The brief downturn in the Multifamily-for-Rent market outlook is clearly over as PSMJ’s forward-looking proposal activity metric reached its highest level for the sector in nearly two years. Proposal activity in the 4th Quarter, as measured by PSMJ’s Net Plus/Minus Index, climbed to 58% in the 4th Quarter, up from 40% in the 3rd Quarter. This is the sector’s highest NPMI since it hit 76% in the 1st Quarter of 2018, according to PSMJ Resources’ Quarterly Market Forecast (QMF). Multifamily had plummeted to -2% and +7%, respectively, in the first two quarters of 2020, coming off a 4th Quarter 2019 NPMI of 54%. Its 1st Quarter 2020 performance was its lowest in almost a decade.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the turnaround in the Multifamily-for-Rent and Condominium markets are part of an overall upward trend for all Housing markets. “The significant turnaround in both of these multifamily markets are attributable to an increase in personal savings resulting from the government’s stimulus checks as well as significant movement of many people from cities to suburbs – which is shifting the location of the demand,” he said. “So we believe the Multifamily market will continue to be strong into the foreseeable future.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the architecture and engineering (A/E) industry since its inception in 2003. A consistent group of over 300 A/E firm leaders participate regularly, with 132 contributing to the most recent survey.

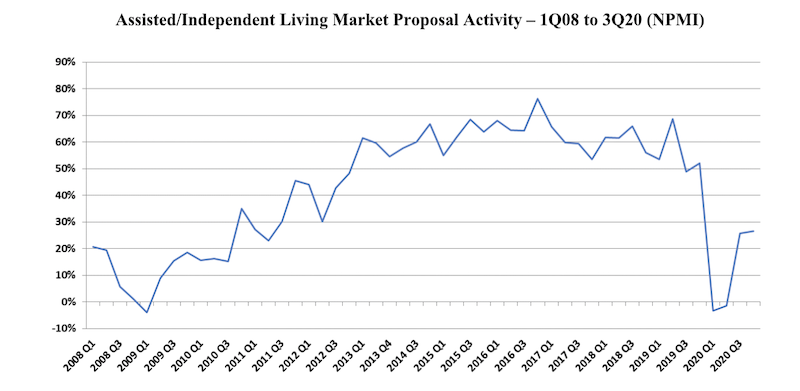

The Condominium and Assisted/Independent Living markets also continued their rebound. Condos’ NPMI crept up to 15% from 11% in the 3rd Quarter, off dismal results in the 1st (-28%) and 2nd (-26%) quarters. The 4th Quarter performance for Condos was still off from the 22% it recorded in the 4th Quarter of 2019. Similarly, Assisted/Independent Living showed minor improvement in the 4th Quarter (up from 26% to 27%, quarter over quarter) and down from the 52% the survey reported for the sector a year ago. It was also negative in the 1st (-3%) and 2nd (-1%) quarters of 2020.

The two other Housing markets measured in the PSMJ survey also show long-term promise for design and construction activity, according to the QMF. Single-Family Homes (59%) and Single-Family Subdivisions (51%) both reached their highest NPMI since PSMJ began collecting survey data for submarkets in 2006.

Among the 12 major markets surveyed, Energy/Utilities unseated Housing with an NPMI of 47%, though Housing’s runner-up NPMI of 43% was an improvement from 38% in the 3rd Quarter. Water/Wastewater, another stand-out during COVID, slipped to 6th among the 12 markets measured. Its NPMI of 23% is down from 37% the prior quarter. Healthcare’s outlook remained steady at 35% (up from 30%), as did Light Industry (35%, up from 27%). Heavy Industry had the greatest gain, rocketing to 32% from 0% due to strong scores in Product Manufacturing (40%) and Pharmaceutical Production (35%).

Proposal activity for Education projects trailed again at -29%, though it improved from -37%. Commercial Users (-29%, up from -31%) and Commercial Developers (-13% up from -23%) rounded out the dozen.

PSMJ Resources, a consulting and publishing company dedicated to the A/E industry, has conducted its Quarterly Market Forecast for more than 17 years. It includes data on 12 major markets and 58 submarkets served by A/E firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Senior Living Design | May 9, 2017

