In the recent U.S. Construction Pipeline Trend Report released by Lodging Econometrics (LE), at the close of the fourth quarter of 2021, Dallas leads the U.S. markets in the number of pipeline projects with 152 projects/18,180 rooms. Following Dallas, the U.S. markets with the largest total hotel construction pipelines by project count are Atlanta, at a cyclical high, with 133 projects/17,593 rooms; New York City with 121 projects/19,303 rooms; Los Angeles with 120 projects/19,815 rooms; and Houston, with 91 projects/9,912 rooms.

Despite the impact COVID-19 has had on hotel development, three markets in the U.S. announced more than 10 new construction projects in Q4‘21. Miami had the highest number of new projects announced into the pipeline with 17 projects/2,797 rooms. Following Miami is Dallas with 13 projects/1,308 rooms, and then Orlando with 11 projects/1,791 rooms.

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms. Following distantly are Dallas with 28 projects/3,945 rooms, Austin with 28 projects/3,706 rooms, Atlanta with 26 projects/4,120 rooms, and Detroit with 23 projects under construction, accounting for 2,432 rooms. These five markets collectively account for 20% of the total number of projects currently under construction in the U.S.

Dallas has the most projects scheduled to start in the next 12 months, with 51 projects/5,989 rooms. Behind Dallas are Atlanta with 51 projects/5,989 rooms; Houston, with 42 projects/4,107 rooms; Los Angeles with 41 projects/6,278 rooms; and Phoenix with 38 projects/4,401 rooms. Dallas also has the largest number of projects in early planning, at the end of Q4’21, with 73 projects/8,246 rooms. Los Angeles follows with 57 projects/9,907 rooms; Atlanta 56 projects/6,561 rooms; Orlando 45 projects/7,896 rooms; and Nashville 38 projects/4,680 rooms.

The top 50 markets saw 449 hotels/63,742 rooms open in 2021. LE is forecasting these same 50 markets to open another 446 projects/57,837 rooms in 2022 for a 2.2% growth rate, and 421 projects/52,460 rooms in 2023 for a growth rate of 1.9%.

Moving into the New Year, an important metric to monitor will be markets with large construction pipelines as compared to their existing census of open & operating hotels. These markets are likely to see the fastest supply growth and largest supply-demand variances over the next few years. At the end of 2021, there were 17 markets with total pipelines in excess of 15% of their current census. Raleigh-Durham tops this list at 24.1%, followed by Miami, Fort Worth-Arlington, Austin, and then Memphis at 22.1%.

The markets topping the forecast for new hotel openings in 2022 will be New York City with 48 new hotels/6,656 rooms for a 5.4% growth rate, Atlanta with 22 projects/2,398 rooms for a 2.1% growth rate, Dallas with 21 projects/2,522 rooms for a 2.4% growth rate, and Austin with 20 projects/2,722 rooms for a 5.9% growth rate. LE expects a 2.1% average growth rate for the top 25 markets in 2022 and, come 2023, these top 25 markets will experience an average growth rate of 1.9%. New York will again top the charts in 2023 for new hotel openings. LE anticipates New York will open 42 new hotels, accounting for 7,058 rooms, again for a 5.4% growth rate, followed by Atlanta 21 projects/3,664 rooms for a 3.2% growth rate, and Dallas with 21 new opens/2,318 rooms for a growth rate of 2.2%.

