Esports is the fastest growing theme in the gaming sector. These organized multiplayer video game competitions have enjoyed spectacular growth over the last decade, with thousands of fans filling stadiums to watch live events and millions following them on streaming platforms. Although eSports currently caters to a niche audience – almost 10% of the global online population of around 4.5 billion – its reach is expanding rapidly.

GlobalData’s latest report, ‘Esports – Thematic Research’, states that the industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations, which pushed eSports further into the mainstream and brought it to the attention of a wider audience.

Rupantar Guha, Senior Analyst of Thematic Research at GlobalData, commented: “Brands from a wide range of industries are investing in eSports to reach a young demographic that is typically resistant to traditional advertising channels. The increasing involvement of non-endemic brands such as Coca-Cola and BMW is helping to legitimize eSports, as well as bringing in significant revenue.”

See Also: Erudite eSports: Colleges build their very own eSports arenas

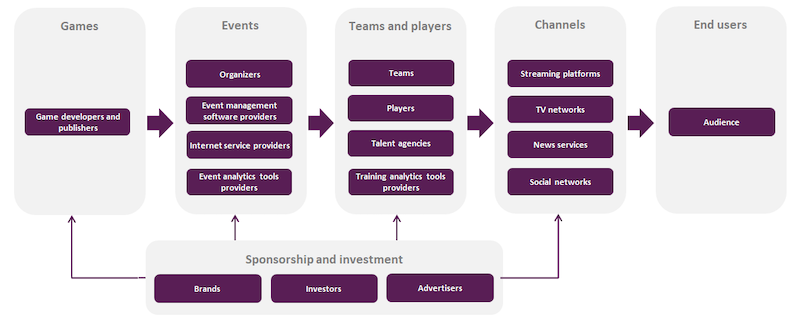

GlobalData splits the eSports value chain into six segments: games, events, teams and players, channels, sponsorship and investment and end users. The report discusses each aspect of the value chain in detail and throws light on how the industry will shape up over the next two to three years.

Related Stories

Market Data | Apr 16, 2019

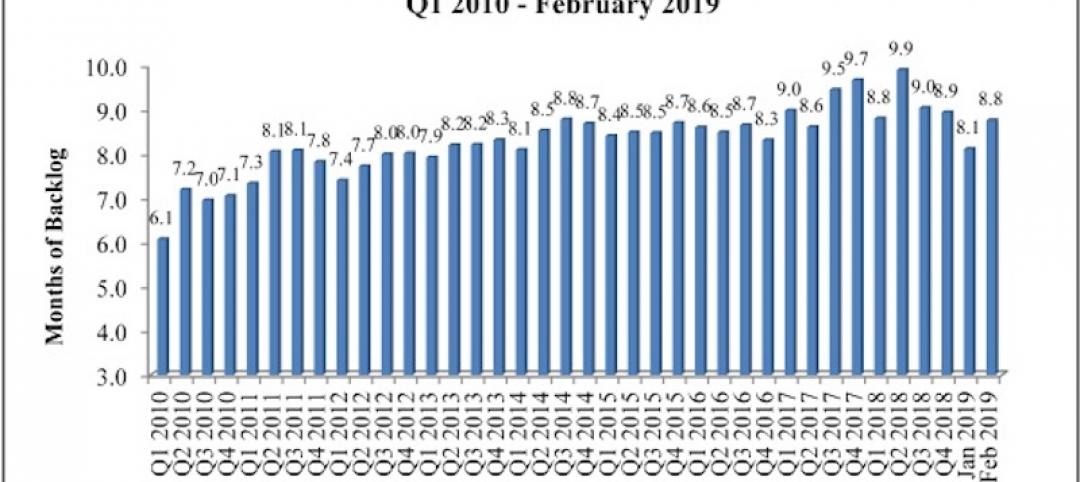

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

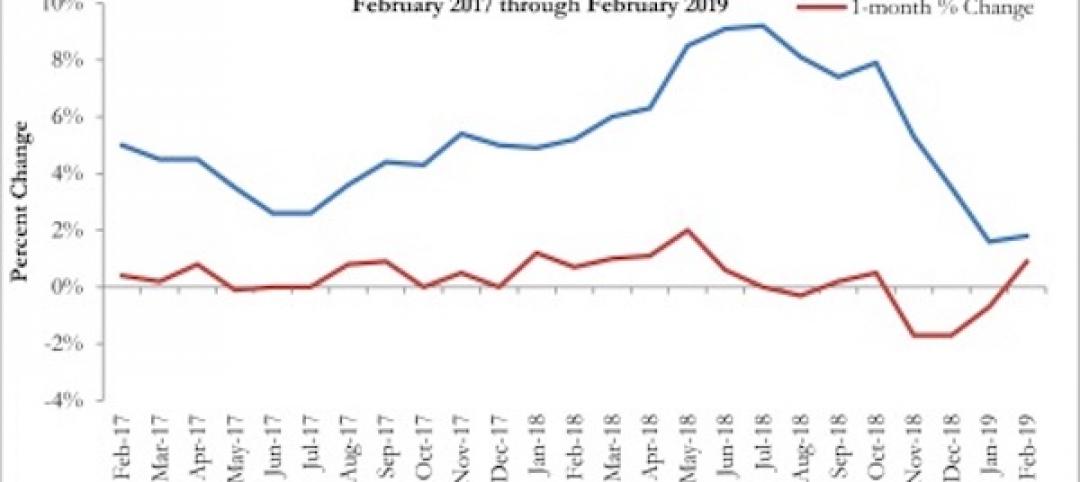

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

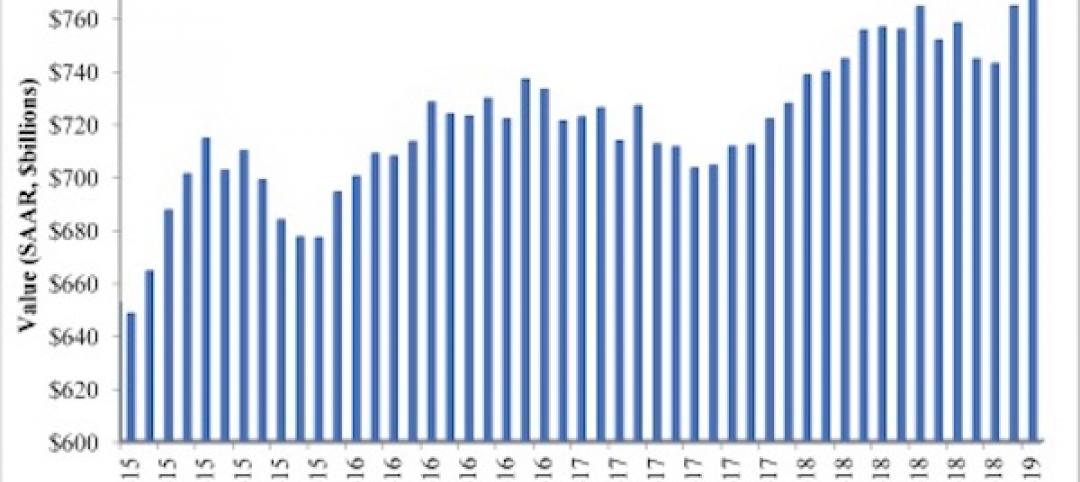

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.