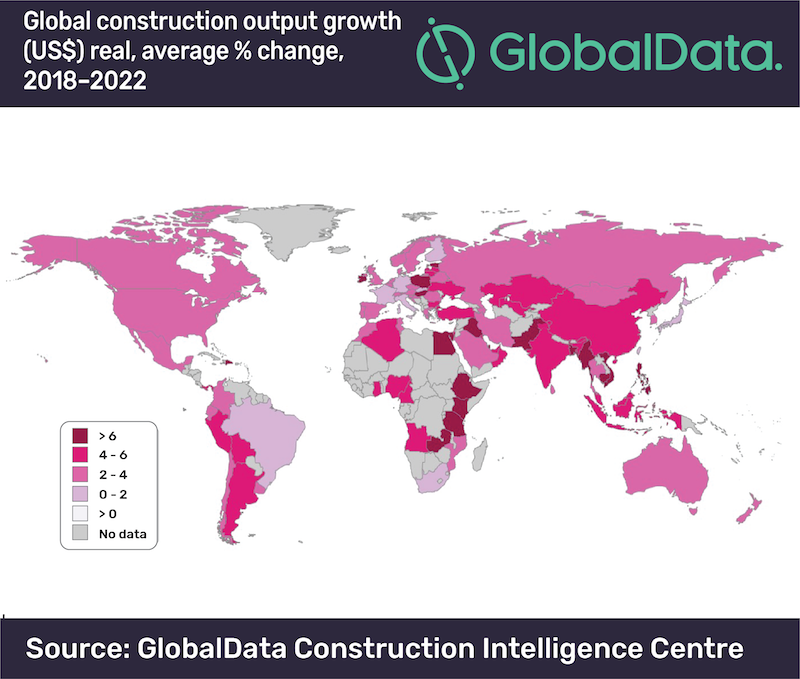

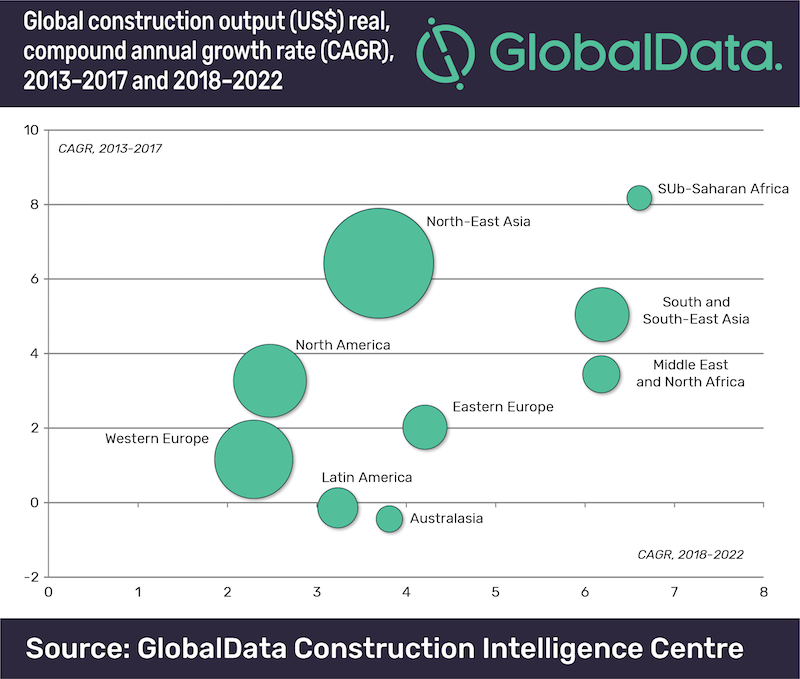

The global construction industry is expected to grow by an average of 3.6% a year over the forecast period 2018 to 2022, according to GlobalData, a data and analytics company.

The company’s latest report, ‘Global Construction Outlook to 2022: Q3 2018 Update’ reveals that in real value terms*, global construction output is forecast to rise to $12.9 trillion by 2022, up from $10.8 trillion in 2017.

Danny Richards, Construction Lead Analyist at GlobalData, says, ‘‘We forecast that global construction output growth will accelerate to +3.6% in 2018, up from 3.1% in 2017, reflecting the recovery in the US as well as general improvements across emerging markets. In South and South-East Asia, for example, construction in India has regained growth momentum, while the pick-up in oil prices has supported the recovery in the Middle East and Africa.’’

