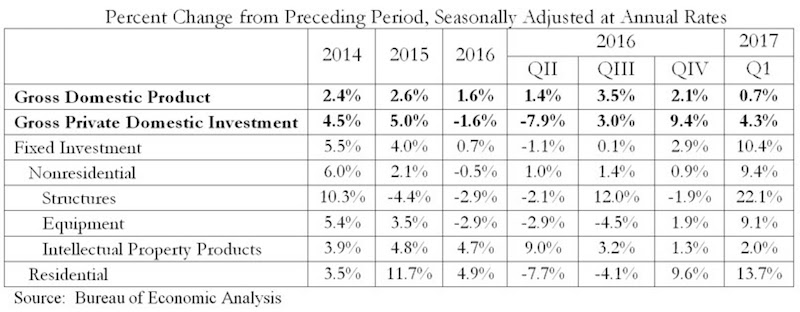

The U.S. economy’s performance slowed in the first quarter of 2017, but nonresidential fixed investment expanded at an impressive 9.4 percent seasonally adjusted annual rate, according to analysis of U.S. Bureau of Economic Analysis data recently released by Associated Builders and Contractors (ABC).

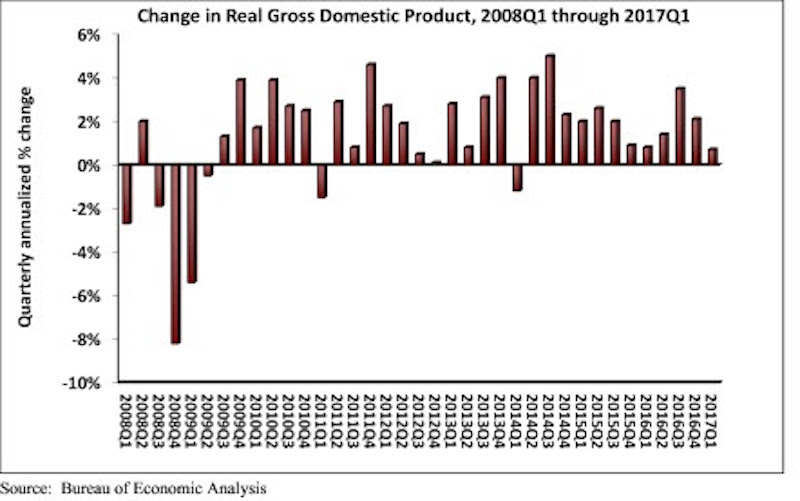

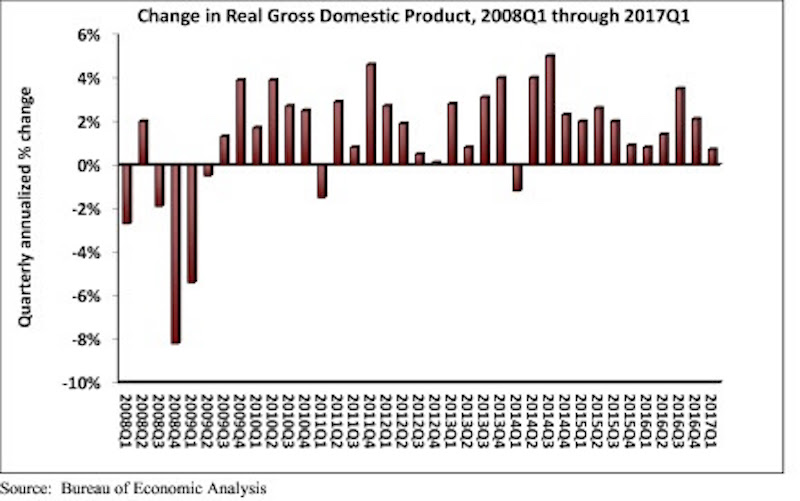

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year. Despite the subdued growth, GDP has now expanded in every quarter over the past three years. Fourth quarter 2016 growth was revised upward from a 1.9 percent annual rate of expansion to a 2.1 percent annual rate.

This represents the best quarter for nonresidential fixed investment, a category closely aligned with construction and other forms of business investment, since the end of 2013 and ends more than a year of tepid nonresidential fixed investment growth. Investment in structures, a subcomponent of nonresidential fixed investment, expanded 22.1 percent for the quarter after contracting by 1.9 percent in the fourth quarter of 2016. The other two subcomponents of nonresidential fixed investment—equipment and intellectual property products—expanded at a 9.1 percent rate and a 2.0 percent rate, respectively.

“It was expected that first quarter GDP would indicate that the U.S. economy remained unable to generate a high rate of growth,” said ABC Chief Economist Anirban Basu in a release. “Many economic actors appear to have adopted a cautious attitude in an environment characterized by a considerable amount of policy uncertainty. The decline in defense expenditures is likely to be a surprise to many given recent discussions about supposed vast increases in defense outlays.

“The investment in nonresidential structures during the first three months of the year is particularly remarkable in an environment otherwise characterized as generating little economic growth,” said Basu. “Rather than adopt a wait-and-see attitude, developers appear to have acted with conviction, taking advantage of growing confidence among investors and other market participants to forge ahead with planned projects. While the new presidential administration has yet to implement even a small fraction of its pro-business agenda, the development community continues to express confidence in the administration’s ability to create the conditions necessary for a much more vibrant U.S. economy.

“The expectation is that the balance of the year will be associated with much more rapid growth,” said Basu. “Consumer spending should pick up after a weak first quarter, given accelerating wage increases and elevated levels of job security. Business spending is also likely to expand briskly, particularly if the Trump administration is able to make meaningful progress on the corporate and personal income tax front.”

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.