Enabling talent, managing cost, and expanding influence are the three primary mandates that corporate real estate (CRE) executives are grappling with in their companies.

In its inaugural Americas Occupier Survey 2015/16, the CBRE Institute polled 229 executives about their strategies priorities, and practices. Forty-five percent of those respondents are in the Banking and Finance or in Tech and Telecom industries.

The majority (56%) of CRE executives say they are evaluated on the value and satisfaction they create among internal stakeholders. Throughout the survey, executives noted that their roles require them to address shortages in skilled labor, escalating costs, and economic uncertainties. Not surprisingly, uncertainties for execs in the Banking and Finance sectors revolve around tighter regulations.

CRE execs are dealing with a workforce that is more culturally, generationally, and ethnically diverse than ever. That workforce “strives to connect, integrate, and find community among peers in a world that is increasingly online” the report’s authors observe. Indeed, the highest portion of the survey’s respondents, 44%, says that connectivity to partners and supports is the most important factor to their labor forces, followed by flexible working hours, flexible space, and amenities.

Fifty-seven percent of respondents say their workplace strategies are driven by employee attraction and retention. And employers of choice are delivering the ideal work experience by linking their corporate real estate missions with human resources and information technology. Such “hyper-customized” environments emphasize brand, functionality, freedom of work style and community connectivity.

But CRE executives also insist that their strategic goals are thwarted when they don’t have support from their companies’ corporate suite. Productive and flexible workspaces and greater capital expenditure for real estate investment also rank high among the factors that give CRE execs the wherewithal to accomplish their objectives.

And when it comes to data, the majority of executives say they need information that enables data visualization and decision support. “Our research indicates that an optimal approach to CRE decisions will involve selective and discriminating use of analytics, paired with the irreplaceable role of a leader’s intuition and experience,” the report says.

CRE executives often manage their firms’ portfolio costs. A remarkable 85% of those polled said their companies had used space restructuring as a lever to reduce costs in the previous 12 months. But the pendulum is swinging away from smaller workstations and lower rents to smarter workplaces and agile leasing structures The survey finds that 31% of respondents’ companies are currently using shared office facilities, and another 15% say they are considering the merits of sharing space.

An emerging co-worker model “offers environments that inspire new levels of energy and connectivity that eluded earlier incarnations of the shared workplace model.”

Lease negotiation seems preferable to relocation as a cost-saving measure. For one out of every two companies, “talent determines the market; cost pinpoints the location,” the report says. However, expansion still dictates some moving decisions, as two out of five executives polled say accessing new markets and customers drive their companies’ relocation strategies.

AEC firms, take note: building and floorplan design is a leading decision driver when real estate executives are selecting a building to move into, even more important that real estate costs, lease options, or the quality of the location’s infrastructure or amenities.

Other findings of note from the survey include:

- 70% of CRE execs say their companies use external partnerships to deliver at least one function, like project or facilities management.

- Three quarters of CRE executives say their companies operate centrally.

- Half of the companies polled—which are all based in the Americas—favor India and Southeast Asia as expansion destinations.

