“This isn’t the end of office. This is merely survival of the fittest.”

So concludes Frank Petz, Office Lead-U.S. Capital Markets for Colliers International, about the viability and efficacy of office conversions, in a new white paper on the topic released jointly by Colliers and the architecture, design and planning firm SGA.

The white paper is in the form of a Q&A, with Colliers’ Director of National Capital Markets Research Aaron Jodka interviewing Petz and Maren Reepmeyer, AIA, LEED AP, Vice President with SGA, about what is likely to become of the current glut of vacant office space in markets around the country.

Along with the white paper, SGA and Colliers have produced an Office Conversion Compatibility Chart that breaks down 14 building types by structural considerations, MEP/FP infrastructure considerations, code considerations, envelope considerations, and servicing/operational considerations.

For example, if a developer wants to convert an office building into a space for life science research or labs, the Chart contends that the developer or owner needs to consider the building’s structural grid layout constraints, slab and roof capacity (150 pounds per sf), vibration criteria (4 MIPS+), floor-to-floor heights (15 ft minimum), slab penetrations for MEP/FP shafts, vertical additions for a mechanical penthouse and/or screening, increased air exchange (10 cubic ft per minute minimum), HVAC redistribution, individual tenant generators, specialty exhaust, increased fire resistance and ratings, sound attenuation, roof upgrades, a secure site or chemical storage, and hazardous waste requirements.

PDFs of the full report and compatibility chart can be downloaded from here.

Office-to-housing can be expensive

What happens to vacant office space is a question of considerable urgency for cities like San Francisco and Boston, whose office real estate represents between 18% and 22% of their property tax revenue. “I heard anecdotally that 90% of tenants are looking for 10% of the buildings. So where does this leave the rest of them?” asks Jodka. That question is especially relevant as businesses “recalibrate” their definitions of office and work to factor in work-from-anywhere options.

Petz and Reepmeyer run through what have become familiar pros and cons about office conversions. In urban markets, says Reepmeyer, this conversation mostly revolves around adding more residential to downtown central business districts. “Part of this stems from government agencies and jurisdictions looking to solve the housing crisis while bringing vibrancy and occupancy to vacant office buildings,” she explains.

However, there is a particular set of challenges that comes with office-to residential conversions. For example, bringing light and air deep into high-rise floorplates can drive costs exponentially. “It’s often a density play in the form of a vertical addition that makes these projects viable,” observes Reepmeyer.

Cost definitely can make conversions problematic. Petz points out that, assuming all the structural elements can be met, there’s still a broad $450-$650 per sf price range for a conversion in urban markets, depending on the extent of renovation necessary. Even if the conversion of a Class B office building can be lowered to $150-200 per sf, Colliers estimates that “all-in” costs total somewhere around $550 to $850 per sf, making an office-to-res conversion “economically unfeasible.”

Conversions to other building types besides housing, like self-storage or hotels, might make more sense economically (albeit with their own issues). And Petz predicts that demolition of existing office buildings could be a more expedient route to achieving residential redevelopment because it would “benefit from better zoning, higher densities, and quicker approval processes.”

