Another round of steep price increases and supply-chain disruptions are wreaking hardships on contractors, driving up construction costs and slowing projects, according to an analysis by the Associated General Contractors of America of government data released today. The data comes a day after the association released a new survey showing materials delays and price increases are affecting most contractors. Association officials urged the Biden administration to end a range of trade tariffs in place, including for Canadian lumber, that are contributing to the price increases, and to help uncork supply-chain bottlenecks.

“Both today’s producer price index report and our survey results show escalating materials costs and lengthening delivery times are making life difficult for contractors and their customers, including hospitals, schools, and other facilities needed to get the economy back on track,” said Ken Simonson, the association’s chief economist. “Project owners and budget officials should anticipate that projects will cost more and have longer—perhaps uncertain—completion times, owing to these circumstances that contractors cannot control.”

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged sharply since last April, Simonson said. A government index that measures the selling price for materials and services used in new nonresidential construction jumped 1.9% from January to February and 12.8% since April 2020. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.3% last month and 0.5% in the 10 months since April.

“The nearly 1500 contractors who responded to our survey overwhelmingly reported rising costs, shortages, and delays in receiving needed materials, parts, and supplies,” Simonson added. “Eighty-five% of respondents said their costs for these items have risen in the past year, and a majority—58%—reported projects were taken longer than before the pandemic struck. This situation will intensify the cost squeeze apparent in the producer price index data.”

Association officials called on the president to remove tariffs on key construction materials, including steel and lumber. They also urged Washington officials to look at ways to address supply chain problems by making it easier for Canadian materials to enter the country and exploring regulatory measures to increase shipping capacity. They noted that construction firms are already absorbing the costs associated with protecting workers from the pandemic, and that materials price spikes and shipping delays are making it harder for firms to cope.

“Contractors are caught between a pandemic market that isn’t willing to pay more for projects and materials prices that continue to spike even as delivery schedules become less reliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Construction firms won’t be able to thrive if rising materials prices continue to shrink already pressured profit margins.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s survey.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

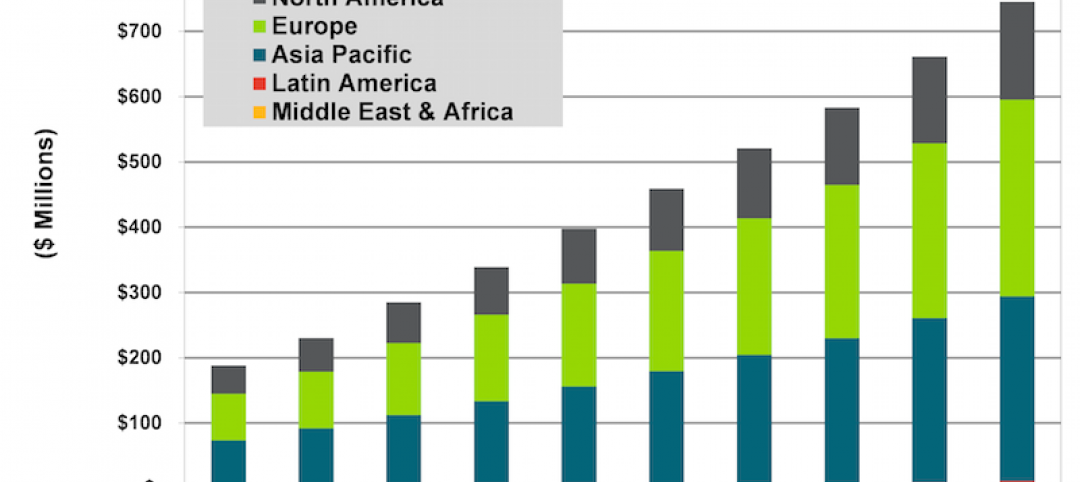

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.