Related Stories

Market Data | Apr 3, 2017

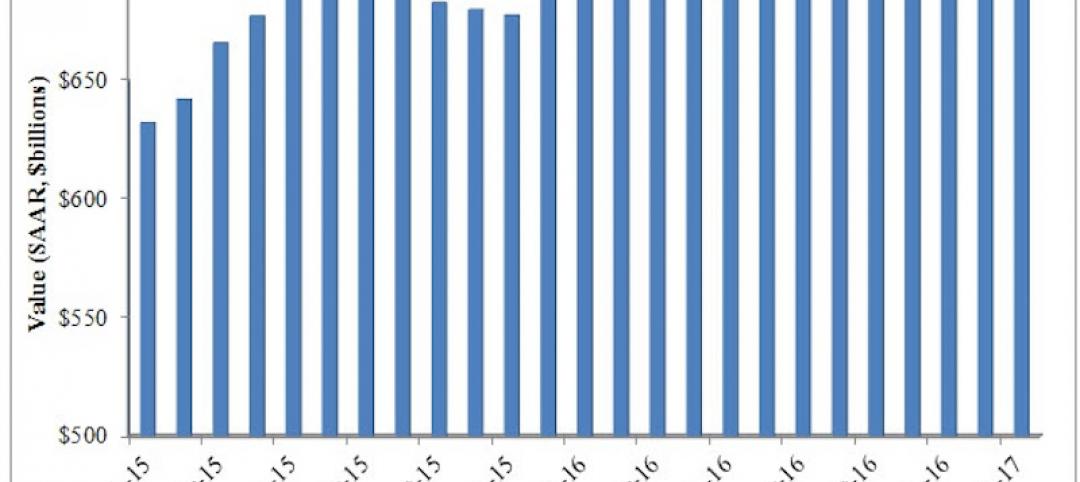

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

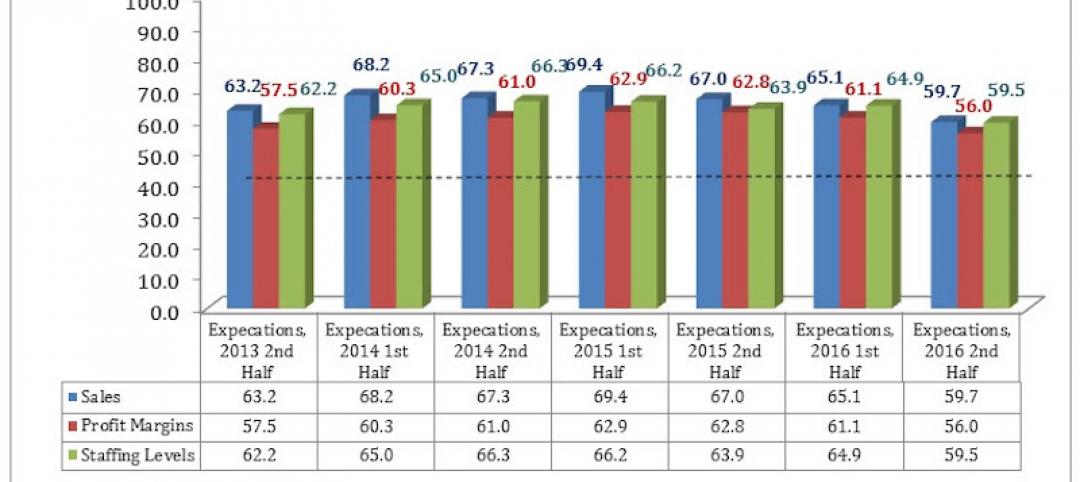

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

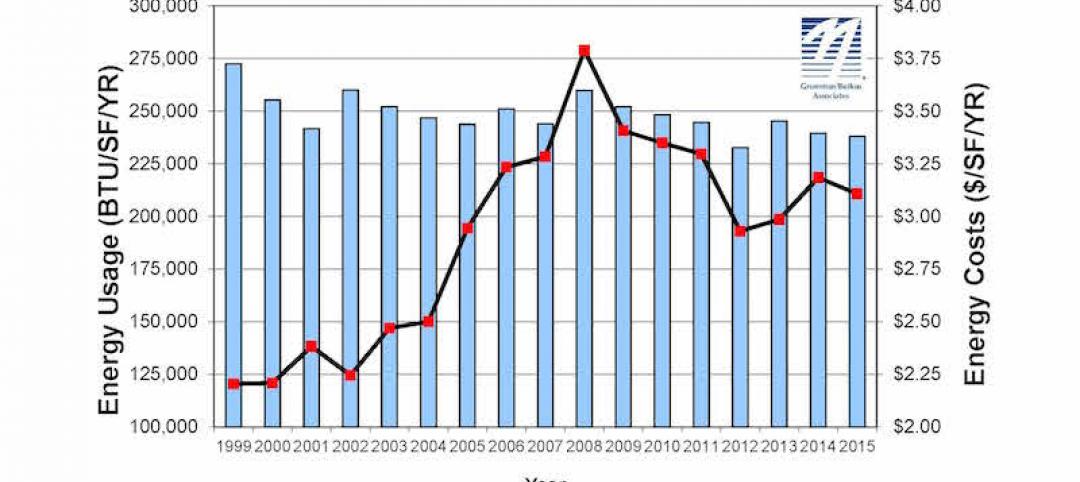

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

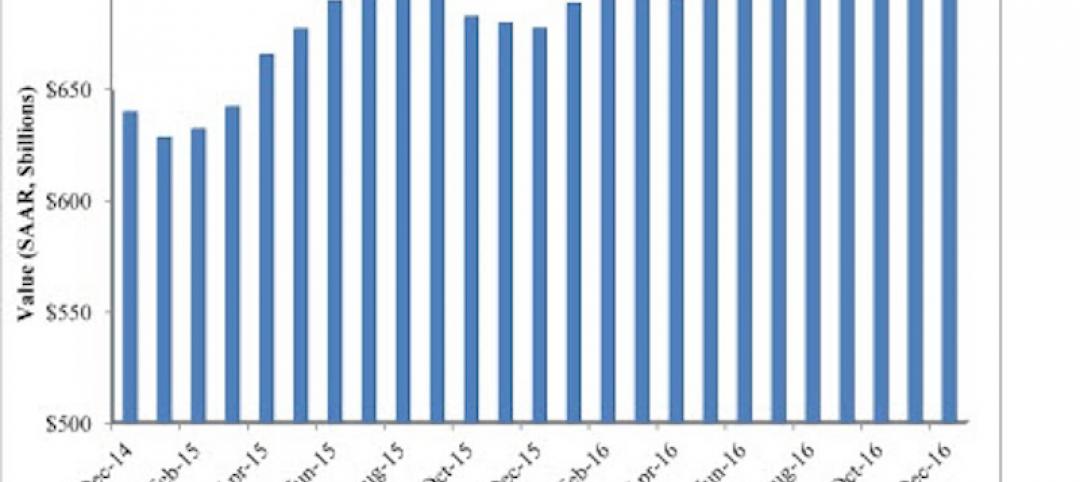

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.