In the third quarter of 2018, analysts at Lodging Econometrics (LE) report that the top five markets with the largest total hotel construction pipelines are: New York City with 170 projects/29,630 rooms; Dallas with 157 projects/18,954 rooms; Houston with 150 projects/16,473 rooms; Los Angeles with 141 projects/24,129 rooms; and Nashville with 115 projects/15,179 rooms.

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs. Markets with the greatest number of projects already in the ground and those scheduled to start construction in the next 12 months are New York with 145 projects/24,675 rooms, Dallas with 112 projects/13,854 rooms, Houston with 103 projects/11,562 rooms, Los Angeles with 92 projects/14,249 rooms, and Nashville with 88 projects/12,322 rooms.

In the third quarter, Los Angeles has the highest number of new projects announced into the pipeline with 22 projects/6,457 rooms. Detroit follows Los Angeles with 18 projects/1,937 rooms, Dallas with 14 projects/1,529 rooms, New York City with 12 projects/1,857 rooms, and then Atlanta with 12 projects/1,354 rooms.

Reflecting the strong cyclical highs in the pipeline, LE’s forecast for new hotel openings will continue to rise in 2018-2020. In 2018, New York City tops the list with 29 new hotels expected to open/5,351 rooms, Dallas with 29 projects/3,187 rooms, Houston with 27 projects/3,259 rooms, Nashville with 22 projects/3,018 rooms, and Los Angeles with 12 projects/2,152 rooms. In the 2019 forecast, New York continues to lead with the highest number of new hotels expected to open with 59 projects/8,964 rooms followed by Houston with 31 projects/3,098 rooms and Dallas with 30 projects/3,379 rooms. In 2020, Dallas is forecast to take the lead for new hotel openings with 41 projects/4,809 rooms expected to open, followed by New York with 36 projects/5,978 rooms, and Los Angeles with 33 projects/4,292 rooms expected to open.

With the exception of New York City and Houston, the other markets mentioned in the opening show that supply growth has begun to surpass demand. The variances in 2018 year-to-date are small but are certain to widen in the next two years, given the strength of these pipeline in the markets.

All in all, 10 of the top 25 markets show supply growth minimally exceeding demand growth in 2018.

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

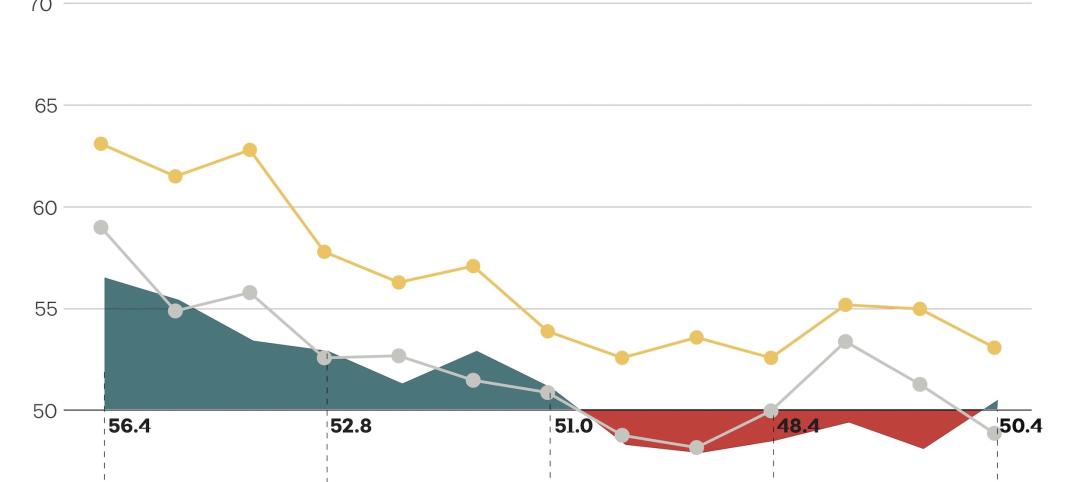

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

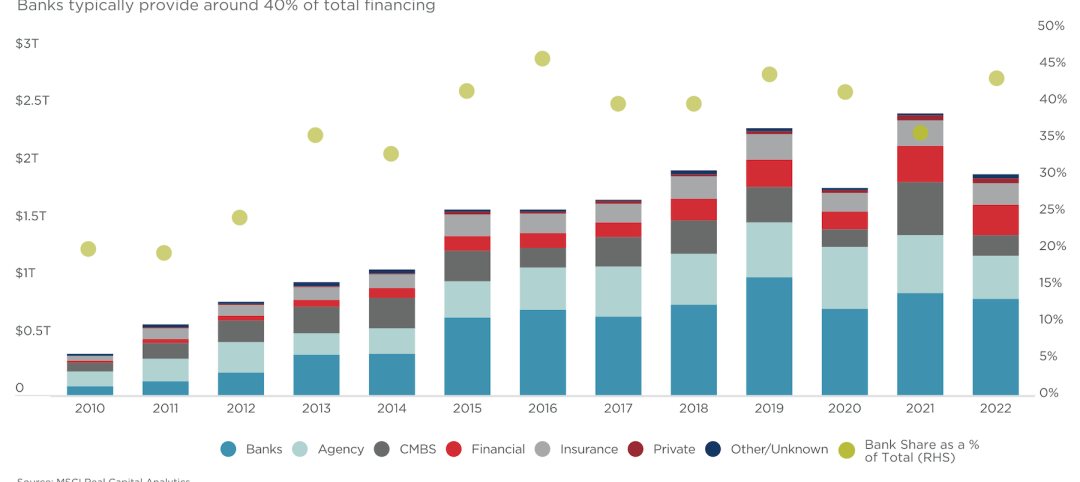

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

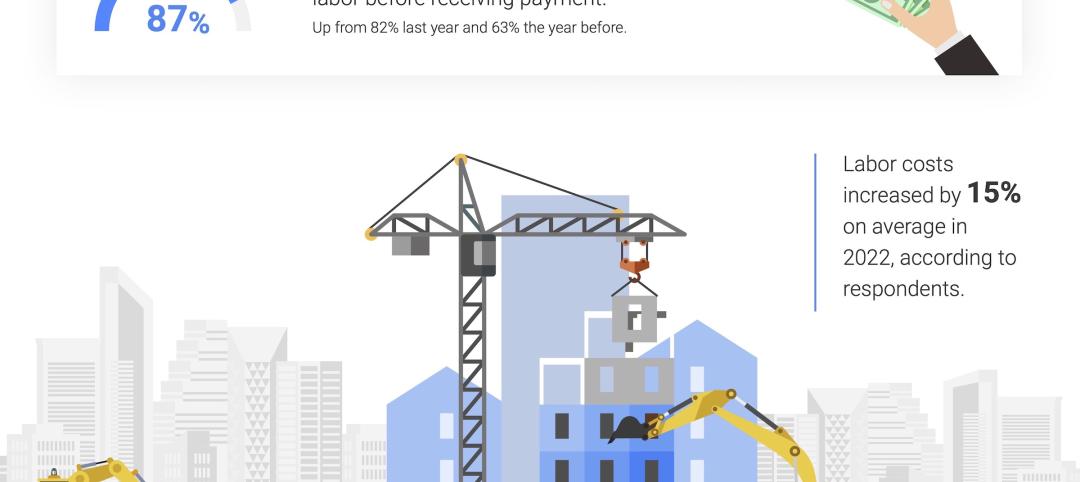

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.