PwC's latest quarterly analysis reported that the worldwide engineering and construction industries closed 218 merger and acquisition deals in 2014 worth more than $172 billion. The numbers are more than three times greater than 2013's total of $55 billion. Last year was the busiest year for M&A activity since 2007.

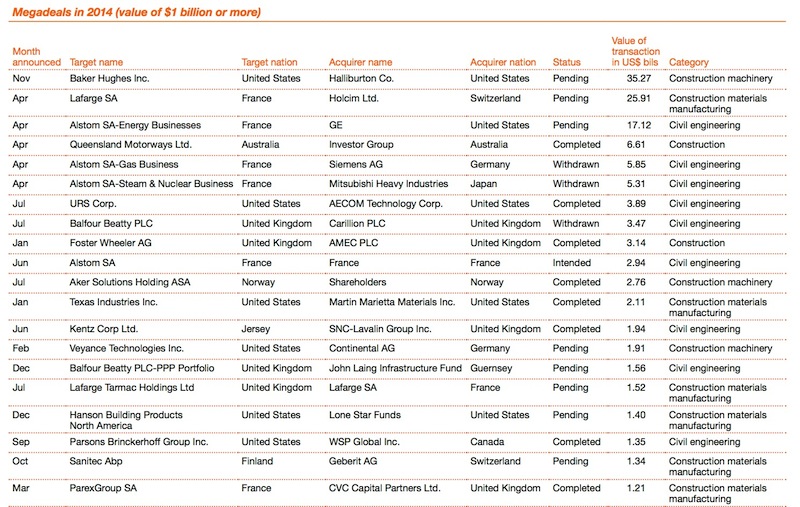

There were four mega deals in the fourth quarter of 2014, including one valued at $35 billion. Overall, there were 21 mega deals last year, totaling $127 billion. The greatest number of deals took place in Asia and Oceania.

“Some of the significant year-over-year growth in M&A activity can be attributed to companies seeking to better position themselves for mega projects that not only require a longer commitment of time and capital, but also deeper pools of highly skilled talent,” said H. Kent Goetjen, U.S. engineering and construction leader at PwC. “The lack of available talent, which is being fueled in the U.S. by the retirement of the baby boomer generation, is driving up the price of acquisitions and will continue to do so for the foreseeable future.”

PwC analysts are monitoring several other trends that are expected to affect the values and locations of deals in the engineering and construction sector, including:

• The integration of design and consultancy firms with construction companies is well under way as the E&C industry continues to move toward full service integration. Firms are generally looking to leverage higher-value added services, such as design, while balancing out their regional exposure.

• A major driver of consolidation is talent needs, as companies compete for specialized technical expertise in high-demand segments. As an alternative to acquiring expertise, some companies are embarking upon joint ventures, but these are complicated and add significant operational risk to any project. Companies are positioning themselves to bid on larger, increasingly complex projects with new partners and non-traditional sources of funding.

• A flurry of smaller, local deals took place, particularly within Asia. Cross-border activity dropped to 22% of the total in the quarter, with most local activity occurring in Asia.

• Cement oversupply and tepid demand continue to plague the industry. Top players, in an attempt to maintain their market share and margin, continue to acquire smaller companies post-merger announcement of Holcim and Lafarge.

• The consolidation in Asia was not limited to the construction materials segment, and not all driven by overcapacity, as all segments of E&C experienced a pick-up in local consolidation. The uncertain economic outlook in China raises many concerns for inbound activity in Asia but does not seem to be hindering deal activity in the region.

Related Stories

| Aug 18, 2016

LOCAL GOVERNMENT GIANTS: A ranking of the nation’s top design and construction firms in local sector work

HOK, Stantec, Turner Construction Co.,Clark Group, AECOM and STV top Building Design+Construction’s annual rankings of the nation’s largest local government sector AEC firms, as reported in the 2016 Giants 300 Report.

| Aug 18, 2016

STATE GOVERNMENT GIANTS: A ranking of the nation’s top design and construction firms in state sector work

CannonDesign, Stantec, Turner Construction Co.,Mortensen Construction, WSP | Parsons Brinckerhoff and AECOM top Building Design+Construction’s annual rankings of the nation’s largest state government sector AEC firms, as reported in the 2016 Giants 300 Report.

| Aug 15, 2016

SPORTS FACILITY GIANTS: New and renovated college sports venues - designed to serve students and the community

Schools are renovating existing structures or building new sports facilities that can serve the student body and surrounding community.

| Aug 15, 2016

Top 30 Sports Facility Engineering Firms

AECOM, Thornton Tomasetti, and ME Engineers top Building Design+Construction’s annual ranking of the nation’s largest sports facility sector engineering and E/A firms, as reported in the 2016 Giants 300 Report.

| Aug 15, 2016

MILITARY GIANTS: Cross-laminated timber construction gets a salute from the Army

By privatizing the construction, renovation, operation, maintenance, and ownership of its hotels the Army expects to cut a 20-year timetable for repairs and replacement of its lodging down to eight years.

| Aug 12, 2016

SCIENCE + TECHNOLOGY GIANTS: Incubator model is reimagining research and lab design

Interdisciplinary interaction is a common theme among many new science and technology offices.

| Aug 12, 2016

Top 50 Science + Technology Engineering Firms

Jacobs, Affiliated Engineers, and Vanderweil Engineers top Building Design+Construction’s annual ranking of the nation’s largest science + technology sector engineering and EA firms, as reported in the 2016 Giants 300 Report.

| Aug 12, 2016

OFFICE GIANTS: Technology is giving office workers the chance to play musical chairs

Technology is redefining how offices function and is particularly salient in the growing trend of "hoteling" and "hot seating" or "free addressing."

| Aug 12, 2016

Top 70 Office Engineering Firms

Jacobs, AECOM, and Thornton Tomasetti top Building Design+Construction’s annual ranking of the nation’s largest office sector engineering and E/A firms, as reported in the 2016 Giants 300 Report.

| Aug 11, 2016

RETAIL GIANTS: Retailers and developers mix it up to stay relevant with shoppers

Retail is becoming closely aligned with entertainment, and malls that can be repositioned as lifestyle centers will have enhanced value.