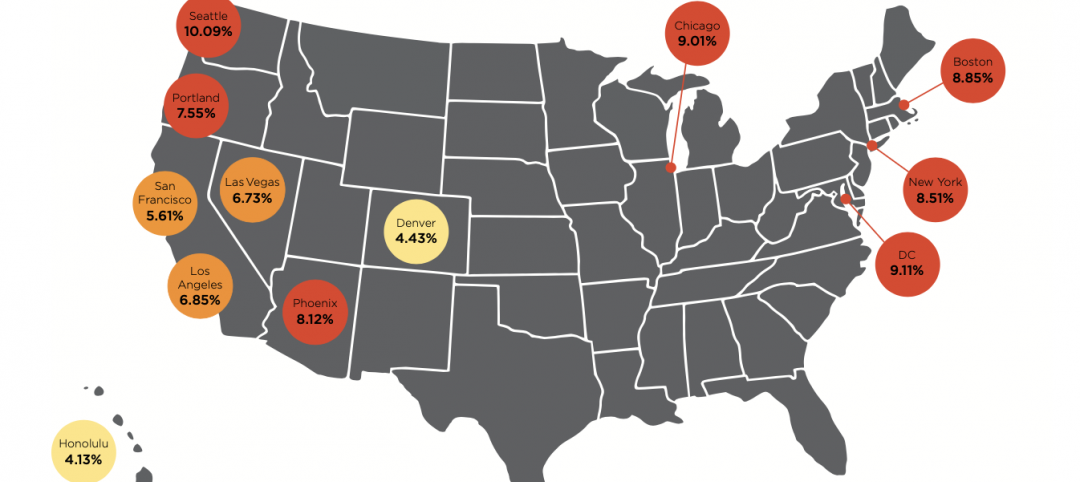

For the U.S., FMI forecasts that half of all megaproject spending over the next three to five years could occur in just 20 metros, and just five of these markets—New York, Los Angeles, Dallas, Houston, and Washington D.C.—will account for one-fifth of total construction in the country. But FMI also ends its report with a cautionary warning for the construction industry. “We have no choice but to completely change our mindsets. Should megaprojects continue to fail just as their spending is expected to reach new heights, the impacts could be devastating to the framework of the E&C industry.”

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.