Related Stories

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

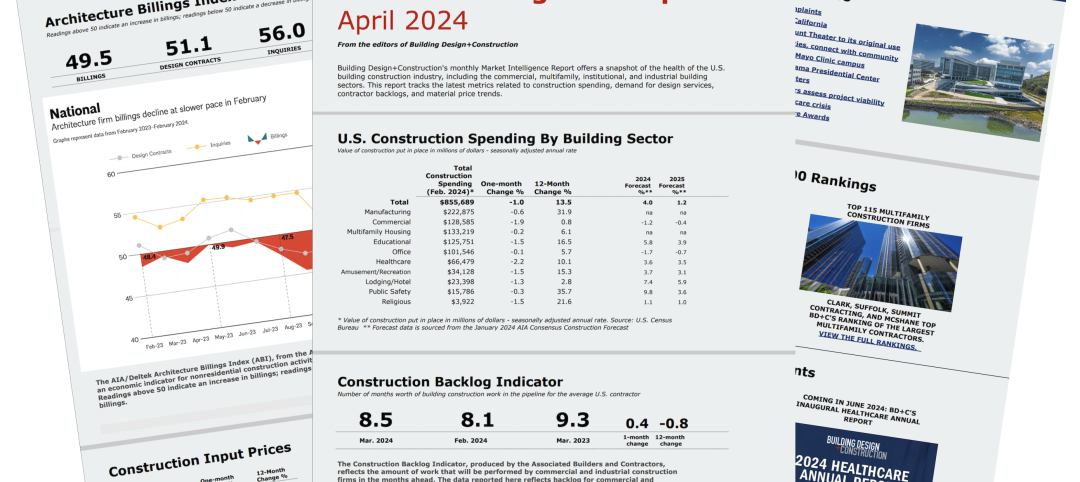

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

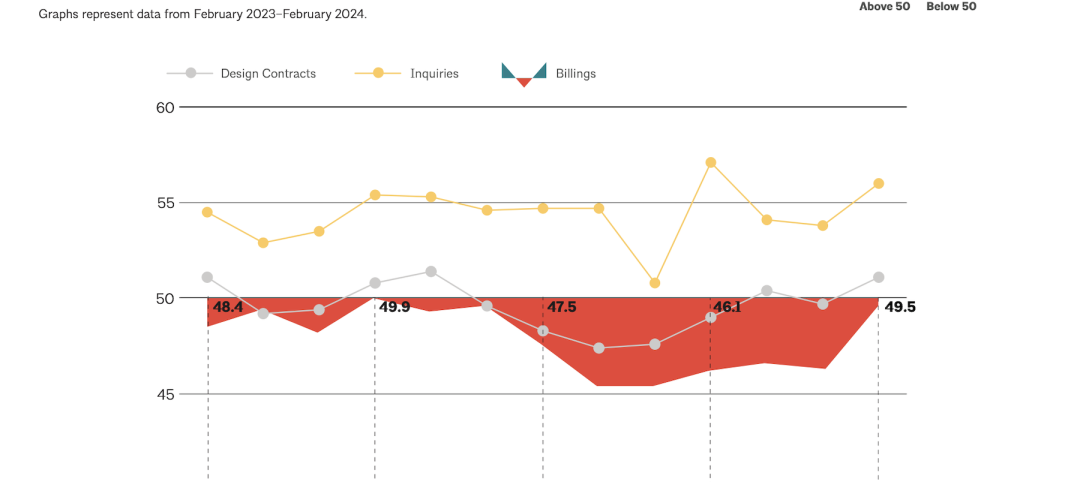

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

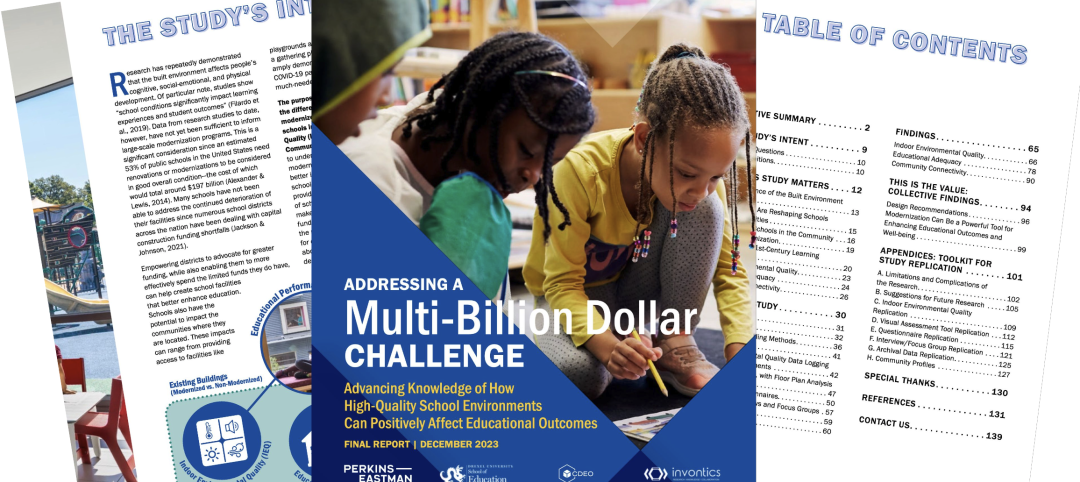

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.