Only 14 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials noted that widespread supply chain disruptions amid and the lack of a much-needed federal infrastructure bill have impeded the sector’s recovery.

“Construction employment remains below pre-pandemic levels in more than two-thirds of the states,” said Ken Simonson, the association’s chief economist. “Supply problems have slowed down many projects and forced contractors to hold down employment, while the lack of an infrastructure bill is leading some to delay hiring.”

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 14 states and D.C., decreased in 35 states, and stalled in Connecticut. Texas shed the most construction jobs over the period (-48,000 jobs or -6.1%), followed by New York (-47,300 jobs, -11.6%) and California (-32,600 jobs, -3.6%). The largest percentage losses were in Louisiana (-16.1%, -22,000 jobs), Wyoming (-15.7%, -3,600 jobs) and New York.

Utah added the most construction jobs since February 2020 (9,400 jobs, 8.2%), followed by Washington (6,300 jobs, 2.8%), North Carolina (5,300 jobs, 2.2%), and Idaho (5,100 jobs, 9.3%). The largest percentage gains were in Idaho, Utah, and South Dakota (7.9%, 1,900 jobs).

From August to September construction employment decreased in 16 states, increased in 32 states and D.C., and was unchanged in Iowa and Kansas. The largest decline over the month occurred in Tennessee, which lost 2,800 construction jobs or 2.1%, followed by Missouri (-1,600 jobs, -1.3%). The largest percentage decline was in Alaska (-800 jobs, -4.9%), followed by Tennessee and Montana (-400 jobs, -1.4%).

Texas added the most construction jobs between August and September (8,900 jobs, 1.2%), followed by Florida (6,900 jobs, 1.2%) and Washington (3,600 jobs, 1.6%). Connecticut had the largest percentage gain (3.0%, 1,700 jobs), followed by Delaware (2.9%, 700 jobs) and West Virginia (2.3%, 700 jobs).

Association officials continued to urge the Biden administration to remove tariffs on a host of key construction materials, including steel and aluminum, and to do more to relieve shipping bottlenecks that are crippling many parts of the distribution network. They also urged House officials to quickly pass a Senate-backed infrastructure bill to increase investments in the nation’s transportation and water systems.

“The latest state employment figures show that gridlock in our ports and on Capitol Hill is retarding construction employment as well as the broader economy,” said Stephen E. Sandherr, the association’s chief executive officer. “Even as the administration looks for ways to unclog domestic supply chains, the President should urge the House to pass the infrastructure bill, on its own, as quickly as possible.”

View state February 2020-September 2021 data and rankings, 1-month rankings.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

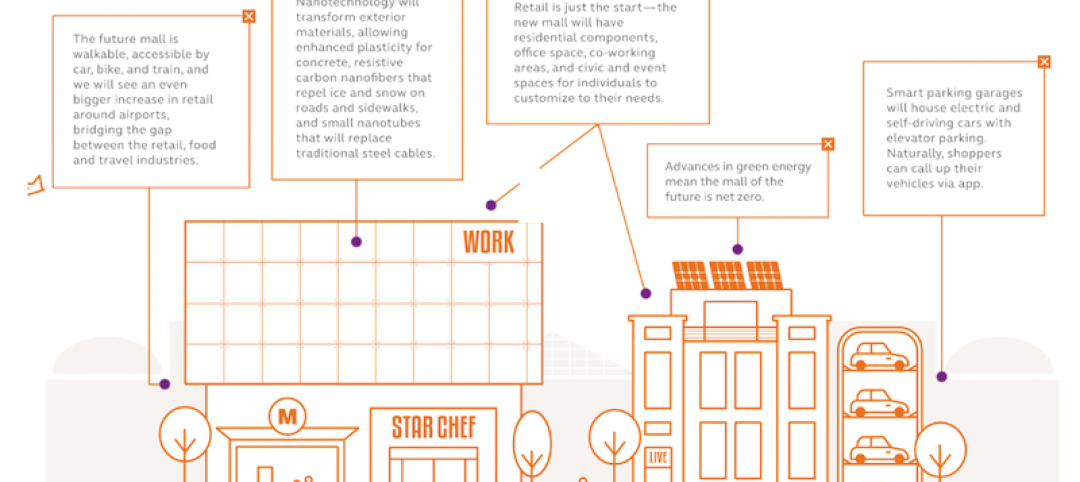

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.