Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

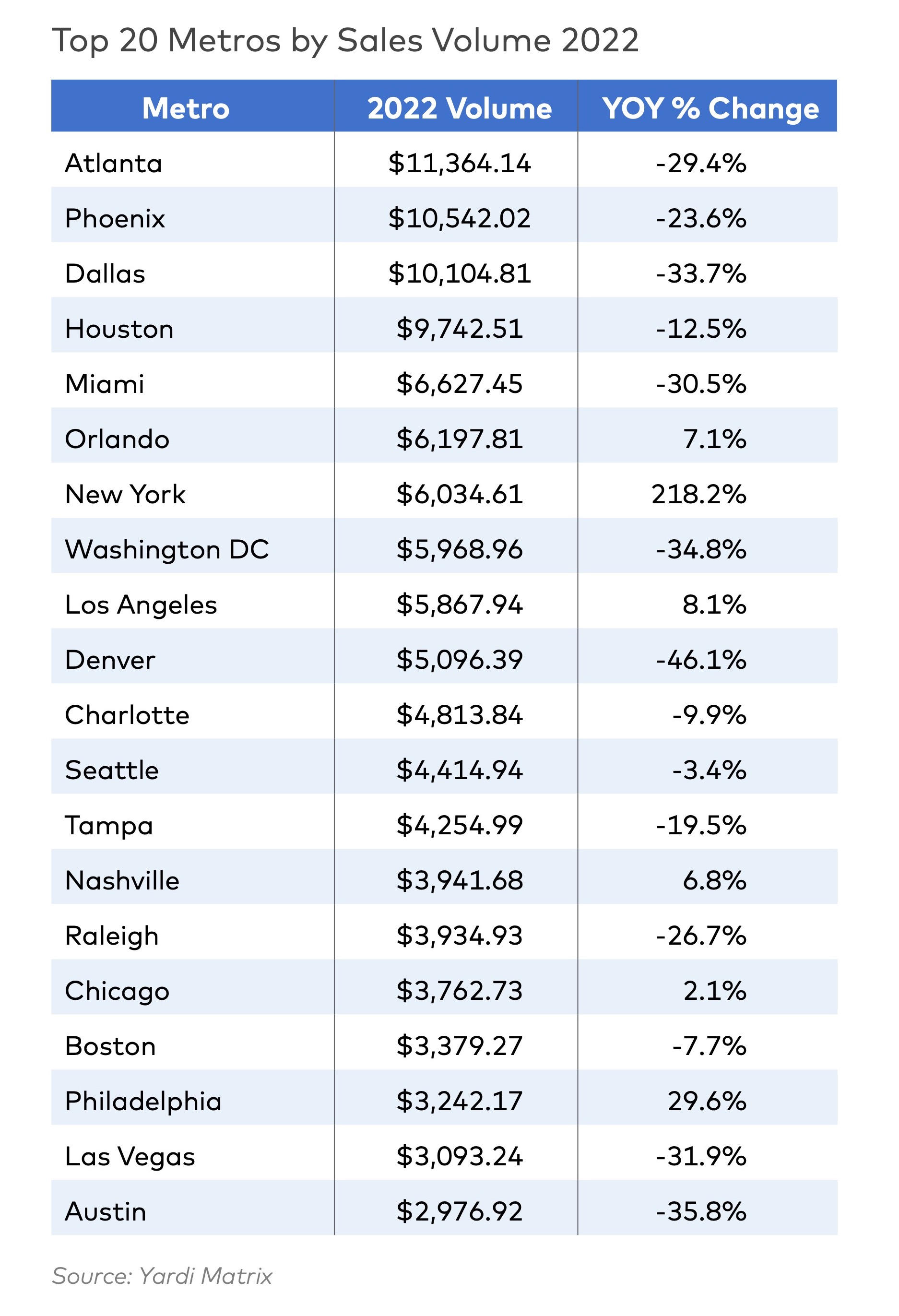

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

| Jul 10, 2013

TED talk: Architect Michael Green on why we should build tomorrow's skyscrapers out of wood

In a newly posted TED talk, wood skyscraper expert Michael Green makes the case for building the next-generation of mid- and high-rise buildings out of wood.

High-rise Construction | Jul 9, 2013

5 innovations in high-rise building design

KONE's carbon-fiber hoisting technology and the Broad Group's prefab construction process are among the breakthroughs named 2013 Innovation Award winners by the Council on Tall Buildings and Urban Habitat.

| Jul 8, 2013

RSMeans cost comparisons: hotels, motels, and apartment buildings

Construction market analysts from RSMeans offer construction costs per square foot for hotels, motels, and apartment buildings.

| Jul 3, 2013

Architects team with HUD to promote 'Rebuild By Design' competition for Hurricane Sandy recovery effort

The American Institute of Architects (AIA) today announced a communications campaign urging its membership to enter the “Rebuild by Design” multi-stage regional design competition announced by Department of Housing and Urban Development (HUD) Secretary Shaun Donovan on June 20.

| Jul 2, 2013

LEED v4 gets green light, will launch this fall

The U.S. Green Building Council membership has voted to adopt LEED v4, the next update to the world’s premier green building rating system.

| Jul 1, 2013

Report: Global construction market to reach $15 trillion by 2025

A new report released today forecasts the volume of construction output will grow by more than 70% to $15 trillion worldwide by 2025.

| Jun 28, 2013

Building owners cite BIM/VDC as 'most exciting trend' in facilities management, says Mortenson report

A recent survey of more than 60 building owners and facility management professionals by Mortenson Construction shows that BIM/VDC is top of mind among owner professionals.

| Jun 26, 2013

Commercial real estate execs eye multifamily, retail sectors for growth, says KPMG report

The multifamily, retail, and hospitality sectors are expected to lead commercial building growth, according to the 2013 KPMG Commercial Real Estate Outlook Survey.

| Jun 25, 2013

Mirvish, Gehry revise plans for triad of Toronto towers

A trio of mixed-use towers planned for an urban redevelopment project in Toronto has been redesigned by planners David Mirvish and Frank Gehry. The plan was announced last October but has recently been substantially revised.

| Jun 25, 2013

First look: Herzog & de Meuron's Jade Signature condo tower in Florida

Real estate developer Fortune International has released details of its new Jade Signature property, to be developed in Sunny Isles Beach near Miami. The luxury waterfront condo building will include 192 units in a 57-story building near high-end retail destinations and cultural venues.