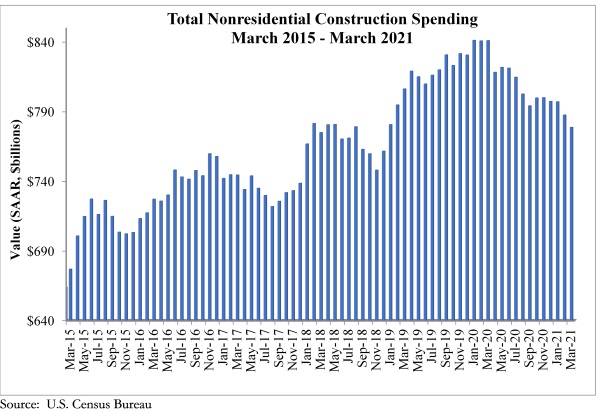

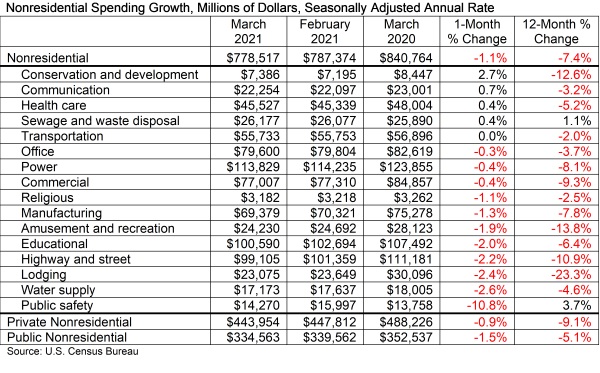

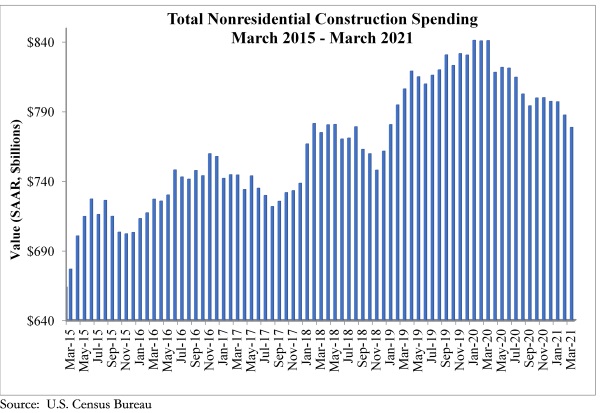

National nonresidential construction spending declined 1.1% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $778.5 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.9%, while public nonresidential construction spending fell 1.5% in March.

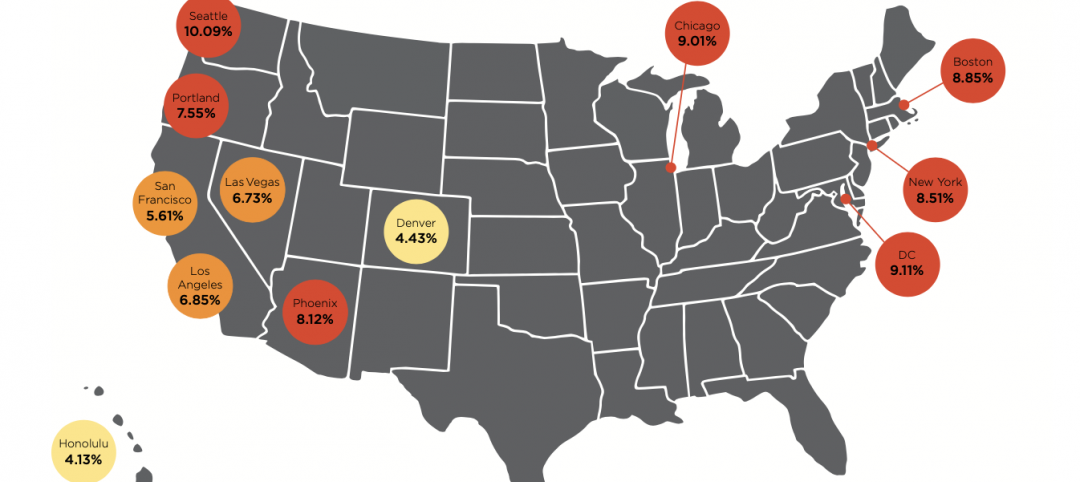

“While the longer-term outlook for nonresidential construction is superb, the pandemic is lingering, creating much damage to commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “The lodging, office and commercial segments experienced declines in spending in March. Office vacancy rates are elevated in many markets, and the industry experienced negative net absorption. The trials and tribulations of hotel operators, retailers and restauranteurs are also well known. Private nonresidential construction spending is down more than 9% from March 2020.

“Public construction spending was weak in March and is down more than 5% on a year-over-year basis,” said Basu. “While large-scale federal infrastructure outlays are likely in the future, that money has yet to arrive. State and local government finances have generally held up far better than many had predicted earlier in the COVID-19 crisis, but many governments have had to spend significant operational sums to countervail the public health crisis and therefore had to redirect money away from infrastructure.

“ABC’s Construction Backlog Indicator has foreshadowed this state of affairs for months,” said Basu. “The most recent readings suggest that the construction spending recovery will be slow over the near-term. However, as the broader economic recovery picks up additional speed later this year with more pervasive vaccinations and re-openings, both private and public construction spending should begin to manifest more positive momentum later this year and into 2022.”

Related Stories

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.