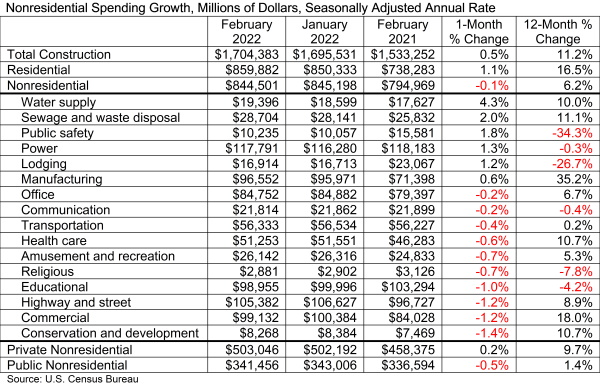

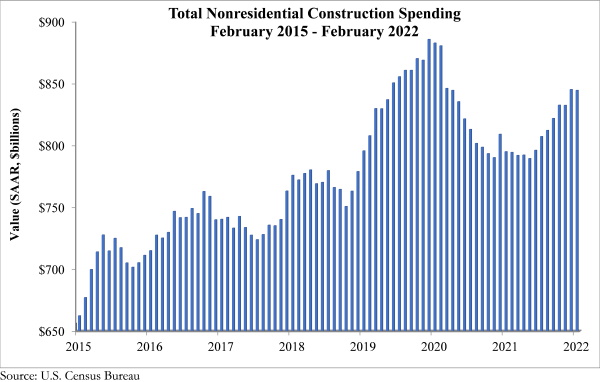

National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $844.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was up by 0.2%, while public nonresidential construction spending was down 0.5% in February.

"Nonresidential spending decreased in February despite inflationary pressures that should have driven it higher," said ABC Chief Economist Anirban Basu. "True, nonresidential spending is up 6.2% year over year, but given the significance of construction materials inflation, spending has almost certainly declined in real terms.

"Moreover, the Russia-Ukraine war has spawned further materials price increases, which in turn raises the risk that project owners will decide to postpone or cancel projects,” said Basu. “ABC’s Construction Confidence Index indicates that a growing number of contractors expect to trim their margins during the year ahead in order to induce purchasers to continue to move forward. The spread of an omicron subvariant in China has started to interfere with production there, which translates to additional supply chain disruptions.

"As if that were not enough, the risk of recession is rising," said Basu. "While there is evidence of ongoing momentum, a recent increase in interest rates coupled with hawkish statements from the Federal Reserve imply that credit conditions will become more challenging this year. The question is whether the Federal Reserve can slow economic growth in order to counter inflation without driving the economy into recession.

“The recent inversion of the yield curve is viewed by many economists as a leading indicator of recession,” said Basu. “Since the early 1980s, most rate tightening cycles have ended in recession. For contractors that largely work on private construction projects, this suggests risk of weakening backlog at some point later this year or in 2023. For those largely focused on public work, the economics are more favorable, since federal infrastructure outlays will be elevated for approximately the next five years."

Related Stories

Industry Research | Apr 25, 2023

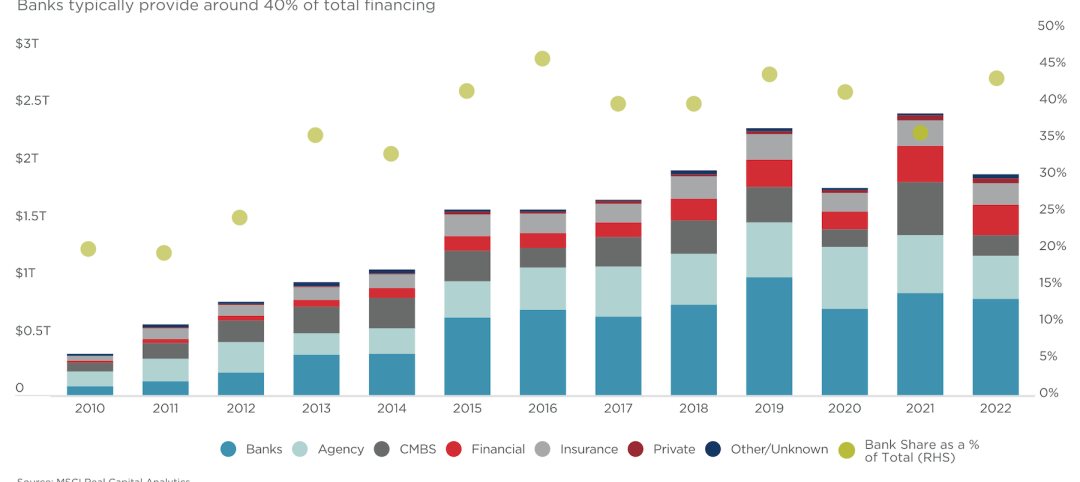

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Self-Storage Facilities | Apr 25, 2023

1 in 5 Americans rent self-storage units, study finds

StorageCafe’s survey of nearly 18,000 people reveals that 21% of Americans are currently using self-storage. The self-storage sector, though not the most glamorous, is essential for those with practical needs for extra space.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Market Data | Apr 11, 2023

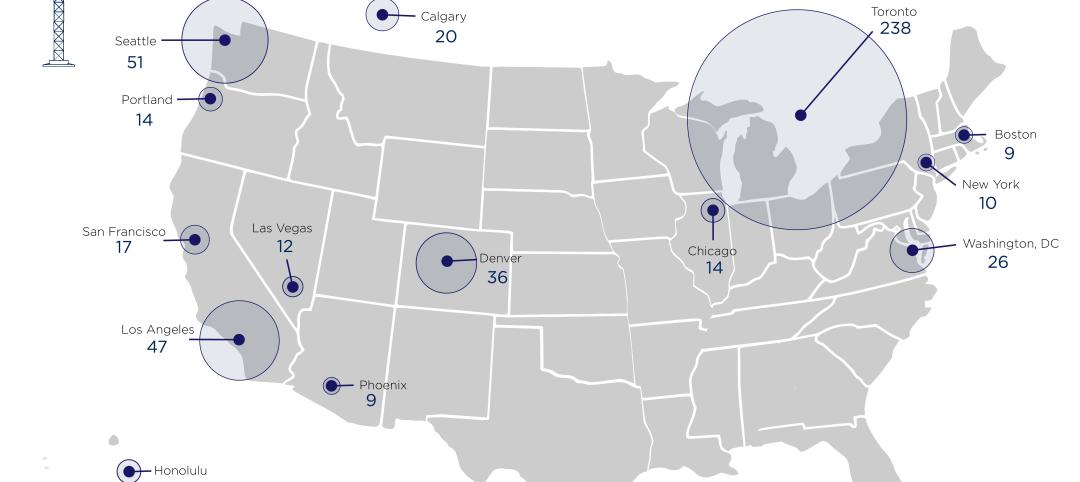

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.

Sustainability | Apr 4, 2023

NIBS report: Decarbonizing the U.S. building sector will require massive, coordinated effort

Decarbonizing the building sector will require a massive, strategic, and coordinated effort by the public and private sectors, according to a report by the National Institute of Building Sciences (NIBS).

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.