Demand for multifamily housing is expected to remain strong in the foreseeable future. But multifamily construction, which has been well above “normal” levels, is likely to slow a bit, which could impact rental rates.

At the recent International Home Builders Show in Las Vegas, the National Association of Home Builders (NAHB) unveiled its latest projections for home starts and sales. The association’s members had just come off of a year in 2014, when single-family home sales jumped by 29.3% to 436,000 units, according to Census Bureau and National Association of Realtor estimates. Builders started a total of 993,000 homes in 2014, 6.7% more than the previous year.

Over the past few years, housing starts have fallen short of NAHB’s predictions about a housing recovery. Last year, single-family starts were just north of 638,000 units, or about 3% more than in 2013. But the association now thinks housing is poised to take off in 2015, and expects single-family starts to rise by 26% to 804,000 units.

NAHB is less gung-ho about multifamily construction, which “has been producing more units than in previous cycles,” observed David Crowe, the association’s chief economist. His forecast shows multifamily starts reaching 358,000 units in 2015, or only 1.7% more than last year. In 2016, the association expects multifamily starts to hit 361,000 units, or just 0.8% more than the starts in 2015.

Looked at another way, NAHB expects multifamily starts from the third quarter of 2014 through the end of 2016 to be 105% of “normal” production (“normal” being based on the average of quarterly production in the years 1995 through 2003). Over that same period of time, NAHB sees single-family starts going from 49% of normal production (which it remains convinced lies somewhere between 1.3 million and 1.4 million units) to 90%.

What remains to be seen is where the equilibrium between multifamily construction and demand finally settles. The vast majority of multifamily development is currently for rental properties. Despite low interest rates, and predictions that younger adults still want to own homes eventually, rental options remain attractive to a lot of people, particularly those who prefer to live nearer to urban centers.

But if construction slows, and rents escalate in response to scarcer availability, multifamily could reach a point of diminishing return that pushes renters into the buyer column quicker.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

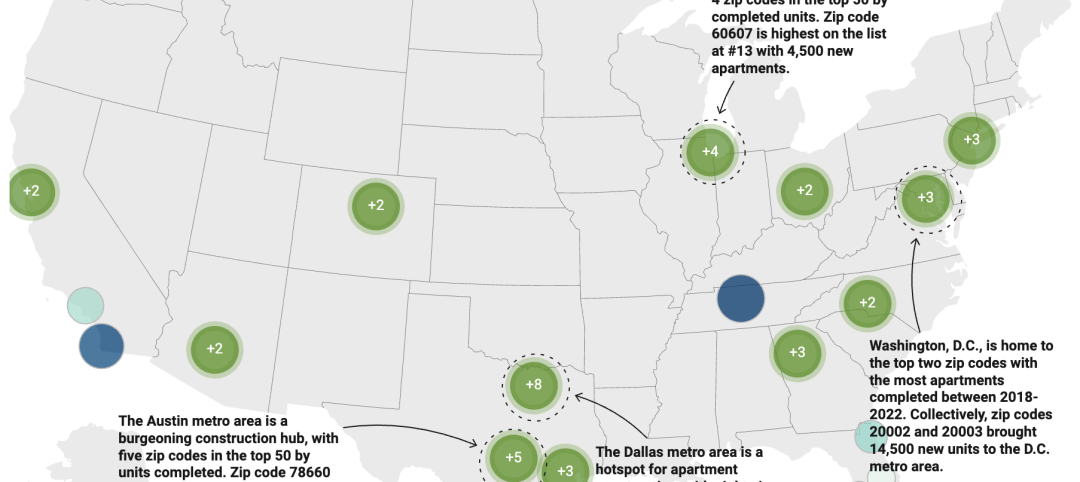

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”