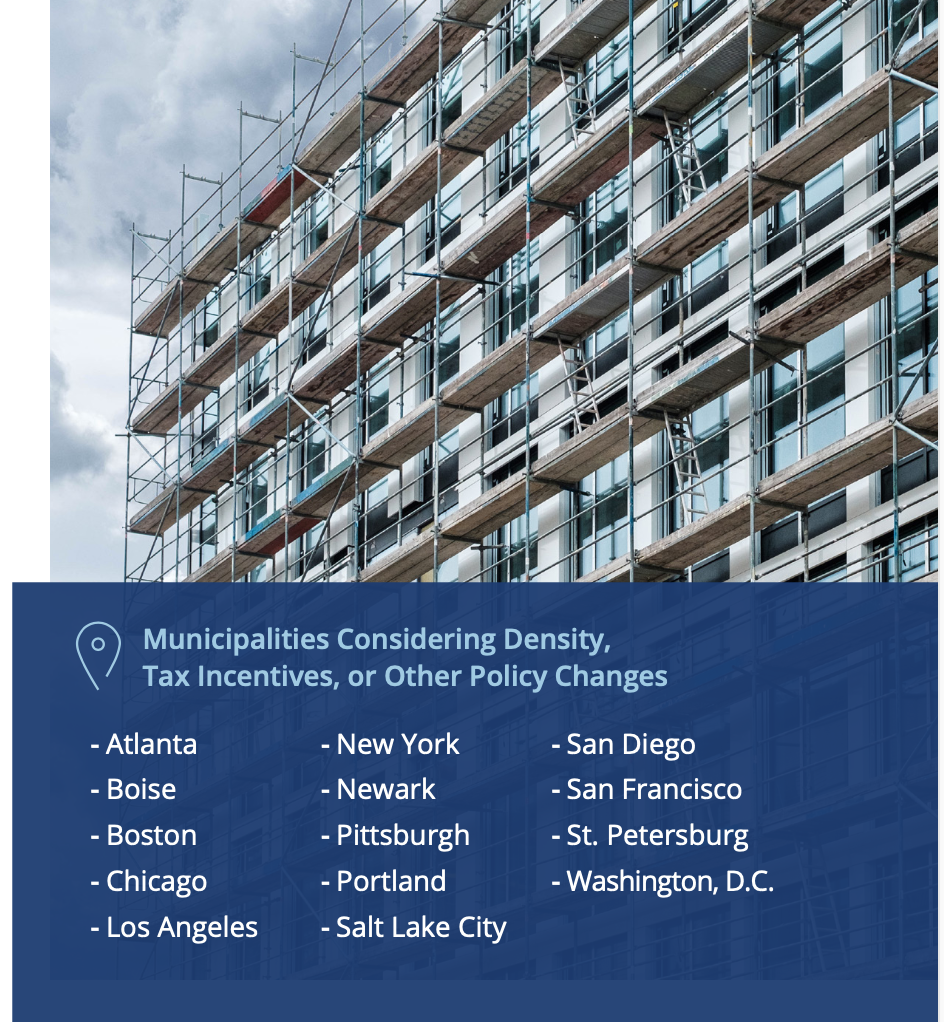

Petz asserts that for offices to be converted to residential in suburban markets, “a public policy decision must be made around housing and affordability.” That translates into local municipalities offering tax abatements, financing support, accelerated permitting and broader zoning. “Policy changes must be abrupt and clearly defined,“ says Petz.

Reepmeyer notes that Boston—following the leads of other cities such as Chicago and New York—has unveiled plans to implement a pilot program that would reduce tax burdens by 75 percent over a 29-year period, for office properties converting to residential use.

But, she adds, discussions about office-to-res conversions have been rendered all but moot in suburban markets where there’s much more interest in converting vacant offices to spaces for life sciences, tech, R&D, industrial, and auxiliary spaces supporting science, research, and manufacturing. “Depending on infrastructure parameters, a substantial amount of suburban inventory is well-suited for these types of conversions, given their high bays and long spans from a structural perspective,” Reepmeyer states.

Offices might also be suitable for conversions to distribution centers and so-called “last mile” warehouse facilities that are much sought after by suburban municipalities.

Offices still ‘necessary’

Colliers and SGA aren’t ready to give up on offices yet, especially now that more companies are pushing for their employees to return to workplaces, even if for only a few days per week. Earlier this month, President Biden called on his Cabinet to “aggressively execute” plans for federal employees to work more from their offices by this fall.

“There will always be a need for commercial office space, and the flight-to-quality will continue as long as supply outweighs demand in the commercial office sector,” says Reepemeyer. She notes that more companies are taking advantage of market conditions to improve their corporate footprint, promote culture, and prioritize the human experience as it relates to their organization. This shift includes upgraded user-focused working environments, access to vibrant sought-after amenities, and a new-found focus on collaboration and community-building.

“It’s interesting that these attributes are not unlike the placemaking and activation that are so strongly desired at city and neighborhood scales,” Reepmeyer adds.

Petz agrees that all office “isn’t going away.” He believes that a significant number of office buildings in cities remain viable, and the majority “will be necessary” in the future, as new industries and businesses, like artificial intelligence, lure workers back to places like San Francisco.

Related Stories

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Headquarters | May 16, 2023

Workplace HQ for party clothing company Shinesty celebrates its bold, whimsical products

The new Denver headquarters for Shinesty, a party clothing company, was designed to match the brand’s fun image with an iconic array of colors, textures, and prints curated by the design agency, Maximalist. Shinesty’s mission, to challenge the world to live more freely and “take itself less seriously,” is embodied throughout the office interior.

Office Buildings | May 15, 2023

Sixteen-story office tower will use 40% less energy than an average NYC office building

This month marks the completion of a new 16-story office tower that is being promoted as New York City’s most sustainable office structure. That boast is backed by an innovative HVAC system that features geothermal wells, dedicated outdoor air system (DOAS) units, radiant heating and cooling, and a sophisticated control system to ensure that the elements work optimally together.

Headquarters | May 15, 2023

The new definition of Class A property

Dan Cheetham, Managing Director and Founder of FYOOG, believes organizations returning to a "hub and spoke" model could have a profound effect on properties once considered Class B.

Headquarters | May 9, 2023

New Wells Fargo development in Texas will be bank’s first net-positive campus

A new Wells Fargo development in the Dallas metroplex will be the national bank’s first net-positive campus, expected to generate more energy than it uses. The 850,000-sf project on 22 acres will generate power from solar panels and provide electric vehicle charging stations.

Digital Twin | May 8, 2023

What AEC professionals should know about digital twins

A growing number of AEC firms and building owners are finding value in implementing digital twins to unify design, construction, and operational data.

Office Buildings | May 5, 2023

9 workplace design trends for 2023

HOK Director of WorkPlace Kay Sargent and Director of Interiors Tom Polucci discuss the trends shaping office design in 2023.

Office Buildings | May 4, 2023

In Southern California, a former industrial zone continues to revitalize with an award-winning office property

In Culver City, Calif., Del Amo Construction, a construction company based in Southern California, has completed the adaptive reuse of 3516 Schaefer St, a new office property. 3516 Schaefer is located in Culver City’s redeveloped Hayden Tract neighborhood, a former industrial zone that has become a technology and corporate hub.

Mass Timber | May 3, 2023

Gensler-designed mid-rise will be Houston’s first mass timber commercial office building

A Houston project plans to achieve two firsts: the city’s first mass timber commercial office project, and the state of Texas’s first commercial office building targeting net zero energy operational carbon upon completion next year. Framework @ Block 10 is owned and managed by Hicks Ventures, a Houston-based development company.

Office Buildings | May 1, 2023

Office building owners face potential legal liabilities when adding new workplace amenities

Many landlords in the war for tenants have turned to offering new amenities such as conference room services, fitness centers with nutritionists, and high-end food and beverage offerings. To provide new services, landlords often engage with third-party vendors, which can present thorny legal liability.