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

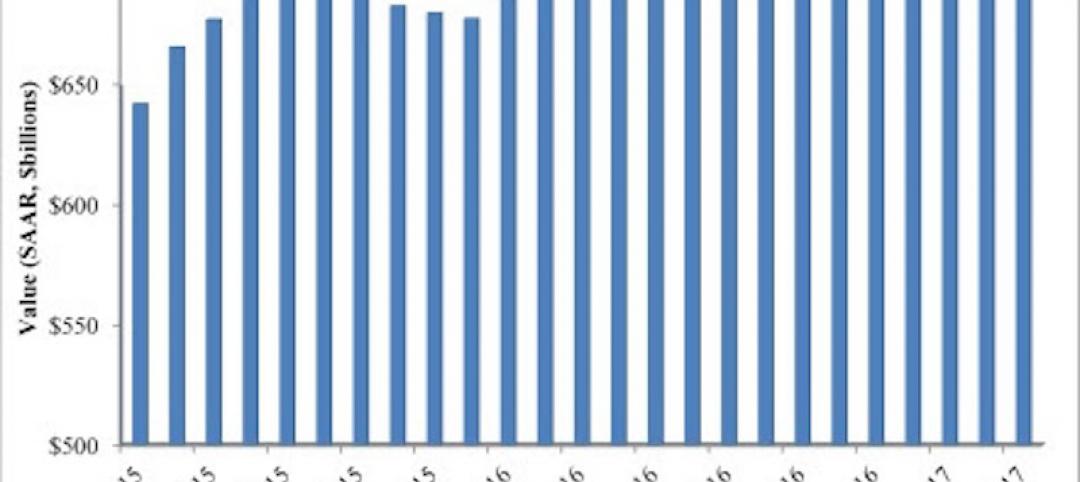

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

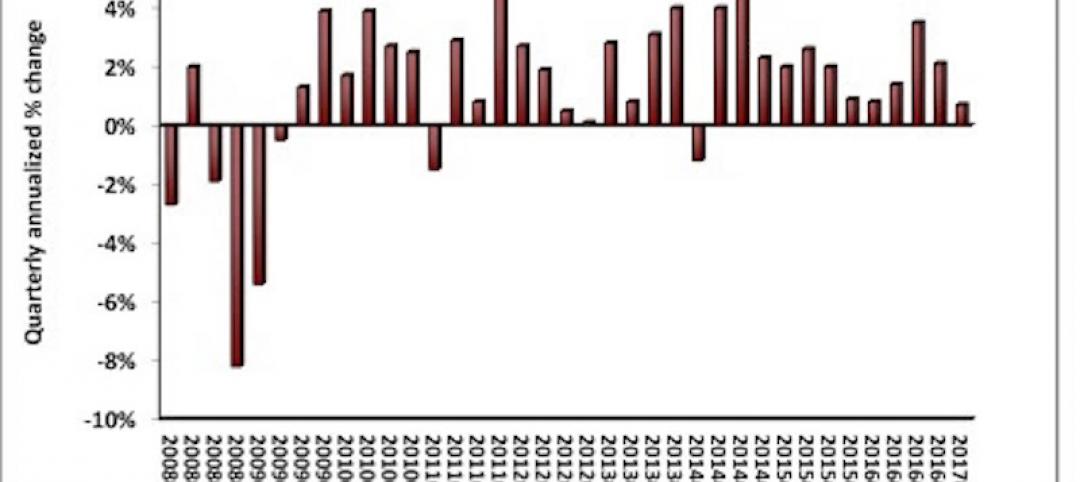

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

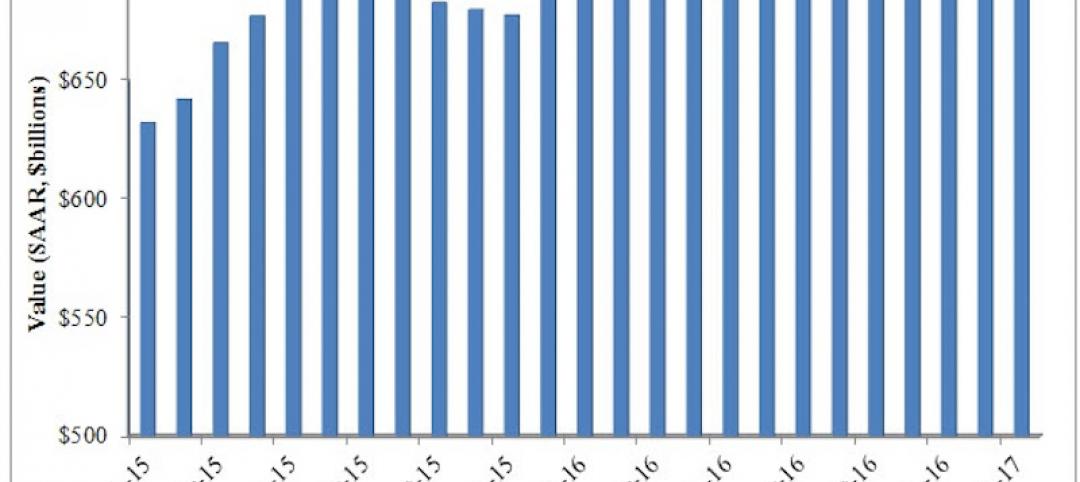

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.