All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

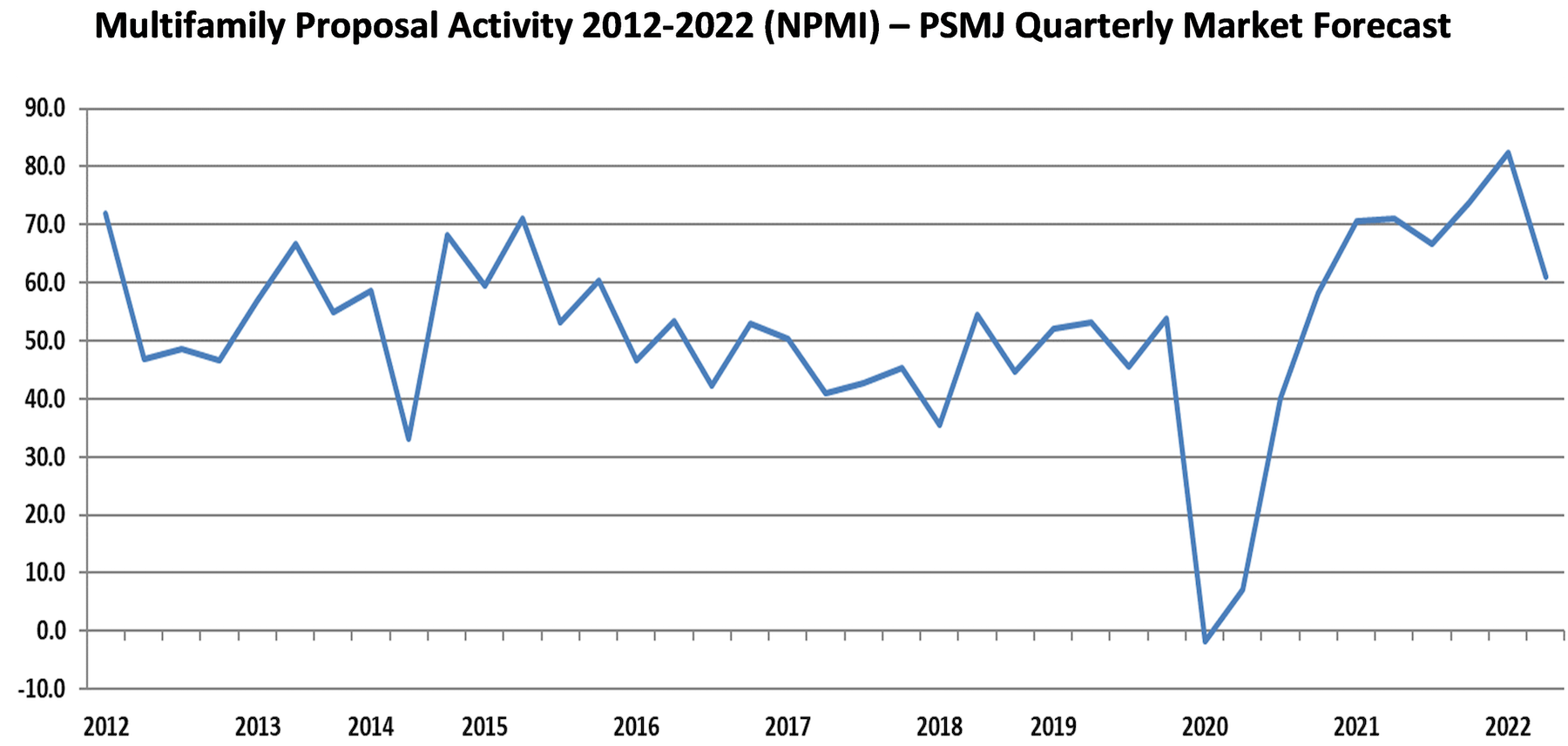

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| Aug 11, 2010

Housing America's Heroes 7 Trends in the Design of Homes for the Military

Take a stroll through a new residential housing development at many U.S. military posts, and you'd be hard-pressed to tell it apart from a newer middle-class neighborhood in Anywhere, USA. And that's just the way the service branches want it. The Army, Navy, Air Force, and Marines have all embarked on major housing upgrade programs in the past decade, creating a military housing construction boom.

| Aug 11, 2010

Loft Condo Conversion That's Outside the Box

Few people would have taken a look at a century-old cigar box factory with crumbling masonry and rotted wood beams and envisioned stylish loft condos, but Miles Development Partners did just that. And they made that vision a reality at Box Factory Lofts in historic Ybor City, Fla. Once the largest cigar box plant in the world, the Tampa Box Company produced boxes of many shapes and sizes, spec...

| Aug 11, 2010

World's tallest all-wood residential structure opens in London

At nine stories, the Stadthaus apartment complex in East London is the world’s tallest residential structure constructed entirely in timber and one of the tallest all-wood buildings on the planet. The tower’s structural system consists of cross-laminated timber (CLT) panels pieced together to form load-bearing walls and floors. Even the elevator and stair shafts are constructed of prefabricated CLT.

| Aug 11, 2010

CityCenter Takes Experience Design To New Heights

It's early June, in Las Vegas, which means it's very hot, and I am coming to the end of a hardhat tour of the $9.2 billion CityCenter development, a tour that began in the air-conditioned comfort of the project's immense sales center just off the famed Las Vegas Strip and ended on a rooftop overlooking the largest privately funded development in the U.

| Aug 11, 2010

Giants 300 Multifamily Report

Multifamily housing starts dropped to 100,000 in April—the lowest level in several decades—due to still-worsening conditions in the apartment market. Nonetheless, the April total is below trend, so starts will move progressively back to a still-depressed 150,000-unit pace by late next year.

| Aug 11, 2010

The softer side of Sears

Built in 1928 as a shining Art Deco beacon for the upper Midwest, the Sears building in Minneapolis—with its 16-story central tower, department store, catalog center, and warehouse—served customers throughout the Twin Cities area for more than 65 years. But as nearby neighborhoods deteriorated and the catalog operation was shut down, by 1994 the once-grand structure was reduced to ...

| Aug 11, 2010

Gold Award: Westin Book Cadillac Hotel & Condominiums Detroit, Mich.

“From eyesore to icon.” That's how Reconstruction Awards judge K. Nam Shiu so concisely described the restoration effort that turned the decimated Book Cadillac Hotel into a modern hotel and condo development. The tallest hotel in the world when it opened in 1924, the 32-story Renaissance Revival structure was revered as a jewel in the then-bustling Motor City.