For the past few years, several production and semi-custom home builders have ventured outside of their for-sale comfort zones to engage in construction for rental customers.

Toll Brothers, the industry’s 13th-largest builder, told analysts in October that it had plans for five joint-venture projects to build a total of 1,900 rental apartment units, and had another 2,500 apartments already in its production pipeline. The builder’s City Living division has a number of mid- and high-rise rental buildings either operating or under construction in New York, Philadelphia, and Washington D.C.

CEO Doug Yearley said Toll Brothers would contribute one-quarter of the total equity for the JVs. He referred to rental as a market “hedge” that is synergistic with Toll’s core business model.

For more on the multifamily housing sector, read BD+C's Special Report: "5 intriguing trends to track in the multifamily housing game"

In 2012-13, Lennar, the industry’s second-largest builder, launched Lennar Multifamily. Through August 31, this division had completed 19 rental communities, with another 16 under construction. Lennar uses third-party property managers to lease and manage its apartments.

These and other builders—notably Arbor Custom Homes in the Pacific Northwest, and Sares-Regis Group and MBK Homes in California—have delved deeper into metro areas facing severe shortages of rental units. In San Francisco alone, 90% of the 7,000 residential units under construction are rentals.

It’s important to note, however, that the majority of production builders with townhouses and condos in their portfolios still target buyers, not renters. One of these is San Francisco-based Trumark Urban, a division of Trumark Homes. As of late October, Trumark Urban had nine for-sale condo projects with 1,000 units in the works, seven of them in its hometown. Its total investment in these projects: $700 million.

Unlike other production builders that have dipped their toes in the apartment arena, Trumark has stuck with for-sale condos, and has nine such projects in development in California. Photo: ©Christopher Mayer Photography

Unlike other production builders that have dipped their toes in the apartment arena, Trumark has stuck with for-sale condos, and has nine such projects in development in California. Photo: ©Christopher Mayer Photography

Arden Hearing, Trumark Urban’s Managing Director, says condo customers run the gamut from Millennials to empty nesters and age groups in between––“anyone who values the urban fabric.”

For Amero, which broke ground in San Francisco in November 2013, Trumark Urban offered two- and three-bedroom condos from 1,000 to 2,500 sf, selling at $1,100 to $2,000 per sf. Amero offers what Hearing says is a world-class roof deck. There’s a bike-parking space for every tenant, and a bike shop that’s managed by the homeowners’ association.

Hearing says the firm can be selective about what amenities it offers in San Francisco because the neighborhood itself is the biggest amenity. “It’s transit oriented and walkable,” he says. “I bet there are 15 bars within a short walk of Amero.” No need for an on-site gym either: there are numerous fitness centers close by.

Trumark’s projects in Los Angeles, however, have more extensive on-premises amenities. A 150-unit downtown building, three blocks from the Staples Center, has a 6,000-sf pool deck with grilling, private rooms, and yoga studios.

Hearing says his company has avoided marketing its condos as “luxury” in San Francisco, “where that’s a four-letter word.” But that label might be unavoidable for a $150 million, 77-unit condo project that Trumark broke ground on in October in San Francisco’s toney Pacific Heights neighborhood.

Trumark Urban is currently looking for opportunities in Seattle, San Diego, and international markets. “We want to go where people want to live,” says Hearing.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

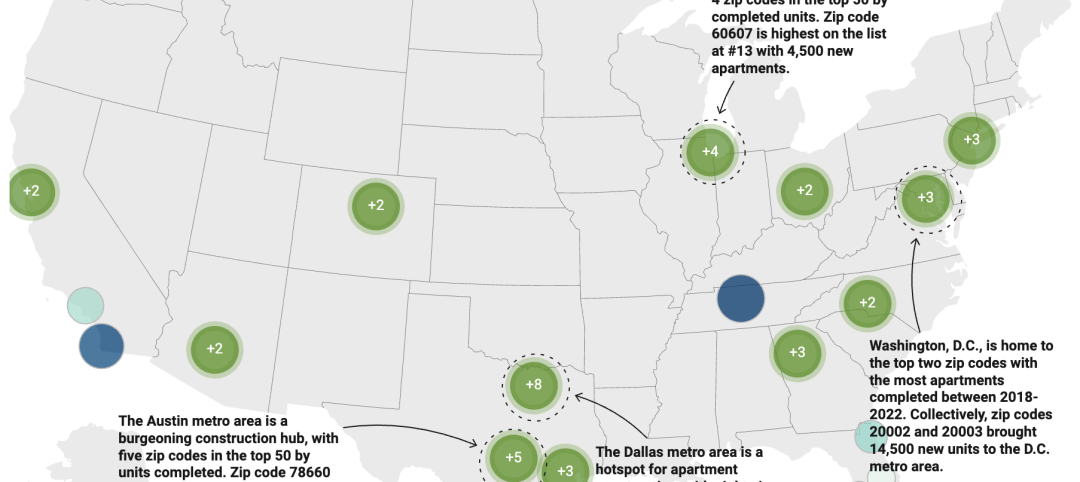

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”