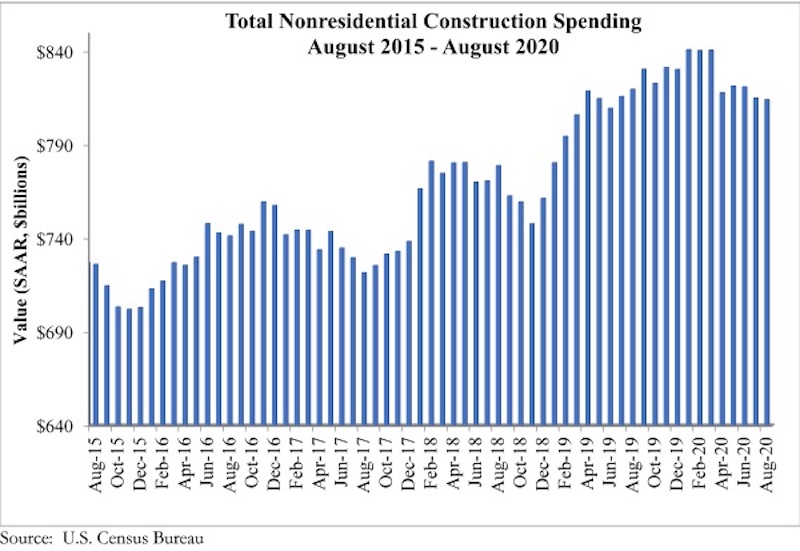

National nonresidential construction spending fell 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $814.3 billion for the month.

Of the 16 nonresidential subcategories, nine were down on a monthly basis. Private nonresidential spending decreased 0.3% from July, while public nonresidential construction spending was up 0.2%. Nonresidential construction spending is down 0.7% compared to August 2019.

“While overall construction spending rose significantly in August, much of that was attributed to surging single-family housing starts,” said ABC Chief Economic Anirban Basu. “The picture is very different in a number of nonresidential construction categories, especially in segments that have been disproportionately impacted by the pandemic, such as lodging and office, which are down 12.1% and nearly 9% year over year, respectively.

“The good news is that nonresidential construction spending momentum remains apparent in a number of public segments,” said Basu. “On a monthly basis, construction spending was up in the water supply, highway/street and educational categories. Spending in the public safety segment is up nearly 40% compared to the same time last year.

“Absent an infrastructure-oriented stimulus package, the likely trajectory of nonresidential construction spending does not appear especially bright,” said Basu. “Commercial real estate fundamentals are poor, with elevated vacancy rates and tighter lending conditions, rendering it probable that private nonresidential construction spending will continue to dip. State and local finances have been pummeled by the pandemic, resulting in less support for the next generation of public projects. Many contractors report declining backlog, according to ABC’s Construction Backlog Indicator, and fewer opportunities to bid on new projects. With winter coming and infection rates poised to rise, the quarters to come are shaping up to be challenging ones.”

Related Stories

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

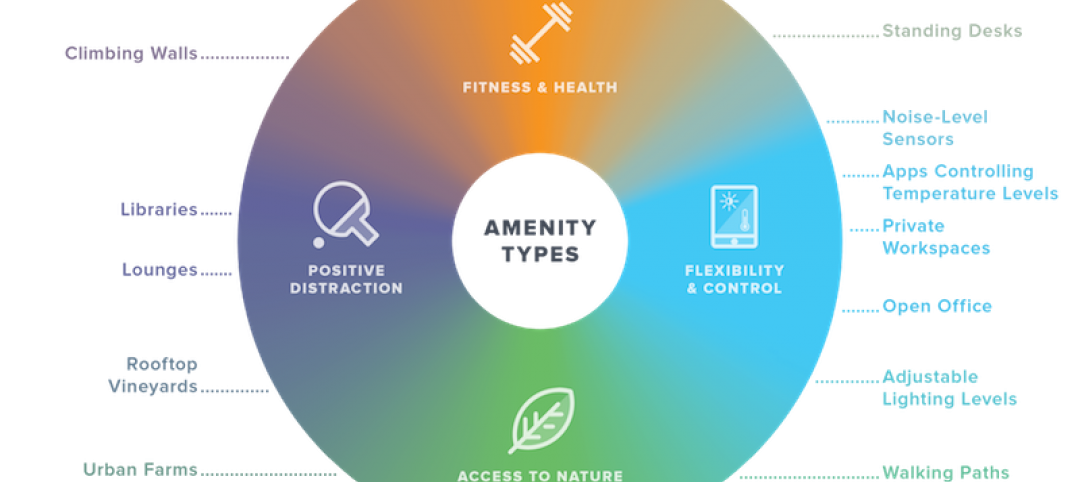

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

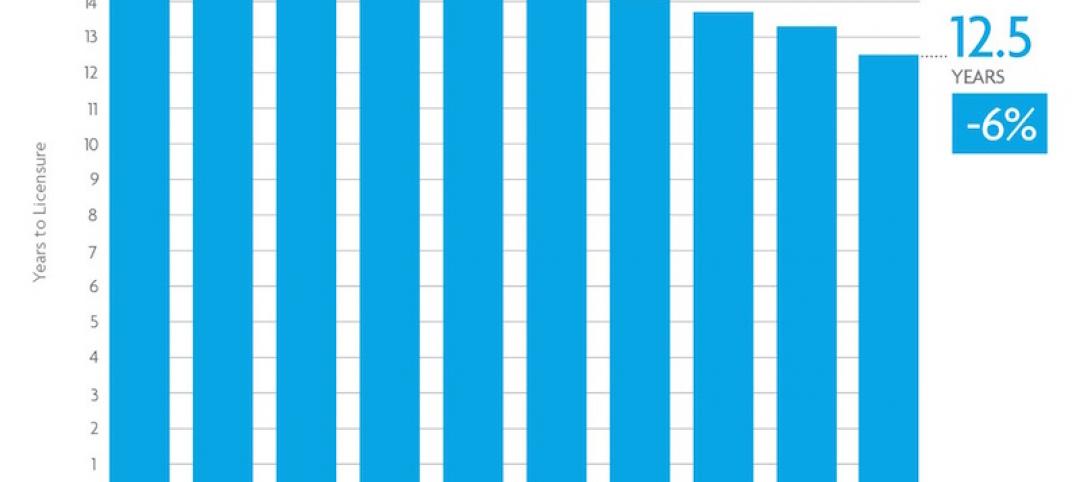

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.