More than 10 years after the end of the most severe financial crisis since the Great Depression, the U.S. economy is again making history by continuing its longest-ever expansion. Nevertheless, emerging weakness in business investment has been hinting at softening outlays, giving commercial and industrial construction contractors cause for concern, according to a mid-year economic outlook by Anirban Basu, chief economist of Associated Builders and Contractors.

“Given that every expansion in U.S. history has ended in recession, leaders of construction firms are rightly wondering when the record-setting expansion will end,” said Basu. “Looking at conditions on the ground, it likely won’t be in 2019, but 2020 could be problematic for the broader economy and 2021 for a significant number of contractors.”

Basu cites numerous vulnerabilities that could trigger a recession in 2020, including:

— Trade wars

— Softening corporate earnings

— Slowing job growth

— Elevated levels of household, corporate and government debt

— Election 2020

But there are plenty of reasons to remain optimistic. “For the most part, the economy has held up better than anticipated,” said Basu. “During the first quarter of 2019, gross domestic product expanded at a smart 3.1% annualized rate. The U.S. Bureau of Economic Analysis’ initial estimate suggests that the economy slowed to 2.1% growth during the second quarter, but that neatly beat economists’ expectation that that growth had fallen below 2%.”

“The economy could continue to prove resilient,” says Basu. “To date, the economy has navigated ongoing trade disputes and associated tariffs with aplomb. It has also withstood serial interest rate hikes, the longest federal government shutdown in history, extreme weather, shifting immigration policy, ongoing labor market shortages and a lengthy investigation regarding foreign influence in U.S. elections.”

To read the full economic outlook story, visit ConstructionExec.com.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

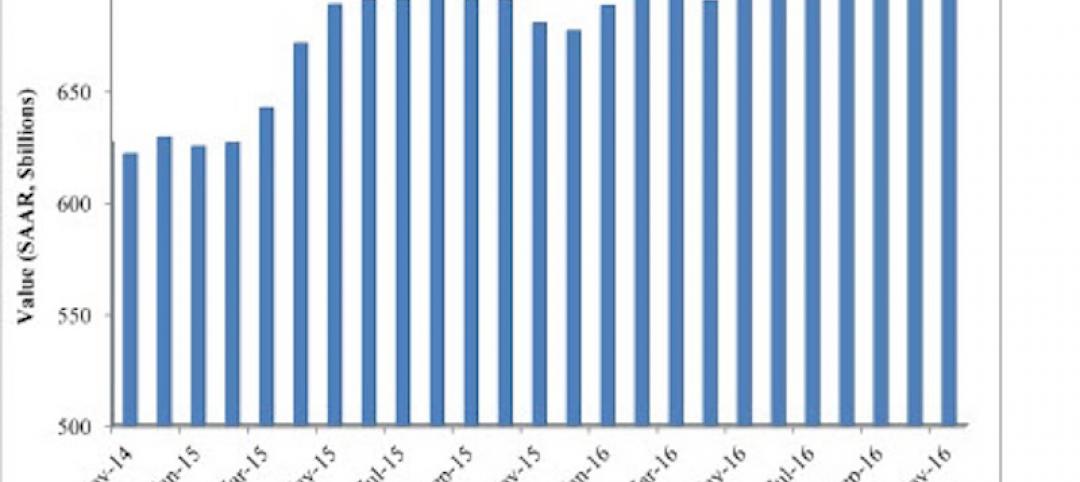

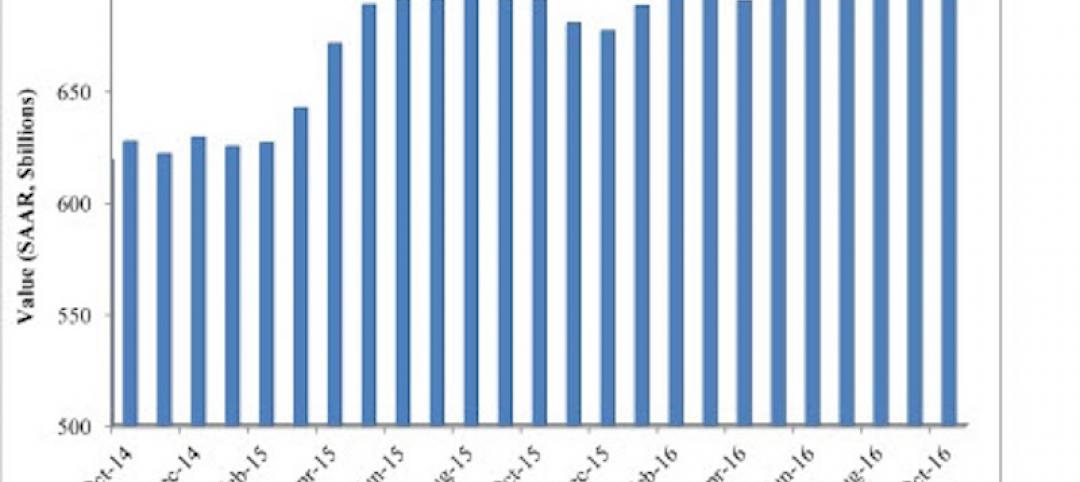

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

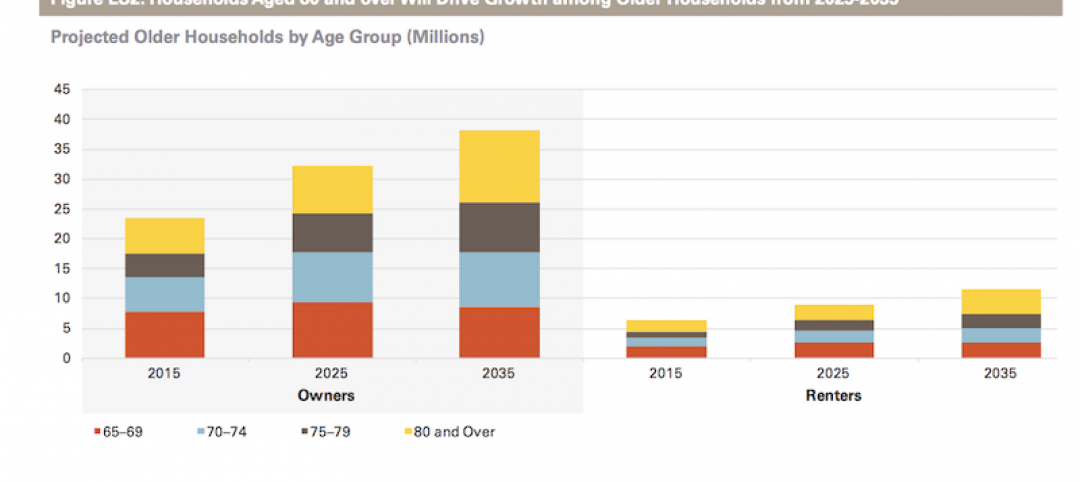

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.