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020, before easing back in the latter part of the forecast period, reflecting trends in some of the largest markets.

The Asia-Pacific region will continue to account for the largest share of the global construction industry, however the pace of growth will slow given the projected slowdown in China’s construction industry to an average of +4.2% between 2018 and 2022, offset by an acceleration in construction growth in India.

Construction activity is gathering momentum across Western Europe with the region’s output set to expand by 2.4% a year on average from 2018 to 2022. However, expansion in the UK is subject to major downside risks in the face of uncertainty over Brexit.

The Middle East and Africa region as a whole will be the fastest with an annual average growth of 6.4% from 2018 to 2022. Countries in the Gulf Cooperation Council (GCC) have suffered from the weakness in oil prices in recent years, greatly reducing government revenues. As oil prices pick up, however, large-scale investment in infrastructure projects - mostly related to transport - will be a key driving force behind the construction growth in the region.

Richards says, “Whilst there are intensifying downside risks for global construction related to global economic growth, notably stemming from the erupting trade war between the US and China, the global economy will continue to expand in the range of 2.5% to 3% a year from 2018 to 2022 which will support continued construction growth in key markets.’’

* ‘real value terms’ is measured from constant 2017 prices and US$ exchange rates

Related Stories

Market Data | Mar 8, 2018

Prioritizing your marketing initiatives

It’s time to take a comprehensive look at your plans and figure out the best way to get from Point A to Point B.

Market Data | Mar 6, 2018

Persistent workforce shortages challenge commercial construction industry as U.S. building demands continue to grow

To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions.

Market Data | Mar 2, 2018

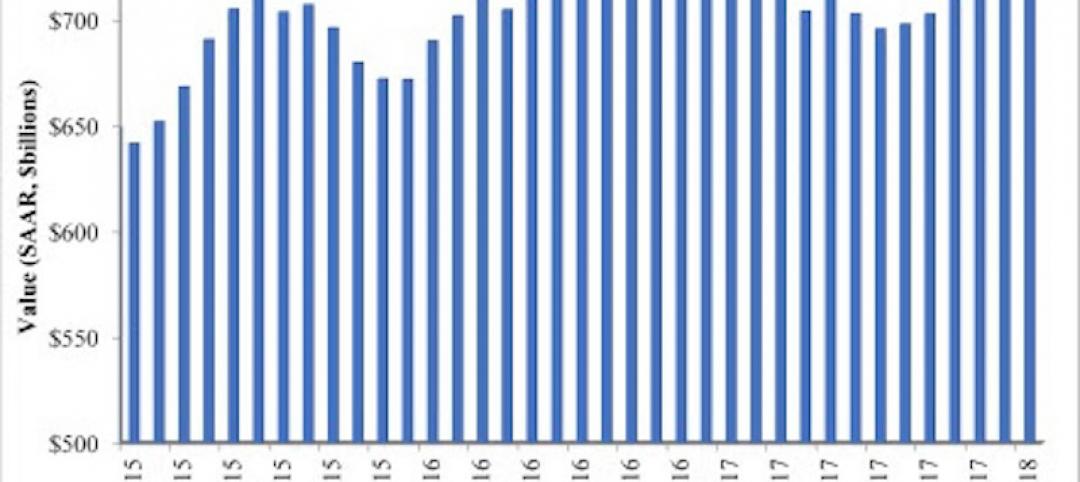

Nonresidential construction spending dips slightly in January

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%.

Market Data | Feb 27, 2018

AIA small firm report: Half of employees have ownership stake in their firm

The American Institute of Architects has released its first-ever Small Firm Compensation Report.

Market Data | Feb 21, 2018

Strong start for architecture billings in 2018

The American Institute of Architects reported the January 2018 ABI score was 54.7, up from a score of 52.8 in the previous month.

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Market Data | Feb 1, 2018

Nonresidential construction spending expanded 0.8% in December, brighter days ahead

“The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending,” said ABC Chief Economist Anirban Basu.

Green | Jan 31, 2018

U.S. Green Building Council releases annual top 10 states for LEED green building per capita

Massachusetts tops the list for the second year; New York, Hawaii and Illinois showcase leadership in geographically diverse locations.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.