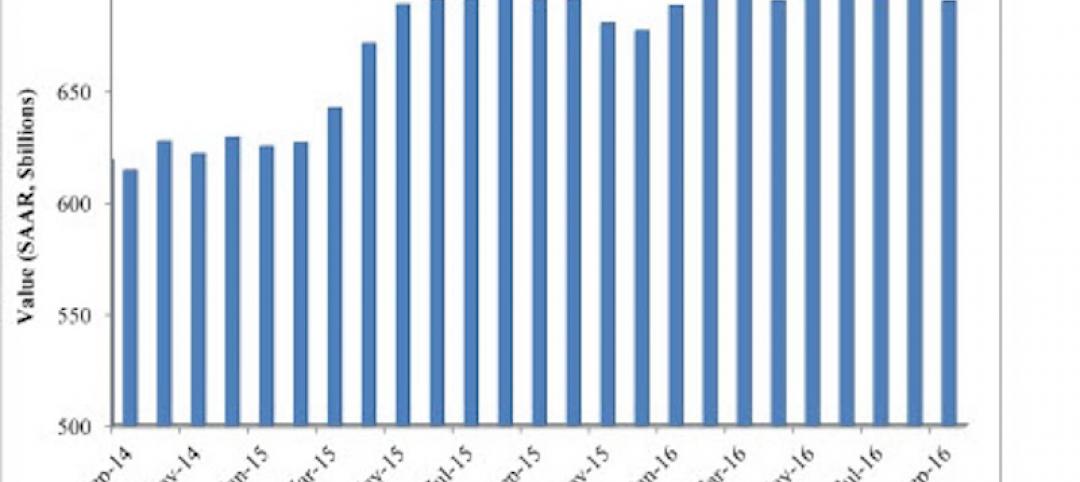

Growing materials costs and dwindling talent pools coupled with looming political and economic uncertainty is leaving construction leaders grappling with serious challenges. But where there is greater challenge, comes greater opportunity. According to JLL’s latest report on United States construction activity there is stability ahead with indicators showing a growing backlog of contractor work and seasonal construction spending up 5.7% year-over-year.

But that’s not all. A closer look at the construction industry’s biggest challenges reveals some unexpected opportunities amidst the adversity.

“Many of the biggest industry issues have been consistent over the past year and are nothing new to industry experts,” said Mason Mularoni, Senior Research Analyst, JLL Project and Development Services. “These challenges are leading to a shift in traditional thinking, giving way to more innovation and a greater use of technology. This creates opportunities to generate better project efficiency and save on costs.”

Challenge or opportunity? You decide.

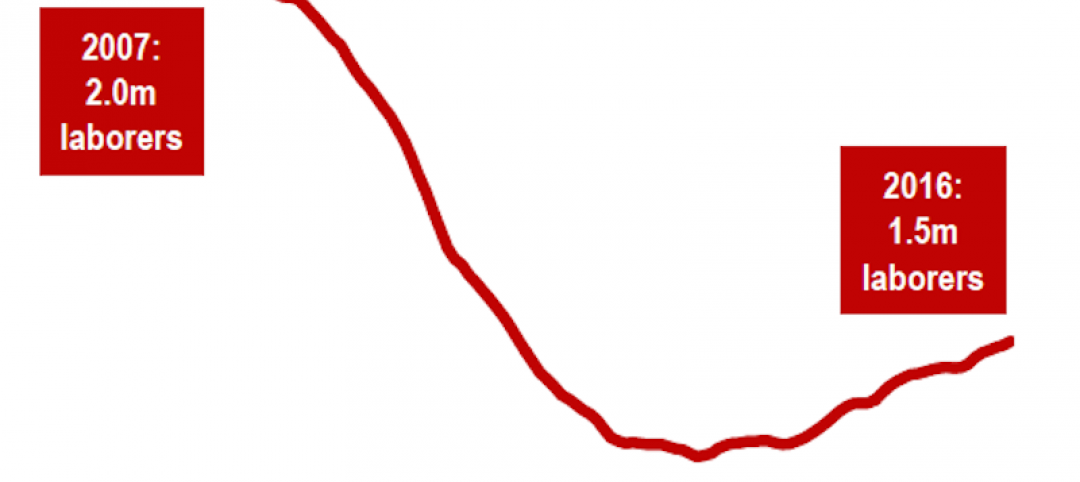

The seemingly interminable labor shortage: Construction unemployment continues to reach historic lows, sitting at 5.3% while hourly wages increase and outpace inflation. This is stretching project budgets and timelines, resulting in a heightened focus on productivity enhancement.

The silver lining? In an industry too often bogged down by contract and paper-passing to get work done efficiently, construction leaders are beginning to rethink the role of technology in day-to-day operations. Unified communications systems save time on paperwork, streamline communications and create better workflows and document sharing between teams. Investing in cloud and mobility solutions helps architects, designers and crew leaders communicate no matter where their works takes them.

Rising costs of materials: Over the last 12 years, materials costs have risen by nearly 30%, with 10% of the change happening in the last five years. With continued construction demand for materials and unknowns surrounding tariffs and international import changes, we can only wait and see when cost increases will slow.

The silver lining? The advent of building information modeling (BIM), artificial intelligence (AI) and modular construction are enabling firms to build more with less material and less waste. BIM technology allows architects and developers to reduce waste in both building and in operations. By knowing exactly how much to plan for, they can save on up-front materials costs. AI is helping firms to optimize materials distribution, while advances in modular construction is also reducing materials waste through recycling, more controlled inventory and enhanced quality control. Such innovations may not come cheap up-front, but they could contribute to cost savings down the line.

Overbuilding anxiety: The U.S. economy has grown steadily, quarter-over-quarter, since the Great Recession—and so has the commercial real estate and development industry. With construction pipelines showing no signs of slowing, many industry leaders are beginning to wonder when the next slowdown might occur.

The silver lining? Planning for different scenarios is an excellent mitigate uncertainty. And the better the analytics at hand, the clearer the outlooks become. Planning tools specific to construction activity are becoming more common, like apps that specifically exist to help project managers track complex data sets like capital planning and change management statistics. By taking long term goals into account, construction firms can begin to make slight changes such as buying materials early for large projects, building a solid pipeline of future work and considering risk carefully when opening a new multi-year development. All of these ideas can help firms move through the upcoming years with confidence and stability.

“Analyzing and tracking challenges like the skilled labor shortage and rising construction costs has allowed us to understand the biggest worries our clients have when it comes to their projects,” said Todd Burns, President, JLL Project and Development Services. “Because of this we are able to offer experience, technology solutions and non-traditional approaches to ease their minds and maximize proficiency.”

Download the latest JLL United States Construction Outlook here.

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.