Price increases—some to record-setting levels—and long delivery delays are causing hardships for construction firms that are also experiencing challenges in completing projects with crews limited by illness or new work site procedures resulting from the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged the Biden administration to review and rescind a range of trade tariffs in place, including for Canadian lumber, that are contributing to the price increases.

“The extreme price increases, as reflected in today’s producer price index report and other sources, are harming contractors on existing projects and making it difficult to bid new work at a profitable level,” said Ken Simonson, the association’s chief economist. “While contractors have kept bids nearly flat until now, project owners and budget officials should anticipate the prospect that contractors will have to pass along their higher costs in upcoming bids.”

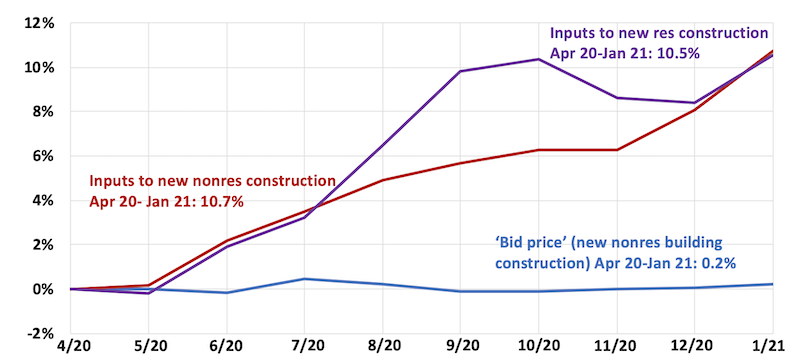

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged sharply since last April, Simonson said. A government index that measures the selling price for materials and services used in new nonresidential construction increased 2.5 percent from December to January and 10.7 percent since April. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.2 percent over both the latest month and the nine months since April.

“The government data was collected more than a month ago, and numerous sources indicate price increases have continued or even accelerated since then,” Simonson added. “For instance, the Framing Lumber Composite Price compiled by the publication Random Lengths hit an all-time high last week. Several steel product prices are also reported at record levels, and copper futures are at an eight-year peak. Meanwhile, delivery delays are affecting both imports and domestically sourced construction inputs.”

Association officials said that while there are a range of reasons driving price spikes for key building materials, tariffs on numerous materials, including lumber and steel, are contributing to those cost increases. They urged the Biden administration to rescind these tariffs to provide immediate relief to construction employers caught between stagnant bid prices and rising materials costs. They also urged the administration and Congress to explore new ways to expand capacity for a host of key construction materials by reviewing regulatory impediments to expanding logging and steel production, for example.

“Left unchecked, these rising materials prices threaten to undermine the economic recovery by inflating the cost of infrastructure and economic development projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Widespread harm is caused by maintaining tariffs on products that so many Americans need to improve their houses, modernize their infrastructure and revitalize their economy.”

View producer price index data. View chart of gap between input costs and bid prices.

Related Stories

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

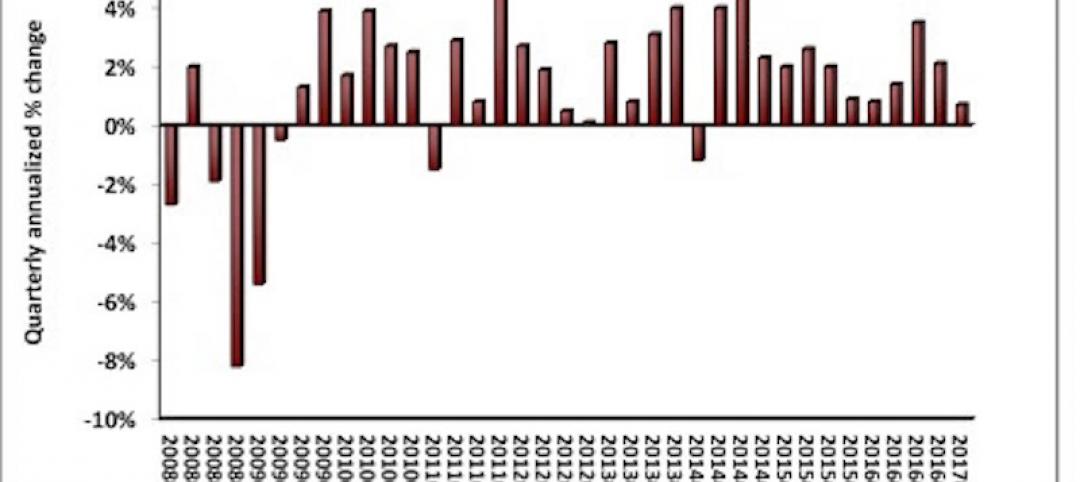

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

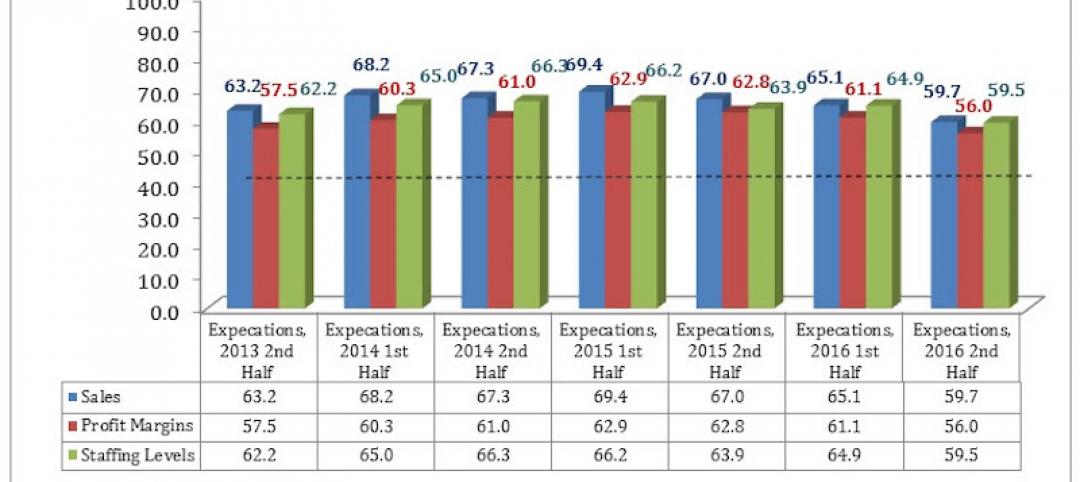

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.